Newsletter August 2023

DRN welcomes IQ Group from Neerijnen

The DRN board is pleased to welcome the IQ Group that also benefits the diversity of the membership. They focus particularly on energy conservation of commercial properties, offering a complete package. So throughout the course of the improvement process. They provide complete delivery and installation and advise you on the various financing and subsidy options. If required, iQ-group also supplies sustainably generated energy to its customers. In doing so, they use the latest techniques in solar energy, LED lighting, indoor climate (including heat pumps), insulations and roofing. In the advice, they align all the elements and investments. With a clear vision and a clear roadmap. Thus, they save you costs, now and in the long run. The IQ Group has also been active in Romania for a number of years

The DRN board is pleased to welcome the IQ Group that also benefits the diversity of the membership. They focus particularly on energy conservation of commercial properties, offering a complete package. So throughout the course of the improvement process. They provide complete delivery and installation and advise you on the various financing and subsidy options. If required, iQ-group also supplies sustainably generated energy to its customers. In doing so, they use the latest techniques in solar energy, LED lighting, indoor climate (including heat pumps), insulations and roofing. In the advice, they align all the elements and investments. With a clear vision and a clear roadmap. Thus, they save you costs, now and in the long run. The IQ Group has also been active in Romania for a number of years

For further information: see the website www.iq-group.nl

We also welcome VDBA Salarisverwerking B.V. from Geldermalsen

VDBA-Advisory is a payroll processing company specializing in the agricultural sector and especially for migrant workers. Their clients are agricultural companies mainly in greenhouse farming.In addition to salary processing, they also recruit Romanian migrant workers on behalf of their clients. Currently they are active to professionalize their with their own recruiter and recruiting a trainer whether permanent or not.

VDBA-Advisory is a payroll processing company specializing in the agricultural sector and especially for migrant workers. Their clients are agricultural companies mainly in greenhouse farming.In addition to salary processing, they also recruit Romanian migrant workers on behalf of their clients. Currently they are active to professionalize their with their own recruiter and recruiting a trainer whether permanent or not.

Recently, they successfully completed another Romanian project.

For further information: see www.vdba-salarisverwerking.nl

Autumn: a good opportunity for the Romanian calendar

This fall is a good opportunity to reinvigorate business ties or make new contacts

This fall is a good opportunity to reinvigorate business ties or make new contacts  . Because timing is important because 2024 is an election year for Romania and other EU member states. So below is a brief summary of the major scholarships.

. Because timing is important because 2024 is an election year for Romania and other EU member states. So below is a brief summary of the major scholarships.

First of all, a reference to all fairs with mention thus of all sectors taking place in Bucharest from now until January 1, 2024.

Romexpo is the Romanian equivalent of the Dutch trade fair and offers Dutch entrepreneurs an interesting platform for information of the Romanian supply and demand, i.e. especially focused on import and export.

For information, please refer to Romexpo’s English-language website. http:www.romexpo.ro.

TransLogistica Sept. 19-21, 2023 in Bucharest

The use of technology has also increased in the transportation and logistics sector in Romania, a trend that will continue to grow in the coming years. Telematics and fleet tracking systems have become increasingly important to track and optimize the flow of goods and reduce costs.

To cope with these changes and take advantage of growth opportunities in the transportation and logistics sector, companies must be innovative and invest in technology and workforce development. In this sense, the TransLogistica Romania 2023 fair, which will take place from Sept. 19 to 21 at Romexpo, is an important event for everyone working in this sector. The business opportunities, networking and valuable information that can be obtained at this fair are invaluable for development and growth in these areas. We invite all transport, logistics and IT companies to participate in this edition of the TransLogistica Romania fair and take advantage of the benefits offered by this unique event in Romania.

To cope with these changes and take advantage of growth opportunities in the transportation and logistics sector, companies must be innovative and invest in technology and workforce development. In this sense, the TransLogistica Romania 2023 fair, which will take place from Sept. 19 to 21 at Romexpo, is an important event for everyone working in this sector. The business opportunities, networking and valuable information that can be obtained at this fair are invaluable for development and growth in these areas. We invite all transport, logistics and IT companies to participate in this edition of the TransLogistica Romania fair and take advantage of the benefits offered by this unique event in Romania.

For more information, please contact:https://romania.translogistica.eu

Dutch – Moldovan Business Forum on October 4 and 5 in Chisinau (Moldova)

The Netherlands supports Moldova in its European candidacy. The Business Forum is a platform for interaction between the Dutch and Moldovan business communities. Participants can learn about current issues and developments in Moldova, including the impact of the war in Ukraine on Moldova.

The Netherlands supports Moldova in its European candidacy. The Business Forum is a platform for interaction between the Dutch and Moldovan business communities. Participants can learn about current issues and developments in Moldova, including the impact of the war in Ukraine on Moldova.

The Business Forum is an opportunity to network with Moldovan government officials and entrepreneurs. Dutch participants can also apply for personalized matchmaking in cooperation with Moldova Invest Agency.

Register through Moldova Invest Agency’s advisor, Rodica Verbeniuc: rodica.verbeniuc@gmail.com.

For details of the program and the like, please click

here

Indraga 25 – 29 October 2023 in Bucharest

The INDAGRA fair, organized by ROMEXPO in cooperation with the Romanian Chambers of Commerce and Industry, will take place from Oct. 25-29, 2023, at the Romexpo Exhibition Center – Pavilion B1 and on outdoor platforms 1, 2, 4, 10 , 11, 12, 13, V5, V6, Koopmanssteeg.

The INDAGRA fair, organized by ROMEXPO in cooperation with the Romanian Chambers of Commerce and Industry, will take place from Oct. 25-29, 2023, at the Romexpo Exhibition Center – Pavilion B1 and on outdoor platforms 1, 2, 4, 10 , 11, 12, 13, V5, V6, Koopmanssteeg.

The exhibition presents the latest trends in agriculture, viticulture, horticulture and animal husbandry and is aimed at companies from Romania and abroad.

For further information:

Bd.Marasti no. 65-67, sector 1

P.O. Box 32-3, code 011465, Bucharest-Romania

E-mail: romexpo@romexpo.ro

Phone: +40 21 207.70.00

Fax: +40 21 207.70.70

INDAGRA FOOD-a business opportunity for manufacturers, processing technology suppliers and retail chains.

INDAGRA FOOD-a business opportunity for manufacturers, processing technology suppliers and retail chains.

This exhibition takes place simultaneously with the aforementioned Indraga fair, Participation in INDAGRA FOOD provides business opportunities for manufacturers, technology suppliers and processing retail chains.

INDAGRA FOOD theme includes: food, beverages, processing technology, hygiene, food safety, transportation, logistics, warehousing and food.

Sector Logistics and Transport

A new electric truck on Romanian roads:

Routier European Transport takes delivery of first Volvo FH Electric

Volvo Trucks Romania has delivered the first Volvo FH Electric truck to Routier European Transport. A second copy will reach customers in September. A Romanian company located north of Alba Iulia.

The solution chosen by Routier European Transport consists of a 40-ton Volvo FH 4x2T Electric tractor, maximum combined mass, with six battery packs and a total power of 540 kW (six batteries of 90 kW each). The model is equipped with three electric motors, providing continuous power of up to 490 kW, and provides a charging autonomy of up to 300 km per charge cycle. The equipment also includes the Volvo I-Shift transmission, updated for electric trucks, with a new shift strategy. It operates mainly in the higher gears, from seventh and up, and minimizes the number of gear changes to provide greater efficiency.

Earlier, in February 2023, just a few months after Volvo Trucks began mass production of its range of electric heavy trucks, the representative office in Romania delivered the first tractor, a Volvo FH 4x2T Electric, to the company Blue River.

“I have had the opportunity to talk to customers in Romania and we are pleased to see that there is a growing interest in implementing electromobility solutions in this market as well, which is why companies are eager to make this transformation. A transformation based on new technologies, on the charging infrastructure but also on new services that we can offer our customers to guarantee the availability and autonomy they need, and in which we are actively investing. In the context of the need to drastically reduce CO2 emissions, we started producing and marketing Volvo electric trucks in 2019 and since then we have sold 6,000 units in 40 countries around the world, and today we are the market leader in Europe with a market share of more than 50% in the electric truck segment,” said Roger Alm, president of Volvo Trucks.

Routier’s strategy is to implement a fully electrified intermodal transportation solution. Thus, in addition to electrified rail transport, the two purchased Volvo FH Electric tractors provide pickup (first mile) and delivery (last mile) at the beneficiary’s warehouse. Therefore, a sustainable transport solution through electric propulsion with low CO2 emissions. They will operate one in Germany and the second in Romania, in connection with the railroad terminals where the company operates.

“We are proud that this year Routier European Transport will offer its customers 100% electric international transport by purchasing the first electric trucks from Volvo Trucks. We continue our growth with logistics hubs in Romania and abroad (Germany, Italy and the Netherlands), with this new all-electric transport service, covering a distance of about 300 km. We offer the possibility to use the electric tractor head in the terminal hub from which we operate the intermodal service, in Romania it is the Baia-Mare – Oradea and return connection,” said Rareș Retegan, one of the shareholders of Routier European Transport.

Routier European Transport has 17 years of experience in the market and is an important presence in the road transport and logistics market in Europe and Romania. The company focuses on technology integration, both in terms of fleet and operations. The modern fleet currently includes 146 Volvo Euro 6 trucks, to which will now be added the two new electric units, 900 trailers and its own train, supported by logistics areas in Romania and Europe.

For further information: https://routiertransport.com

As previously announced, Romanian companies operating or wanting to operate in the Netherlands will also receive attention if they join the DRN, of course, and Routier has a branch in Nijmegen.

What the new road tax regime looks like for road hauliers of people and goods, which will be in place from 2026. Implementing decisions are also needed

According to a recently formalized law, the road tax regime will change dramatically in 2026. This is especially important for road hauliers of goods and passengers, for whom the current situation is becoming more complex.

First of all, it should be mentioned that from January 1, 2026, there will be two types of road tax covering the vehicles of carriers of goods and people, Roviniëta and Tolro , according to Law 226/2023. The application of one or the other is done as follows:

- Vehicles exclusively for transporting people – roviniëta;

- Vehicles exclusively for transporting goods with a maximum authorized mass (MTMA) of up to 3.5 tons – roviniëta;

- Mixed transport vehicles (passengers and goods in separate compartments) with MTMA not exceeding 3.5 tons – roviniëta;

- Vehicles exclusively for transporting goods with MTMA exceeding 3.5 tons – tolro;

- Mixed transport vehicles (passengers and goods in separate compartments) with MTMA over 3.5 tons – tolro.

What is the difference between roviniëta and tollro? First, the (environmental) damage is determined according to the category of the vehicle, EURO class (pollutant emissions) and the period of use of the road network. And tolro is determined based on a unit rate (consisting of an infrastructure use rate and a rate based on infrastructure costs and the cost of air pollution from traffic) and the distance traveled.

What is the difference between roviniëta and tollro? First, the (environmental) damage is determined according to the category of the vehicle, EURO class (pollutant emissions) and the period of use of the road network. And tolro is determined based on a unit rate (consisting of an infrastructure use rate and a rate based on infrastructure costs and the cost of air pollution from traffic) and the distance traveled.

Second, we also have differences regarding the payment of taxes. The voucher must be paid in advance (with a maximum of 30 days before the effective date of validity) for predetermined periods of one day, 10 days, 30 days, 60 days or 12 months. Tollro is paid depending on the distance, on a contract entered into with a supplier, on a one-way ticket with a validity of 72 hours (prepaid) or via the mobile application provided by the government.

Rovinieta and tolls are payable for using national roads (main or secondary roads), international roads (those marked “E”), and highways. Tolls are not charged on road sections within municipalities.

With the enactment of Law 226/2023, the current Rovinia rules, contained in OG 15/2002, will be repealed. Currently, there is only the wreck and this applies in all cases, depending on the category of vehicles and the duration of use of the roads.

Important!

The new law provides only the general framework of the new traffic tax regime, so not many details are currently available on the pricing itself. The methodological standards of the new law, the categories of vehicles subject to tolls and the level of tolls, as well as the categories of vehicles subject to tolls and the level of the unit rate for tolls will have to be established by March 31, 2025, by order of the Ministry of Transportation.

Environmental Sector (Recycling)

Warranty return system in Romania becomes the second largest in Europe, after Germany

Gemma Webb, CEO of RetuRO, the administrator of the Guarantee Return System, said, “We started looking for funding in December 2022, it was a six-month process and in the end we reached an agreement with ING Bank for funding of 426 million lei,” said Mihaela Bîtu, CEO of ING.

RetuRO, the company that will manage the Guarantee Return System (SGR) in Romania, has selected all 17 logistics centers that will be part of the collection network from Nov. 30, 2023, when the SGR becomes functional on the local market. To operationalize them and equip them with the necessary equipment, RetuRO obtained financing worth 426 million lei (€86 million) from ING Bank, which thus became GSC’s sole financier.

RetuRO, the company that will manage the Guarantee Return System (SGR) in Romania, has selected all 17 logistics centers that will be part of the collection network from Nov. 30, 2023, when the SGR becomes functional on the local market. To operationalize them and equip them with the necessary equipment, RetuRO obtained financing worth 426 million lei (€86 million) from ING Bank, which thus became GSC’s sole financier.

“Of these centers we have already identified, six will be large and 11 will be smaller. We have now made arrangements with the developers from whom we will rent these spaces. The packaging collected from stores will arrive at these centers, where it will be counted, sorted, compressed and from where it will go on for recycling,” said Gemma Webb, CEO of RetuRO, in an interview for Ziarul Financiar.

The raw material – PET, aluminum, glass – then reaches the processors, who are chosen through auctions based on the best price, which is also one of SGR’s sources of funding. Currently, in order to operationalize the system so that it is ready for implementation on Nov. 30, 2023, the administrator has secured a financing package from ING that includes an investment loan of 343 million lei (69 million euros). on a five-year period and a credit for working capital of 83 million lei (16.7 million euros) with a term of two years.

“This project is new to the Romanian market and until the moment of the agreement we were under pressure because of the deadline, as all steps must be completed by Nov. 30,” said Mihaela Bîtu, CEO of ING Bank Romania.

The Guarantee Return System in Romania will be the second largest in Europe, after that in Germany, and it is the second after Iceland in which the state is also involved.

The Guarantee Return System in Romania will be the second largest in Europe, after that in Germany, and it is the second after Iceland in which the state is also involved.

“We started looking for financing back in December 2022, we went around all the banks, explained the model and what we wanted to do, and finally signed an agreement with ING Bank. It was a process that took six months. Funding is a key element in this big project, which will have a huge impact on changing attitudes and behaviors,” Gemma Webb said. She was appointed to the role of CEO and president of the RetuRO Sistem Garantie-Returnare Directorate in November 2022 and was the company’s first employee.

A total of 500 people will work in the 17 logistics centers and recruitment has already begun, choosing the managers of each center, who will then form their work teams. And the company’s management board was established, consisting of seven people. “By mid-September, we will have a team of 40 people in all essential departments: human resources, IT, finance, legal, operations, logistics. Because it is a completely new project, people are learning with us from scratch what needs to be done.”

Another challenge is the development of the GSC’s IT architecture, and in this sense, a tender has been issued to choose the companies that will provide the software structure.

So far, 63,000 of the 80,000 existing retailers in the local market have already registered on the platform, along with 1,500 manufacturers.

“I had no specific inspiration, because in terms of this project, Romania is different from any other country. We want Romania to become a model for other countries,” Gemma Webb said.

RetuRO Guarantee Return System will thus implement the most important circular economy project at the national level, aiming to achieve the collection and recycling targets Romania has adopted for the European Union.

“This is not the only green project we are funding. Only this year, towards the end, we will reach a level of 150-200 million euros of funding for projects in the green economy, excluding the money for RetuRO. However, this is the largest green financing we have provided so far,” Mihaela Bîtu said, adding that if new money is needed in the future for the development of SGR in Romania, the bank is considering granting new credits.

She also added that as a financier, ING Bank regularly receives requests to support green economy projects from different areas, especially after energy prices exploded last year and the focus on sustainability and cost efficiency increased.

While obtaining this green loan, RetuRO Return Guarantee System’s legal counsel was Bondoc si Asociaţii, the law firm selected to provide legal assistance to Returo SGR SA in implementing the system in Romania.

The GSC assumes that consumers will be able to return single-use plastic, glass or metal beverage containers in stores starting Nov. 30, 2023. Buyers pay a guarantee of 0.50 RON when they buy a bottle of liquor (water, soda, beer, cider, wine, spirits) from a retailer. The system applies to non-reusable primary packaging with a capacity of 0.1 to 3 liters. After emptying the package, consumers will have to take it to one of the drop-off points organized by merchants. In exchange for the empty package, the consumer is refunded the value of the deposit originally paid on the spot, without depending on the presentation of the tax certificate.

The obligation covers manufacturers and importers of beverages, as well as businesses that sell beverages to final consumers, including online stores, operators who sell through vending machines, restaurants and bars, and businesses that sell these products as a complementary assortment – for example, bookstores, household appliance and electronics stores.

For very small stores, the simplest collection method is to place a bag where packaging is collected near the cash registers. When the bag is full, it is tied with special seals provided by RetuRO. And the bags are special, resistant. There will be an online platform where the stamp sets will be uploaded, and there RetuRO will count the bags and create the logistical infrastructure to collect the packs from dealers.

The bags of containers are collected and arrive at the counting centers. Then the bales go to recycling parks. Tenders for materials will be open, so packaging can also reach companies abroad, not just in Romania.

The warranty return system is designed to encourage the return of single-use beverage containers for recycling and represents one of the most important circular economy projects in Romania. It is managed by the company RetuRO Sistem Garanţie Returnare SA designated in this regard by government decree.

RetuRO Sistem Garanţie Returnare SA was created by a consortium of three private shareholders: the Association of Romanian Brewers for the Environment, the Association of Soft Drink Producers for Sustainability and the Association of Retailers for the Environment and a public shareholder, the Romanian state, through the central environmental authority, the Ministry of Environment, Waters and Forests.

So far, 10 European countries have implemented SGR at different stages over time, with different objectives. The system in Romania will be the first to respond to the current needs of the business environment, but also to the environmental objectives resulting from European legislation with ambitious targets from 2025.

List of centers phased in from October 2023 to mid-2024

► Major centers: Bucharest, Timisoara, Târgu-Mureş, Bacău, Craiova, Ploiesti.

► Small centers: Oradea, Cluj-Napoca, Constanta, Pitesti, Suceava, Deva, Baia Mare, Galati, Miercurea Ciuc, Brasov, Calarasi.

Source: RetuRO

Mihaela Bîtu, CEO at ING Bank Romania:

This project is new to the Romanian market and until the moment of the agreement we had the pressure of the deadline, as all steps must be completed by November 30.

Water Sector (Irrigation)

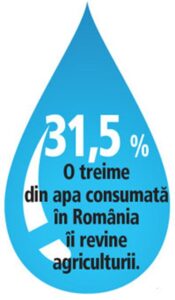

The water war: farmers demand approval for deep wells as soon as possible – A dilemma

One-third of the water consumed in Romania is for agriculture. The farmers point to the government being slow to issue permits for these wells.

One-third of the water consumed in Romania is for agriculture. The farmers point to the government being slow to issue permits for these wells.

“If you want to drill wells, you have to send a file to the National Institute of Hydrology and Water Management in Bucharest, you wait 6-7 months for the approval, then you make a technical project for the well, you send that again to the institute and then you wait another 3-4 months. In the end, it takes more than a year to get the approval for drilling,” said Alexandru Haită, president of Teleorman’s Tinoasa Agricultural Cooperative.

However, the aforementioned institute points out that we should pay attention to groundwater levels. One-third of the water consumed in Romania is for agriculture.

“If we exploit underground water for a long period of time, we will end up like India, where people fear they will run out of drinking water and food, and we could see an exodus of population from that country, that is, more than 1 billion people who will flee to places where there is still water,” said hydrologist Daniel Diaconu . The water in these basins had to be taken from the ground or from rivers.

In the past three years, authorities have granted just over 200 approvals for wells to supply water to irrigation systems. Irrigation systems that rely on well water are the solution found by farmers who do not have access to traditional irrigation infrastructure. The value of such wells can reach 80,000 euros, and nine or 10 wells are needed to irrigate 300-400 hectares.

In the past three years, authorities have granted just over 200 approvals for wells to supply water to irrigation systems. Irrigation systems that rely on well water are the solution found by farmers who do not have access to traditional irrigation infrastructure. The value of such wells can reach 80,000 euros, and nine or 10 wells are needed to irrigate 300-400 hectares.

“The Indian or American model of irrigation of crops from the ground, with water from the water table or from the depth, I don’t know if it is suitable for Romania. Now we have problems with underground water in certain areas because in some places, like Sfântu Gheorghe, they are supplied 100% with underground water and you realize that we cannot, for example, water the potatoes with that water because it is more important that it reaches the population. However, the biggest challenge on this line is not financial, but bureaucratic.

It seems to us useful for the Dutch water sector, both public and private that has international fame to present itself more than before at meetings as indicated above.

See http://www.limnology.ro/wrw2023/topic.html

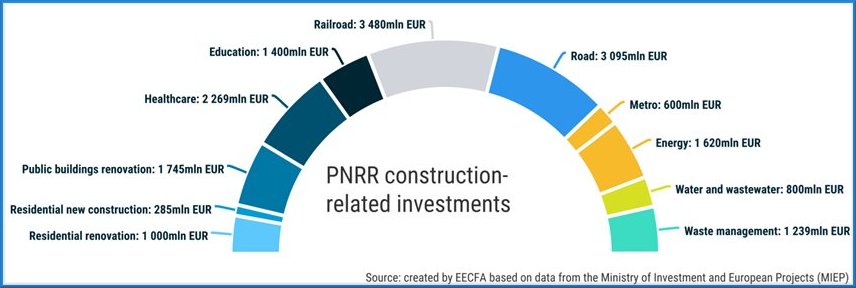

Construction sector

Romania in top 3 EU countries with greatest progress in construction work

Construction activity rose 0.2% in May in the euro zone and in the European Union, compared with the previous month, when there was a 0.6% decline in the euro zone and 0.8% in the EU, while Slovakia, Romania and Slovenia were the member states with the greatest progress, according to data published by the European Statistical Office (Eurostat).

Of the EU member states for which data are available, the largest monthly increases in construction activity in May were recorded in Slovakia (5.5%), Romania and Slovenia (both at 3.7%) and the Netherlands (3.6%), with the most significant decreases in Belgium (minus 2.8%), Austria (minus 2.5%) and Hungary (minus 1.7%).

Data from Eurostat show that in May, compared with the same period in 2022, construction activity increased by 0.1% in the euro area and decreased by 0.4% in the European Union. Among the EU member states for which data are available, the largest increases in construction work in May, compared to the same month in 2022, were recorded in Slovenia (24.6%), Romania (10.6%) and Spain (7.1%), and the most significant decreases in Hungary (minus 12%), Italy (minus 6.5%) and Sweden (minus 6.3%).

Groningen hemp applications successful in Romania

Since 2015, Hempflax has started remodeling and production started in Sebes in the Alba district which is managed from Oude Pekela. The many hemp applications are diverse and not universally known. Given the increasing construction activity especially in Romania and the standards it must meet, it is also used in construction.

Since 2015, Hempflax has started remodeling and production started in Sebes in the Alba district which is managed from Oude Pekela. The many hemp applications are diverse and not universally known. Given the increasing construction activity especially in Romania and the standards it must meet, it is also used in construction.

The diagram below makes that clear.

For further information see their website: www.hempflax.com

Financial sector

ING Bank launched 100% online loan for SMEs

ING Bank Romania launched the 100% online Useful Loan for Entrepreneurs, granted directly from the ING Business web platform. Without going to the bank, customers can get up to 500,000 lei online for up to 5 years.

ING Bank Romania launched the 100% online Useful Loan for Entrepreneurs, granted directly from the ING Business web platform. Without going to the bank, customers can get up to 500,000 lei online for up to 5 years.

The credit documentation is signed with a qualified electronic signature, offered free of charge by ING in the online banking platform. The entire online loan application process takes about 10 minutes and the money is available immediately.

“A year ago, we launched ING Credit Util, a new loan with repayment in equal installments that entrepreneurs could take out on the spot at an ING branch.

Wanting to offer their customers more digital tools that are truly relevant to their needs, ING Credit Util can now be obtained 100% online, with direct access to money, through the ING Business platform. Therefore, it is one of the fastest loans for micro-enterprises and small businesses in all fields: from construction, transportation and manufacturing to consulting and services, to take advantage of commercial opportunities or for unforeseen expenses.

ING Credit Util 100% online confirms our strategy to offer simple and digital solutions, including financing, available anywhere and anytime to ING entrepreneurs and their businesses.” – Mihaela Otel, director of product development, within the Business Banking Division, ING Bank Romania.

Who has access to the ING Util loan?

ING Credit Util was created for micro-enterprises and small businesses with sales up to nine million lei.

Entrepreneurs can obtain up to 500,000 lei for current expenses or other expenses specific to the company’s activity (suppliers, salaries, payment obligations to the state budget, share purchases, etc.) Verification of eligibility and financial situation is carried out automatically by the bank, without the need for financial documents or material guarantees, for approval and direct access to credit.

How do customers access the ING Util 100% loan online?

Eligible ING customers can access the Products section -> Loans -> I want a new loan in the ING Business web platform. The process is simple and intuitive. When they apply for credit, they validate the company’s information, see the amount they qualify for and get a free electronic signature required to sign the credit agreement. After signing, the money is immediately available.

Eligible ING customers can access the Products section -> Loans -> I want a new loan in the ING Business web platform. The process is simple and intuitive. When they apply for credit, they validate the company’s information, see the amount they qualify for and get a free electronic signature required to sign the credit agreement. After signing, the money is immediately available.

For both customers and those who are not yet ING customers, Creditul Util is also available at all ING branches, where it is also granted on the spot.

Opening an additional account and applying for a new card, 100% online, in ING Business

In addition to online credit, ING is bringing new innovations to the ING Business platform:

- ING customers can open an additional account online, accessible within a maximum of 2 minutes of launching the application. The account can be opened in 6 currencies: lei, euro, dollar, British pound, Swiss franc or Hungarian forint.

- They can also request an additional card online, in the name of the legal representative, with the option of sending it to the desired mailing address.

Opening the new account and issuing the new card can now be done quickly, also in ING Business, under Products.

Other news from ING for entrepreneurs

In June, ING also implemented instant payments for small and medium-sized businesses in the ING Business Internet Banking application. Any payment in lei, with a value of less than 50,000 lei, sent to an IBAN of a bank affiliated with the instant system, is immediately collected by the business partner, without any additional fees or extra steps. In about 2 weeks after the launch, ING entrepreneurs made more than 300,000 direct payments in the ING Business platform.

ING Bank Romania launched the campaign “Banking and more for small and medium-sized businesses” and continues to improve the user experience of its customers, from dialogue with them. In a dynamic context, ING is a reliable partner for healthy business growth, offering Romanian entrepreneurs predictability and flexibility, through the right financial instruments, to always be one step ahead and take their business to the next level.

Socio-Economic Developments within the EU

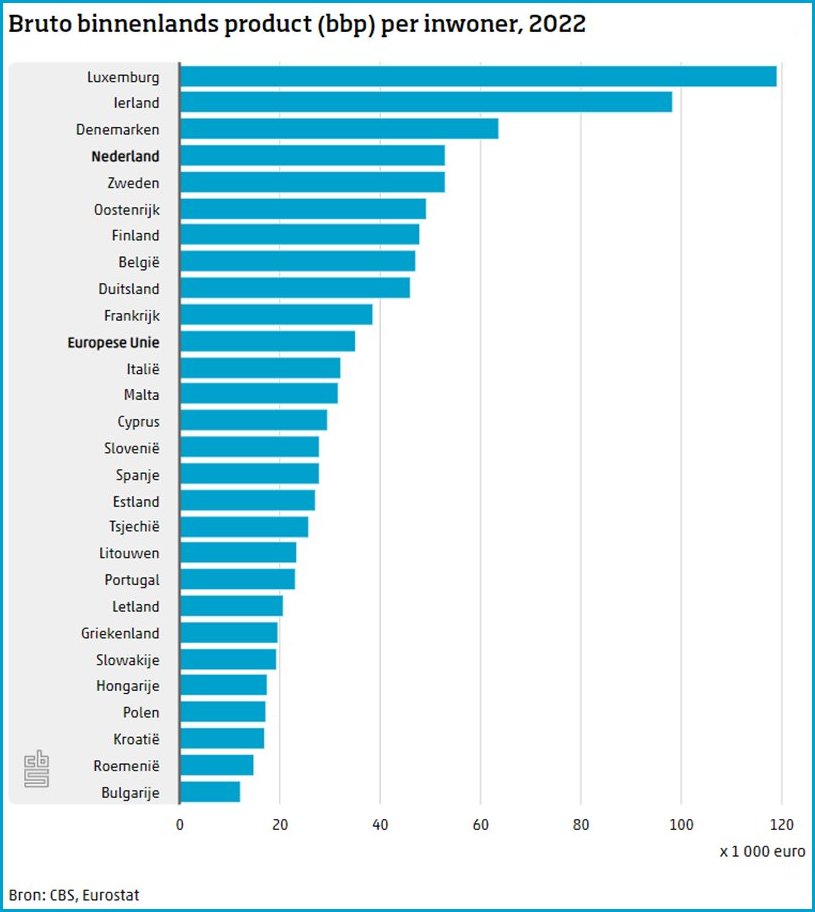

Dutch GDP per capita in fourth place within EU

The Dutch gross domestic product (GDP) per capita was over 53 thousand euros in 2022. This places the Netherlands fourth in the European Union. In 2021, the Netherlands ranked fifth. Like a year earlier, GDP per capita was one and a half times the EU average. This is according to figures from CBS and Eurostat.

Luxembourg has the highest GDP per capita within the European Union. This is because of the relatively large number of financial institutions in the country, and because many people work in Luxembourg but do not live there. Second place is taken by Ireland, followed by Denmark and the Netherlands. At 12 thousand euros, Bulgaria has the lowest GDP per capita in the European Union. This is more than two and a half times lower than the EU average.

Gross domestic product (GDP) is the total of goods and services produced in a country. So everything the people in the country earned together. Usually for a year. GDP is used to show how well a country is doing (economically speaking).

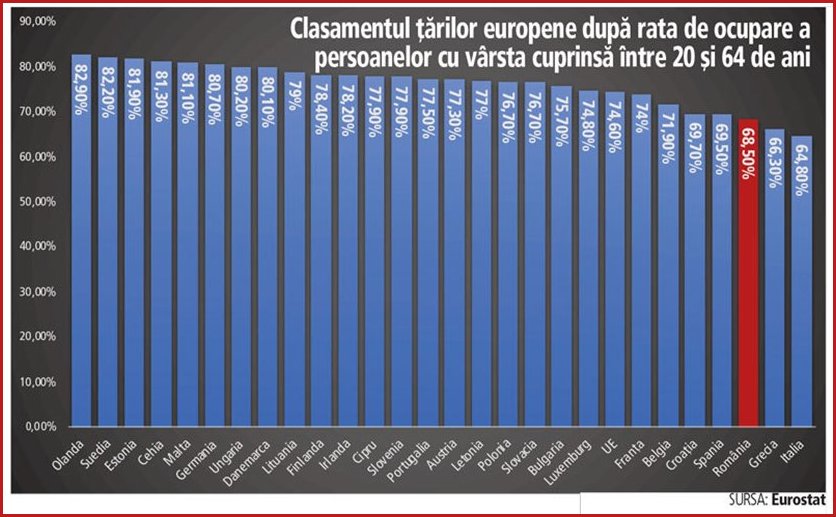

Romania has the third-lowest employment rate in the EU

The employment rate of adults aged 20-64 in Romania was 68.5%. The European Union average in 2022 was 74.6% Eight EU member states had employment rates below 80%.

Romania has the third lowest employment rate among European Union member states, according to data from Eurostat, the European statistical office. For example, in 2022, the labor force participation rate of adults aged 20-64 in Romania was 68.5%, while the European average reaches almost 75%.

Thus, the employment rate in the EU – which measures the proportion of the population aged 20-64 that was working – was 74.6% in 2022. There were eight EU member states where at least 80% of adults aged 20-64 were employed: the highest rates were recorded in the Netherlands (82.9%), Sweden (82.2%) and Estonia (81.9%).

Conversely, less than 70% of adults aged 20-64 were employed in Croatia (69.7%), Spain (69.5%), Romania (68.5%), Greece (66.3%) and Italy (64.8%).

After falling by 1 percentage point to 71.7% between 2019 and 2020, the EU labor force participation rate returned to pre-pandemic levels, rising to 73.1% in 2021. In 2022, the occupancy rate rose 1.5 percentage points to 74.6 percent. %. In 2022, the labor force participation rate in all EU member states was higher than in 2019, before the crisis caused by the COVID-19 pandemic.

Also, between 2021 and 2022, the employment rate of people aged 20-64 increased in each of the EU member states. The largest annual increases were observed in Greece (by 3.7 percentage points) and Ireland (3.3 percentage points). France and Luxembourg were the only member states where the labor force participation rate did not increase by at least 1 percentage point.

Commodities Sector

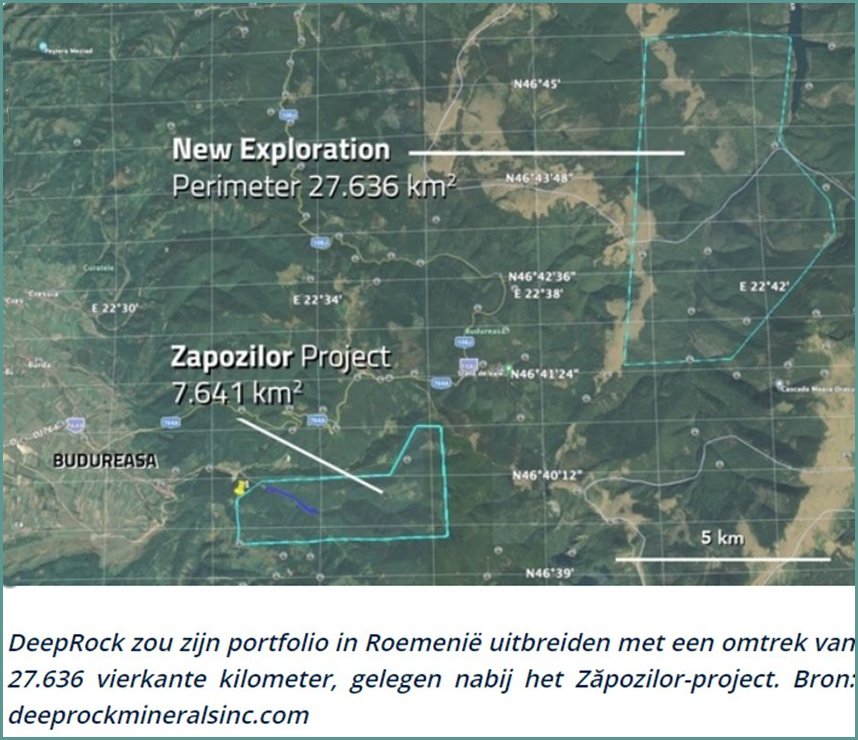

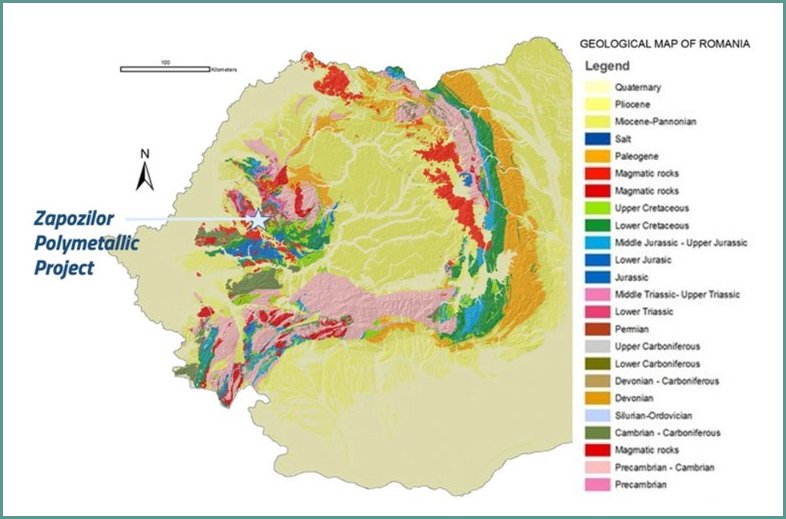

DeepRock Minerals abandons gold mining project in Romania but remains active with other project

DeepRock remains in Romania with the 7,641-square-kilometer Zăpozilor polymetallic mining project in the Apuseni Mountains, Bihor County, for which it acquired the prospecting license in 2020.

In 2021, DeepRock signed a contract to acquire a 100% interest in a future exploration property in the Apuseni Mountains, covering nearly 2,800 hectares.

The company paid an advance of C$275,000 to the seller, Romanian firm Augustine Trading Professionals. Under the contract, it would have issued 9 million shares upon obtaining the exploration license and another 9 million depending on the amount of gold found.

Romania is rich in minerals/natural resources. The country ranks 10th in the world in terms of variety of minerals. There are ±60 operated. Among the main items in this regard are lignite, coal, iron ore, copper, lead, zinc, uranium, gold, rock salt, petroleum, natural gas, timber and water (spring baths, mineral water, white power, fish).

Numerous Canadian companies, operating mainly out of Vancouver and Toronto and regularly under changing names are regularly trying to obtain operating licenses with varying degrees of success. It is a very opaque whole. It is reminiscent of hot air or hot air.

Shipbuilding Sector

Damen cancelled cooperation with Romanian state

By Law No. 187/2023, the legal framework under which the cooperation between the Romanian state and Damen regarding the Mangalia shipyard operated was canceled, according to a statement from Damen.

Shortly after the announcement, construction site management held a press conference in which they explained the next steps toward this decision. “We will convene the Annual General Meeting where we will invite both shareholders to discuss the strategy for the coming period; what will be the medium and long-term vision, what will be the shareholders’ support for continuing the relaunch and positioning Mangalia where it deserves to be. It is an unprecedented situation we find ourselves in,” said Liana Constantin – Corporate Affairs Director and member of the Damen Mangalia yard.

What did Liana Constantin say:

It is our desire to continue the work at the Mangalia site by attracting new orders.

Liana Constantin, director of corporate affairs and member of the Damen Mangalia Shipyard directorate

- made the decision to develop a sales team to attract orders to the site. We want the problem between the two shareholders to be resolved as soon as possible, but this is a shareholder-level problem. But what the activity of the construction site means, we, the management, are 100% committed to continuing the activity on this construction site.

- Let me explain a little bit the original context in 2018, 51% was given to the Damen state took over 51% of the shares, 2% of the shares were given to the Romanian state for free, subject to a legal such that the minority investor Damen Holding can have operational and managerial control over the construction site. With the new legislative amendment, the legal framework originally created will lapse. But the conditions must remain the same.

- As members of the management of this shipyard, we affirm our commitment to the continuation of the activity, to our people and to the potential that this shipyard has, not only in the shipbuilding market, but also in the offshore renewable energy market.

- In 2018, when the site was acquired, it was a site with no assignments, with negative financial statements. The yard had to be relaunched in a totally different market because the market in which it operated no longer existed, and what I can tell you is that Damen financed this learning curve and relaunched the yard in other markets.

- We hope that a solution will be found to ensure continuity of activity at the Mangalia construction site, where we are talking about more than 1,500 workers and more than 600 cooperating subcontractors. That is what we are waiting for in the next general meeting of shareholders to agree with the shareholders what the next steps are in the new legal framework, in the new, much more bureaucratic system that we will have to implement at the Mangalia construction site. And here, therefore, representatives of the Ministry of Economy, together with Damen Holding, should sit down with us to agree on the work system that we should have from now on in the new legal framework.

- The offshore wind market is a €200 billion market. In Europe, there are only five shipyards that can do what Mangalia can do in the offshore industry.

- We have construction ready for delivery that will power 600,000 homes in New York, United States of America, in September. We also have a similar project underway, a 2nd structure larger than the one intended for the US, which will be delivered to Europe. There are no debts to the state budget, there have never been debts to the state budget. There were NO delays in the payment of salaries.

By Law No. 187/2023, the legal framework under which the cooperation between the Romanian state and Damen regarding the Mangalia shipyard operated was canceled, according to a statement from Damen. The current legislation violates the conditions offered by the Romanian state, completely invalidating the principles behind Damen’s decision to invest in the Mangalia site, the document also states.

Damen Mangalia – Photo: Damen

Moreover, this fact comes after more than 3 years of other roadblocks in the decision-making process, no other form of help, involvement or funding from the Romanian partner.

And what else does Damen Holding say in the press release

- Over the past four months, we have repeatedly tried to avoid negative consequences for the shipyard, staff and customers. Thus, we informed the Romanian authorities and relevant entities about the impact of the new law on this partnership, even before it was adopted, and requested immediate measures to prevent it. Damen urged a real dialogue and a quick solution to be implemented before the law takes effect to minimize any disruption to shipyard operations and resolve the current difficult situation. This did not happen.

- Thus, after an already difficult cooperation and now faced with these unilateral changes, Damen not only faces a breach of contract but also a breach of trust on the part of the Romanian state.

- In this regard, after a previous notification of breach of contract in which Damen expressed for the last time its willingness to find a possibility for the continuation of the association, for which no solution was offered by the Romanian side, Damen had no other choice but to notify the termination of the association agreement concluded in 2018 with the Romanian partner.

- By taking this step, established in the contractual framework of the partnership, Damen, as a foreign investor, protects its rights, investments, customers and projects at the Mangalia site.

Brief history:

- In 2018, in the context of the collapse of the Mangalia shipyard activity and the decision of the former shareholder (Daewoo Shipbuilding & Marine Engineering Co. Ltd. respectively) to withdraw from the company, the Romanian state agreed to Damen’s acquisition of the Korean stake.

In 2018, when the site was acquired, it was a site with no assignments, with negative financial statements. The yard had to be relaunched in a totally different market because the market in which it operated no longer existed, and what we can tell you is that Damen financed this learning curve and relaunched the yard in other markets.

In 2018, when the site was acquired, it was a site with no assignments, with negative financial statements. The yard had to be relaunched in a totally different market because the market in which it operated no longer existed, and what we can tell you is that Damen financed this learning curve and relaunched the yard in other markets. - In the first stage of the transaction, Damen acquired 51% of the DSMa shares from the former shareholder, becoming the company’s majority shareholder.

- Later, after the negotiations, the Romanian state imposed and Damen agreed to transfer, without monetary consideration, 2% of the shares to SN 2 Mai SA (owned by the Ministry of Economy), allowing a state-owned company to become a majority shareholder on the Damen Mangalia construction site. This transfer continues to benefit the Romanian state, which managed to become the majority shareholder in a major shipbuilding company that operates one of the largest shipyards in Eastern Europe.

- The transfer of 2% of Damen’s shares to SN 2 Mai SA took place under the condition that Damen would have full administrative and operational control over the Damen Mangalia shipyard (through SN 2 Mai SA) for the entire duration of the cooperation between Damen and the Romanian state (through SN 2 Mai SA), allowing Damen to manage and develop the company based on a business plan developed by Damen.

- In 2018, the Government of Romania adopted GEO No. 73/2018 which incorporated it into GEO No. 109/2011 a provision that excluded certain commercial

companies from the scope of GEO No. 109/2011. This provision introduced by GEO No. 73/2018, contained an exception to the application of GEO No. 109/2011 for operators who would have been subject to GEO No. 109/2011, due to the fact that the private shareholder no longer holds the majority of shares and has the financial and technical capacity necessary for the development of the purpose of the operator’s activity, in which case he may be entrusted with the executive management of the company, administrative and/or operational control.

companies from the scope of GEO No. 109/2011. This provision introduced by GEO No. 73/2018, contained an exception to the application of GEO No. 109/2011 for operators who would have been subject to GEO No. 109/2011, due to the fact that the private shareholder no longer holds the majority of shares and has the financial and technical capacity necessary for the development of the purpose of the operator’s activity, in which case he may be entrusted with the executive management of the company, administrative and/or operational control. - Currently, these exemptions have been canceled by Law 187/2023, and one of the affected companies is the Damen Mangalia shipyard, as the association agreement between Damen Holding BV and the Romanian state is being violated.

- The decision in no way affects the Damen Galăți Shipyard, in which the Damen Group is majority shareholder(100%).

Damen Holding BV (Damen) provides more than 3,500 jobs locally, more than 400 projects have been completed in Romania, and more than 30 defense and security vessels have been built for 14 navies and coast guards around the world, including for NATO and EU countries.

“After an already difficult cooperation and now faced with these unilateral changes, Damen is thus confronted not only with a breach of contract, but also with a violation of the relationship of trust on the part of the Romanian state. In this sense, after an earlier notification of breach of contract in which Damen expressed for the last time its willingness to find a possibility for continuation of the association, for which no solution was offered by the Romanian side, Damen had no choice but to issue the termination of the association agreement concluded in 2018 with the Romanian partner,” company officials say.

What we had noticed earlier

- In 2016, the then Defense Minister Mihnea Motoc(former Ambassador to the Netherlands) awarded the frigate order to Damen Shipyards. Entirely according to the procurement rules of the Lisbon Treaty that matters of national security need not be put out to public tender. However, the next government ignored this already made agreement and turned it into a public tender that was won

by the French Naval afterwards proved unable to meet the requirements. Normally it then shifts to the second provider, and that was Damen Shipyards. For reasons that are unclear, it appeared that the purchase of the frigates was abandoned even though the war in Ukraine made it necessary.

by the French Naval afterwards proved unable to meet the requirements. Normally it then shifts to the second provider, and that was Damen Shipyards. For reasons that are unclear, it appeared that the purchase of the frigates was abandoned even though the war in Ukraine made it necessary. - In May of this year, the Romanian parliament gave the green light to purchase without procurement rules (i.e., they are applied arbitrarily) two Scorpio type submarines from French Naval (2 billion euros) and two 2nd hand minehunters from the United Kingdom.

- In November 2021, Florin Spataru was asked by the current government for the post of Minister of Economy, while until then he was a board member of Damen Shipyards in Mangalia!

In the rotation that took place in June this year, he was not reappointed.

Editorial:Whether it is all a coincidence is a question that arises, as is the question of whether state “corporations” are allowed to engage in (false) competition with business.

Agricultural sector

Status Quo Romanian agricultural production also offers opportunities

The value of agricultural production fell 15.8% in 2022 compared to 2021, to a total of RON 109.56 billion at current prices (about EUR 22 billion), according to data recently published by the National Institute of Statistics (INS).

Crop production fell 22.8% last year to a value of RON 71.91 billion (EUR 14.3 billion), livestock production fell 0.5% (RON 34.86 billion or EUR 7 billion), while agricultural services increased 29.2%, worth RON 2.78 billion (EUR 0.55 billion).

In 2022, the construction of the production value of the agricultural industry showed small variations from the previous year. The share of crop production was 65.6%, down 5.6% from the previous year, livestock production had a share of 31.8%, up 4.8% from the previous year, and agricultural services had a share of 2.5%. %.

Regarding the structure of the value of crop production in 2022, on the main crop groups, increases were recorded for oil plants (+1.7%), potatoes (+1.3%) and cereals (+0.3%) and decreases for vegetables and melons (-2.3%), feed crops (-0.5%), fruits and grapes (-0.4%) and other product groups (-0.1%).

However, according to INS data, the value of animal production in 2022 increased for poultry (+1.8%), products obtained from milk processing in zootechnical farms (+0.7%) and for sheep and goats (+0.5%). Declines in production value shares were recorded in pigs (-2.6%) and in other product groups (-0.4%).

Strong land fragmentation (with a high proportion of subsistence agriculture(kitchen garden economy) – lack of economic viability), difficult climatic conditions, high input and energy costs, are all factors that contributed to the decline in agricultural production by 2022.

The high share of crop production (65%) shows an underutilized potential of the Romanian agricultural sector, leaving Romania in a status quo as a mere supplier of agricultural commodities as long as no value is added to primary production. However, it also shows the strong base and “great space” Romania has for developing its agri-food sector, and the potential to increase its role as a contributor to European food security.

Fiscal budget woes

The annual struggle for the treasury

As in any country, measures, necessary or not, are casting their shadow in Romania. Whether or not these make it to the finish line is not yet known; at most, it provides a direction. This year will undoubtedly play a role that 2024 will see several elections both at the national and European levels.

Once the budgets are established, we will provide you with further information in consultation with the experts from our member Mazars.

A first shot across the bow

Since it is a draft, some changes may occur. In any case, life is getting more expensive in Romania.

Construction and agricultural workers will pay CASS (National Health Insurance Fund). In short, their exception is removed.

Dividend tax goes up from 8% to 10%.

In the case of distributed dividends based on the interim financial statements prepared during 2023, the dividend tax rate is 8%, without recalculation of the tax on the respective dividends, after their regularization based on the financial statements with respect to the 2023 year.

VAT increases from 5% to 9% for:

- The delivery of textbooks, books, newspapers and magazines, on physical and/or electronic media, excluding those that have wholly or predominantly video content or audio-music content and that are intended solely or primarily for advertising;

- Services consisting of providing access to castles, museums, memorial houses, historical monuments, architectural and archaeological monuments, zoological and botanical gardens;

- The provision of housing as part of social policy, including the land on which it is built. The land on which the home is built also includes the home’s footprint. For the purposes of this title, housing provided as part of social policy means:

- the completion of buildings, including the land on which they were constructed, intended to be used as housing for the elderly and pensioners;

- delivery of buildings, including the land on which they are constructed, intended to be used as children’s homes and convalescent and rehabilitation centers for minor disabled persons;

- the delivery of homes with a use area of up to 120 m², excluding household outbuildings, whose value, including the land on which they are built, does not exceed 600,000 lei, excluding sales tax, purchased by natural persons individually or jointly with another natural person(s). Any natural person can buy a single home alone or together with another natural person(s) from September 1, 2023, whose value does not exceed the amount of 600,000 lei, excluding VAT, at a reduced rate of 9%;

- the provision of buildings, including the land on which they are built, to municipal offices for allocation by them with subsidized rents to individuals or families whose economic situation prevents them from accessing owner-occupied or rented housing a home on market terms;

the supply to natural persons of firewood, in the form of logs, stumps, twigs, branches or similar forms, falling under NC codes 4401 11 00 and 4401 12 00, and of sawdust, waste and agglomerated wood waste in the form of wood pellets, wood briquettes and similar forms, falling under CN codes 4401 31 00 and 4401 32 00 the supply for use as heating fuel of sawdust, waste and unagglomerated wood waste, falling under NC codes 4401 41 00 and 4401 49 00, to natural persons as end-users, on the basis of the beneficiary’s own declaration of responsibility;

- the supply to legal persons or other entities, regardless of their legal form of organization, including schools, hospitals, medical centres and social assistance units, of firewood, in the form of logs, stumps, logs, branches or similar forms, falling under CN codes 4401 11 00 and 4401 12 00, and sawdust, wood waste and scrap, agglomerated in the form of wood pellets, wood briquettes or similar forms, falling under CN codes 4401 31 00 and 4401 32 00 the supply for use as heating fuel of sawdust, waste and unagglomerated wood waste falling within CN codes 4401 41 00 and 4401 49 00 to legal persons or other entities, regardless of their legal form of organization, including schools, hospitals,

- the supply of cold season thermal energy intended for the following categories of consumers:

- population;

- public and private hospitals, defined according to Law No. 95/2006 regarding health care reform, republished, with subsequent amendments and additions, public and private teaching units, defined according to National Education Law No. 1/2011, with subsequent amendments and additions;

- non-governmental organizations regulated under the law, as well as sect units, as regulated by Law No. 489/2006 on freedom of religion and the general regime of sects, republished;

- social service providers, public and private, accredited, providing social services provided in the nomenclature of social services approved by Government Decree No. 867/2015 for the approval of the nomenclature of social services, as well as the framework for the organization and operation of social services, with subsequent amendments and additions.

- Supply and installation of photovoltaic panels, solar thermal panels, heat pumps and other high-efficiency and low-emission heating systems,

- Supply and installation of photovoltaic panels, solar thermal panels, heat pumps and other high-efficiency low-emission heating systems intended for buildings of central or local public administrations, buildings of entities under their coordination/subordination, excluding commercial companies;

- the supply of dentures and accessories, with the exception of tax-free dentures

- supply of orthopedic products.

What exactly has 9% VAT:

- Supply of the following goods: food, including beverages, intended for human and animal consumption, live animals and domestic birds, seeds, plants and ingredients used in the preparation of food, products used to supplement or replace food, the CN codes of which are determined by the methodological rules, except:

- alcoholic beverages;

- non-alcoholic beverages falling under NC code 2202;

- foods with added sugars whose total sugar content is at least 5 g/100 g of product.”

Real estate transaction tax of 5% of sales price

The document also stipulates that, according to the law, authorized legal and natural persons who dispose of residential buildings by sale are obliged to pay the tax on real estate transactions involving residential buildings established under this title.

The provisions also apply to natural persons who alienate residential buildings from the corporate heritage by sale on the basis of the extract from the land register from which it can be concluded that the building belongs to the corporate heritage

The tax on real estate transactions involving residential buildings is calculated at the first sale by applying a rate of 5% to the sale price of each residential building sold, from which the value of 600,000 lei is deducted, without taking into account the related value-added tax.

In the event that the sale price of each residential building is lower than the minimum value determined by the market study conducted by the chambers of notaries with legally authorized appraisers, the tax is calculated at the level of the value determined by the market study from which the value is deducted 600,000 lei.

Tax on buildings worth more than 2.5 million lei

Individuals who own buildings in Romania whose calculated taxable value exceeds 2,500,000 lei are required to pay the tax on the ownership of various real estate properties.

The tax on the ownership of multiple properties is calculated by applying a rate of 1% to the difference between the sum of individual taxable values communicated by the local tax authority through the tax decree and the ceiling of 2,500,000 lei.

New tax for microenterprises

The tax rates on microenterprise income are:

- 1%, for micro-enterprises with turnover not exceeding 300,000 lei including

- 3%, for microenterprises that:

- earns more than 300,000 lei;

- Carries out activities corresponding to CAEN codes: 5821 – Publishing of computer games, 5829 – Publishing of other software products, 6201 – Custom software creation (customer-oriented software), 6209 – Other information technology services, 5610 – Restaurants, 5621 – Food activities (catering) for events, 5629 – Other food services n.e.c, 5630 – Bars and other beverage service activities, 6910 – Legal activities, for activities of notaries and lawyers, 8621 – General medical assistance activities, 8622 – Specialized medical assistance activities, 8623 – Dental assistance activities, 8690 – Other human health activities.

If during a fiscal year a microenterprise earns revenues of more than 300,000 lei and a return of more than 30%, calculated as the ratio of net profit to total revenues, registered according to the applicable accounting regulations, it is profit taxed from the quarter in which this case is registered.

In addition, amounts representing sponsorship and amounts representing the purchase of electronic tax cash registers yet to be transferred under the law will not be deducted from microenterprises’ income tax due after Jan. 1, 2024.

What happens to the IT science exemption: application limited to 10,000 lei

Natural persons are exempted from income tax for income obtained from salaries and as a result of engaging in the activity of creating computer programs, under the conditions established by joint decree of the Minister of Research, Innovation and Digitalization, of the Minister of Labor and Social Solidarity, of the Minister of Education and the Minister of Finance.

The exemption applies to a single employer/payer, for income up to and including 10,000 lei, obtained from wages and assimilated to the wages earned by the natural person on the basis of a single individual employment contract, service report, deed of delegation or posting or of a special statute provided by law, on the basis of the written possibility, where appropriate, by making known own responsibility to the employer/payer. The portion of gross monthly income that exceeds 10,000 lei does not enjoy tax relief.

According to another document obtained by HotNews.ro, the measures could bring 29.36 billion lei to the state budget.

Geopolitical developments

Citizens of the U.S., Canada and Great Britain need visas to enter Romania. When the new European Union decision takes effect

Starting in 2024, American citizens will need a visa to enter the EU.

Starting in 2024, people traveling to European Union member states must apply for a travel visa, according to new rules that will take effect early this year.

As a result of new travel authorization rules announced by the EU under the European Travel Information and Authorization System (ETIAS), people from more than 60 previously “visa-free” countries, including the United States, Canada and the United Kingdom, will have to fill out an online application form and pay a small fee before traveling to any of the 30 European countries, writes The Washington Post .

The permit costs €7 and can be obtained through the ETIAS website or mobile app. Allows travelers to travel for up to 90 days and is valid for three years or until the passport used in the application expires. In addition to the US, Canada and the UK, the new rules will apply to nearly 60 countries, including Mexico, Australia and Japan.

Travelers under 18 and over 70 are exempt, as are family members of EU or non-EU citizens who can move freely within the European Union.The European Union’s official website urges potential visitors to apply for authorization well in advance of their planned trip and before booking an airline ticket or hotel. One of the European countries that will apply for visas is Romania.

UN Law of the Sea Convention

Given that the Ukrainian Sea ports of Odessa (Black Sea) and Mariupol(Sea of Azov) regularly appear in the news and the Russian Federation as a UN member subscribes to the UN Law of the Sea then it can be held accountable for this. So hence a brief explanation.

Given that the Ukrainian Sea ports of Odessa (Black Sea) and Mariupol(Sea of Azov) regularly appear in the news and the Russian Federation as a UN member subscribes to the UN Law of the Sea then it can be held accountable for this. So hence a brief explanation.

The first 12 nautical miles (about 22 kilometers) from the base or low-water line are called “territorial waters. Beyond that and up to a maximum of 200 nautical miles or 370 km are the exclusive economic zones (EEZ) of a country.31

- The territorial sea (up to 12 miles offshore);

The contiguous zone (12 to 24 miles offshore);

The exclusive economic zone (up to 200 miles offshore);

The continental shelf (the sea floor).

An exclusive economic zone (EEZ) is an area extending up to 200 nautical miles (370.4 km) off the coast of a state. Within this zone, this state has a number of rights, such as the right to exploit the resources present, the right to fish and the right to scientific research. A country that establishes an EEZ is responsible for managing nature in this area. Agreements on this have been made in the UN Convention on the Law of the Sea.[1]

Exclusive Economic Zones (EEZs) lie outside territorial waters and are thus part of international waters. EEZs are therefore subject to different legislation than territorial waters. However, states do have the right to place artificial islands and structures in the EEZ. To protect these artificial islands and structures, states can establish so-called “safe harbors” in the EEZ, which can extend up to 500 meters beyond the artificial island or structure.

The immediate effect of Russian attacks on Danube ports

Russian attacks on Ukrainian ports on the Danube have revealed the risks Kiev faces on its last major grain export route: the Danube. Wheat and corn listings on international exchanges have increased, and analysts still consider the attacks on Ukrainian ports on the Danube River more serious than on the Black Sea port of Odessa.

The immediate proximity of the land borders with Romania and Moldova present a potential danger of conflict expansion. Arrests at sea are not possible because the ships can reach the port of Constanta through territorial boundary.

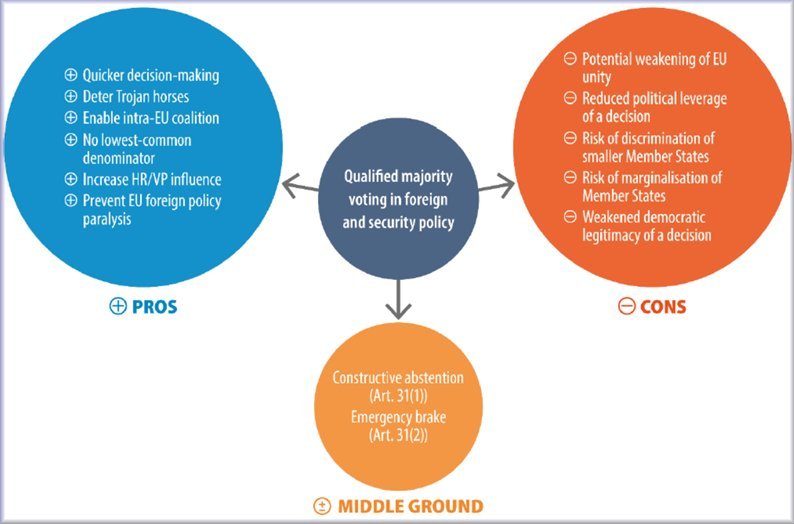

Nine EU countries join forces to reform voting rules on foreign policy and reduce veto power

Under current rules, all EU foreign policy decisions require the unanimous approval of the 27 member states.

A group of nine European Union countries have joined forces to reform the voting rules that currently govern the bloc’s foreign and security policy decisions, which are made by unanimous vote and often fall victim to the veto power of a single member state. The countries argue that the Russian invasion of Ukraine and the tectonic geopolitical shifts it has caused are sufficient reasons to launch the review and gradually move from unanimity to qualified majority, the requirement that applies to the vast majority of EU policy areas, such as climate action, digital regulation, single market and migration.

“EU foreign policy needs adapted processes and procedures to strengthen the EU as a foreign policy actor,” the nine countries wrote in a brief statement released Thursday morning. “Improved decision-making is also essential to make the EU ready for the future.”

The newly formed “Group of Friends on Qualified Majority Voting” consists of Belgium, Finland, France, Germany, Italy, Luxembourg, the Netherlands, Slovenia and Spain, and is open to other countries wishing to join.

Their joint mission is to accelerate and remake decision-making “in a pragmatic way, focused on concrete practical steps” within the framework of the EU treaties. However, their statement does not recommend specific areas of foreign policy, such as sanctions or military aid, which should be subject to qualified majority rather than unanimity. The countries promise to share their future deliberations “transparently” with other member states and coordinate their work with EU institutions.

The support of Germany and France, the two largest and most influential economies in the bloc, gives the campaign a big boost in terms of belief dignity and visibility. Ironically, however, the nine states fail to achieve a qualified majority on their own, as this requires 15 member states representing at least 65% of the bloc’s total population. A growing debate The debate over qualified majority versus unanimity has gained traction in recent years and has further escalated after Russia launched Ukraine on a full scale, a transformative episode in the continent’s history that led the EU to reinvent its policies and break long-standing taboos.

dignity and visibility. Ironically, however, the nine states fail to achieve a qualified majority on their own, as this requires 15 member states representing at least 65% of the bloc’s total population. A growing debate The debate over qualified majority versus unanimity has gained traction in recent years and has further escalated after Russia launched Ukraine on a full scale, a transformative episode in the continent’s history that led the EU to reinvent its policies and break long-standing taboos.

Despite the strong unanimity and surprising speed with which most foreign policy decisions were made, there were embarrassing moments in the past 15 months when unanimity was brutally exploited by just one capital city. Hungary in particular has been heavily criticized for generously using this individual power to hold key agreements hostage, such as an EU-wide ban on Russian oil imports, an €18 billion financial aid package for Kiev and an OECD-brokered deal to impose a 15% minimum corporate tax rate. The vetoes were eventually lifted, but only after Budapest’s unilateral demands were fully met. In most cases, member states had no choice but to agree to break the deadlock: last June, Hungary caused anger after it came up with a last-minute demand to exempt Patriarch Kirill, the head of the Russian Orthodox Church, from the list of EU sanctions. Another case that made headlines occurred in September 2020, when Cyprus single-handedly blocked EU sanctions against Belarus over an unrelated dispute with Turkey.

These PR fiascos have led to calls to leave unanimity behind and adopt a qualified majority in foreign policy, reaching even the upper echelons in Brussels: both European Commission President Ursula von der Leyen and High Representative Josep Borrell have publicly supported the reform, highlighting its growing appeal. Commenting on the news, a Borrell spokesman welcomed the new initiative “as we need to adapt procedures to current and future times to strengthen the EU as a foreign policy actor.” “The EU must become faster and more capable and effective in its ability to decide and act, to cope with an increasingly uncertain geopolitical environment,” the spokesman told Euronews. “We continue to believe that greater use of qualified majority voting in the field of external relations can bring significant benefits and faster and more efficient decisions in defense of our interests and values.” This piece has been updated with new developments.

Austria ignores Hungarian chain migrants while criticizing Romania and Bulgaria

Asked by Germany’s Tageszeitung how Austrian Chancellor Nehammer, on behalf of his party ÖVP, justified the decision to veto Romania’s and Bulgaria’s desire to join Schengen, the Vienna chancellor’s office said the decision was not political but based on security reasons.

Austrian officials also claim that about 70% of migrants detained in Austria have not been checked in any EU country before, demonstrating the poor protection of the EU’s external borders. It is “the right and also the duty of each member state to defend its national interest,” the chancellor’s office said. What the Austrian chancellery ignores, however, is that the country of Viktor Orban, one of the ÖVP’s biggest foreign supporters, leads an extremely large number of unregistered migrants into Austria.

The issue of “illegal” migration was the central theme on the agenda of the conservatives – ÖVP – in the four election rounds, but the strategy to break the votes of the right-wing extremists – FPÖ – did not work, losing almost 10% and the absolute majority in key region of Lower Austria. Austria’s next parliamentary elections will take place in the fall of 2024. According to current polls, the FPÖ is in first place and the ÖVP would be a minority partner at best. Therefore, the government would like to stay on until the end of the term.

Disclaimer

The newsletter of the Dutch Romanian Network is compiled with great care. The Dutch Romanian Network cannot accept any liability for a possible inaccuracy and/or incompleteness of the information provided herein, nor can any rights be derived from the content of the newsletter. The articles do not necessarily reflect the opinion of the board.