Newsletter January 2024

A good start!

We wish you good health and successful 2024!!! And together with you, we want to strengthen your network and make the power of attention measurable. You expect added value from our network because you want something from us, but you also want others to want to connect with you.

That they call you. That is the power of attention.

Over the years, you have wanted to share your experiences and knowledge with us and have given us something of value.

You expect added value from our network, you want something from us so share the knowledge and experience with you. Conversely, of course, the same is true.

We recognize the importance of networking for every entrepreneur, which is why we focus our attention on every entrepreneur who is, by definition, individually minded. Of course, we also place it in the context of the industry to which the individual entrepreneur belongs.

Our new blood group: N-Positive (Networks-Positive)

January is always the month when “traditionally” there is little news offerings from companies, and with that now comes the fact that in Europe elections are taking place and people are keeping their powder dry. Therefore, this newsletter will cover issues that directly or indirectly (may) have an economic impact on business.

The DRN has relaunched after reorganization in 2023, such as the Expert Meeting at Damen Shipyards, for example, and already the groundwork is being laid for the annual Romanian Business Day.

Agri & Food sector

How much does one hectare of arable land cost in Romania? Price varies by region

The average price for arable land increased the most in the northwestern region of Romania in 2022.

The National Institute of Statistics has analyzed how much a hectare of arable land is sold in Romania. For the year 2022, the figures were higher than the previous year, and the highest prices were in the Bucharest Ilfov region.

The average price of a hectare of arable land in Romania in 2022 was 39,704 lei, with the lowest average price recorded in the northeastern region, at 34,743 lei, while the Bucharest-Ilfov region recorded the highest high value, 59,263, respectively. lei, the National Institute of Statistics announced Thursday.According to the INS, in 2022, compared to the previous year, there was an increase of about 6.1% in the average price for arable land in Romania, with the most significant increase observed in the northwestern region of Romania (+23.5%.) )

The average price of permanent pasture registered an increase of about 6% in 2022 compared to the previous year, for the entire country, with the most significant increase occurring in the Northeast region (+14.9%).

In 2022, the average price of a hectare of arable land in Europe showed significant variations. According to available data for 19 EU member states, prices for arable land in 2022 ranged from a minimum average of €3,700 in Croatia to a maximum average of €233,230 in Malta, while the average price in Romania was €8,051/ha.The average price of permanent pasture in EU member states in 2022 ranged from a minimum of €1,887/ha in Bulgaria to a maximum of €46,305 in Luxembourg, while the average price in Romania was €5,671/ha.

How will FrieslandCampina implement its cost reduction strategy in Romania?

The local branch of dairy producer FrieslandCampina, with two production sites in Târgu Mureș and Cluj-Napoca, says the cost optimization strategy through global job cuts will have a “limited” impact on colleagues in Romania. The Dutch manufacturer announced in December that it would lay off 1,800 employees worldwide over the next two years as part of measures to reduce costs and improve profitability.

FrieslandCampina Romania, part of the Dutch group Royal FrieslandCampina, which produces brands such as Napolact at its plants in Târgu Mureș and Cluj-Napoca, announces that it could implement its cost reduction strategy through layoffs, including at the local level.

FrieslandCampina Romania, part of the Dutch group Royal FrieslandCampina, which produces brands such as Napolact at its plants in Târgu Mureș and Cluj-Napoca, announces that it could implement its cost reduction strategy through layoffs, including at the local level.

“The challenges of recent years and inflation have led Royal FrieslandCampina to structurally reduce costs. The strategy of adapting to the current situation also involves a process of global restructuring. Job losses are being implemented worldwide to offset inflation and achieve the annual savings budget needed to invest in business development and increase net profit. As far as these changes affect employment in the company, we will first of all follow the legal provisions and treat those affected with care and respect, as always,” company officials told Economica.

According to them, locally, the producer wants to strengthen its position “as a top player in the dairy industry” and support the global strategy of sustainable growth. Thus, it will implement “several medium-term projects” and continue investments at the local level.

“At the moment, we can say that workers in the two factories (Târgu Mureș and Cluj-Napoca) are not directly affected. This decision, which did not come easily, will be implemented over the next two years and will contribute to the sustainable growth of the company.  We will continue to invest in our production facilities, as we have consistently done in recent years, and FrieslandCampina will continue to provide quality products, made in Romania, with milk from Romania,” company officials said. The Dutch company said it will realize savings of up to 200 million euros after the layoffs, part of its program to reduce annual costs by 400 to 500 million euros starting in 2026.

We will continue to invest in our production facilities, as we have consistently done in recent years, and FrieslandCampina will continue to provide quality products, made in Romania, with milk from Romania,” company officials said. The Dutch company said it will realize savings of up to 200 million euros after the layoffs, part of its program to reduce annual costs by 400 to 500 million euros starting in 2026.

FrieslandCampina has approximately 22,000 employees in 30 countries and sells its products to the food and pharmaceutical industries in more than 100 countries worldwide. Last year it had sales of 14 billion euros.

FrieslandCampina Romania, part of the Dutch Royal FrieslandCampina, owns the Napolact, Campina, Milli, Okay and Dots brands and a range of products including: drinking milk, yogurt, cheese, butter and milk-based snacks.

Napolact products are manufactured at its units in Cluj-Napoca and Târgu Mureş, while its headquarters are in Bucharest. This after the company decided in 2014 to relocate its cheese production from Carei and its cheese cutting and packaging activity from Târgu Mureş to its site in Baciu, in Cluj province. The company said at the time that it was forced to take these measures because of the difficult market conditions, particularly caused by extremely low demand.

In 2022, FrieslandCampina Romania reported sales of 576.1 million lei, up from the previous year, when sales of 468.9 million lei were reported. Frisian operations were also profitable, with a net result of 229.9 thousand lei. The company had 569 employees in 2022.

New EU funds for Romanian fruit investment

The Romanian Ministry of Agriculture and Rural Development (MADR) has just announced the upcoming launch of the project call for investment measure DR-15 – Investments in fruit farms, a key intervention of the Strategic CAP Plan 2023 – 2027.

This initiative contributes to the achievement of a number of specific CAP objectives, i.e. increasing the competitiveness of fruit farms through the provision of machinery and equipment, the establishment, modernization and/or expansion of processing units, the establishment of orchards, the conversion of existing orchards and the increase in the area occupied by fruit tree nurseries.

The session will run from January 8, 2024, 9 a.m. to April 30, 2024, 4 p.m.

The financial allocation for the project submission session is 151,383,527 euros, of which:

- Component establishment and modernization of fruit farms – 142,383,527 euros

- Component establishment and modernization of fruit tree nurseries – 9,000,000 euros

The beneficiaries of this session are farmers (except natural persons), agricultural cooperatives and cooperative associations serving the interests of their members, producer groups and organizations recognized by MADR, established under the applicable national legislation and serving their interests.

The beneficiaries of this session are farmers (except natural persons), agricultural cooperatives and cooperative associations serving the interests of their members, producer groups and organizations recognized by MADR, established under the applicable national legislation and serving their interests.

The non-repayable support granted through intervention DR-15 is up to 65% of eligible costs, with a maximum of €1,500,000/project, except for projects involving the purchase of agricultural machinery and equipment, the cost of which may not exceed €300,000.

MADR hopes to receive many innovative projects that can contribute to the sustainable development of the fruit sector in Romania.

Further information, including the applicant’s guide and required forms, can be found (in Romanian) at www.afir.ro.

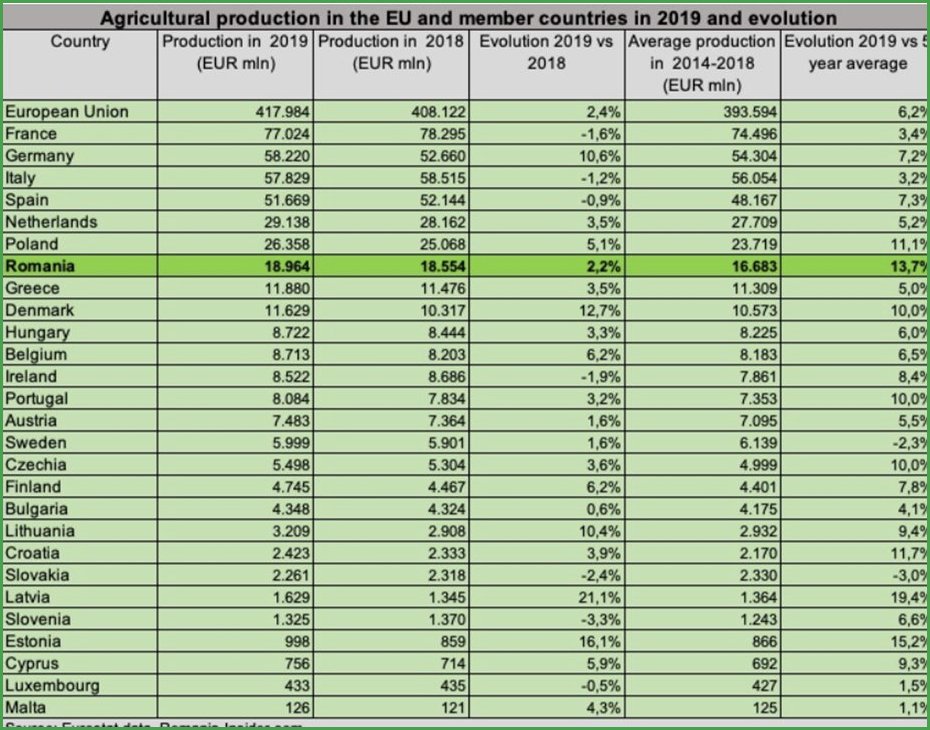

Romania remained the seventh largest agricultural producer in the EU

However, the value of production increased much more slowly than in other major countries According to Eurostat data, Romania remained the seventh largest agricultural producer in the European Union in 2022, with production worth 22.2 billion euros. The value of agricultural production in Romania increased 5.2% from 2021, much slower than EU-level production, which increased 19%. By comparison, the value of agricultural production increased by about 30% in Germany, 18% in the Netherlands, 16% in France and Italy, and 10% in Spain. In 2022, EU agricultural production at basic prices was valued at €537.5 billion.

This figure represented a new peak and continued the upward trend begun in 2010. However, the increase is attributed to price increases. Thus, the change in nominal value largely reflected the strong price increase for agricultural goods and services as a whole (+22.8% estimated), with production volume declining moderately from the 2021 level (an estimated 3.1% decline).

Three-quarters of the value of EU agricultural production in 2022 will come from seven EU countries: France (€97.1 billion, representing 18% of the EU total), Germany (€76.2 billion, 14%), Italy (€71.5 billion, 13%), Spain (€63.0 billion, 12%), Poland (€39.5 billion, 7%), the Netherlands (€36.1 billion, 7%) and Romania (€22.2 billion, 4%). Just over half (54%) of the value of EU agricultural production in 2022 came from vegetable crops (€287.9 billion, +15% compared to 2021). Two-fifths (38%) came from animals and animal products (206.0 billion euros, +26% compared to 2021). The rest came from agricultural services and ancillary activities.

One conclusion may be that Romania has ample potential but it remains untapped so far. There are opportunities here but then people will have to be willing to cooperate because the plots (as we wrote before) are too small.

And now the Romanian pig farmers themselves have their say……..

Our country has extremely favorable conditions for agriculture, but depends on massive imports of strictly necessary agri-food products, which can seriously affect our food security, says Daniel Botănoiu, president of the Romanian Farmers Association (AFR).

Our country has extremely favorable conditions for agriculture, but depends on massive imports of strictly necessary agri-food products, which can seriously affect our food security, says Daniel Botănoiu, president of the Romanian Farmers Association (AFR).

“As we do not have a developed livestock sector, we are forced to ‘import’ food products from European partners, as well as from third markets. As a result, Romania has realized a very large trade deficit in the 2021/2022 agricultural year, representing a net dependence of Romania on agricultural imports, in particular: pork, cut and live. This poses great risks with regard to food security . Sometimes with regard to agriculture we are fascinated by certain achievements, in reality our problems, both from a quantitative, qualitative and value point of view when we talk about agri-food production, remain extremely serious, due to low economic efficiency as a whole,” the AFR president told

He stressed that the agri-food balance of trade situation should be seriously addressed so that two paradoxes facing Romania could be resolved. “We are achieving records in some agricultural crops and occupying the first places in Europe, but we are dependent on food imports to the extent that it is seriously damaging our food security.  Moreover, Romania is the only agricultural power among EU member states with extremely favorable pedoclimatic conditions. to agriculture, but dependent on massive imports of strictly necessary agri-food products,” Botănoiu said.

Moreover, Romania is the only agricultural power among EU member states with extremely favorable pedoclimatic conditions. to agriculture, but dependent on massive imports of strictly necessary agri-food products,” Botănoiu said.

This can be seen in the trade balance, as Romania imports pork annually for the revolution by over 750 million euros.

“Only about 750,000 pigs were raised on Romanian farms in 2022. 17 times less than in the years before the revolution and 7 times less than in 2000. What has happened in the last 30 years to this branch of animal husbandry that once fed a large number of pigs? The entire country? The state’s failure to combat swine fever is just the latest in a long list of causes. The result: a huge importation of pork while we are the first producers of grain corn in Europe. Also only one-fifth of the pork bought by Romanians in 2022 came from farms in Romania. And of this 20%, only half consists of animals born and raised in Romania, while the rest consists of imports of live animals. The calculation does not include pigs raised in households for their own consumption or sold illegally; in any case, their figure has decreased in recent years,” said the president of AFR in his analysis of the pig market in Romania.

He believes that political decisions made late and often out of touch with reality continue to leave a negative mark on this important sector of livestock production.

“Pork consumption increased slightly, but not due to domestic production. Pork imports only result in payments to farmers from other states. It’s surprising because if you look at the statistics, what we import, the balance of payments deficit and so on, pork is by far the number one food product. Following the outbreak of African swine fever on Romanian farms, pork imports increased from 290,000 tons in 2017 to almost 500,000 tons in 2019, and to 750,000 tons in 2022 as shown by the data of the Institute of Statistics,” he also said.

He said livestock numbers for all species have declined over the past decade, with Romania recording some of the largest percentage declines in the pig population between 2012 and 2022. On the other hand, the European Commission is determined and taking strong action to reduce the number of cattle, pigs and other animals kept on EU farms.

“It is a downward trend that can be observed at the EU level over the past decade, with Romania registering some of the largest percentage decreases in the pig population between 2022 and 2012. The pig population decreased by 5.9% in the EU in 2022, Romania at 34.9% the third largest percentage decrease among EU bloc countries, after Slovakia – 39.74% and Lithuania – 36.28%. Romania lost 1.8 million pigs in 10 years, from 5.2 million animals in 2012 to 3.4 million in 2022. European Commission determined and strong action to reduce the number of cattle, pigs and other animals kept on farms in the EU,” the AFR president said.

On the other hand, Botănoiu mentioned that although the number of piglets continuously decreased, the price increased from November 2022: from 53 euros (stock market price, without transport and producer margin) in November 2022, it reached almost 78 euros in November 2022. February 2023, 86 euros in March to a European average of nearly 88 euros, but if you add the transportation and producer margin, the price exceeds 115 euros per head.

“The major member states that produce piglets, including Germany, the Netherlands or Denmark, have changed their policies. Some have reduced the number of piglets, others prefer to breed and supply, especially to the Asian market. Romania is a net importer of piglets and soon it will have nowhere to buy. The sow population has been drastically reduced due to African swine fever. To produce 80% of our piglets ourselves, we need large farms with 3,000 to 5,000 sows. A priority for our governors should be to encourage investment in breeding farms. We have a huge deficit that will be difficult to make up, in that sense many years are still needed. Unfortunately, investors have no confidence to invest in breeding farms,” concluded the President of the Farmers Association of Romania (AFR), Daniel Botănoiu.

Sector Construction Market

Romania, a construction site. Investment of over 12 billion euros in construction

Net investment in new construction totaled more than 74.188 billion lei in the first nine months of 2023, representing 62.6% of total investment in the national economy, compared with 62% in the comparable period of 2022, according to centralized data by the Institute of National Statistics.

Net investment in the sector was mainly focused on new construction and the purchase of machinery, including transportation equipment. The value of construction work in the joint venture increased by 20.61 billion lei.

Net investment in the sector was mainly focused on new construction and the purchase of machinery, including transportation equipment. The value of construction work in the joint venture increased by 20.61 billion lei.

During the said period, net investment in the national economy amounted to 118.497 billion lei, up 14.4% compared to the January-September 2022 period.

Investment from the predominantly private sector totaled 97.742 billion lei, representing 82.5% of the total, compared to 84.1% in the same period of the previous year.

In the first nine months of last year, 26,394 building permits were issued for residential buildings, of which those for single-family residential buildings accounted for 94.1% of the total. Most building permits for individual buildings with one dwelling were issued for the rural area, 17,608 permits respectively, the remaining 7,230 permits for the urban area. Twenty-nine building permits were issued for residential buildings for communities.

As for residential areas, the situation of permits issued during the said period for dwellings in residential buildings indicates a decrease in the number of permits issued, both in the urban area, with 2,692 permits, and in the number of permits issued in the rural area. During the said period, 49,993 homes were completed, a decrease of 2,801 homes. Most completed houses were built with private funds. They represented a 97.5% share of the total number of houses built, a decrease of 3,090 houses compared to the period Jan. 1 – Sept. 30, 2022

Sector Labor market for non-EU citizens.

Employers will be able to employ up to 100,000 new non-EU citizens in our country for the third year in a row

Romanian companies will be able to bring up to 100,000 new workers from outside the EU to our country during 2024, the executive decided through a recently formalized GD. The government initially proposed a quota of no more than 140,000 foreigners who could be put to work in Romania by 2024, but backtracked on this proposal, understanding that the proposed value exceeds the value covered by foreign labor by our region’s companies.

The executive determines by decree, adopted at the end of the year, the quota of new foreign workers (i.e. from outside the EU) that employers can bring to Romania the following year.

The government has set a quota of no more than 100,000 foreign workers newly admitted to the labor market in our country by 2024, according to GD No. 1338 of 2023.

The executive maintains the quota of new non-EU workers that can be brought to Romania for the third consecutive year at no more than 100,000 people, according to an analysis by Economica.net . This is the executive’s proposed solution to the complex problem of the large number of jobs refused or unwanted by Romanians.

The important reasons why Romanians refuse these positions repeatedly cited by employers are the modest incomes, which perpetuate the spiral of working poverty; the positions are located a long distance from the candidates’ homes. with promotional prospects, limited professional and high work volume.

Some of those who qualify for these positions prefer to work abroad occasionally to increase their chances of getting out of the spiral of working poverty in our country, others choose to work in their own households, and some of them open small businesses.

The Romanian employer pays over 272 euros for each foreign worker he lets work in our country. The amount covers the value of the work permit, visa fee, residence permit fee and consular fee, according to data received by Economica.net from the Labor Importers.

By the end of 2022, nearly 52,000 people from outside the EU had residence permits in our country for the purpose of work, according to data provided by officials of the General Inspectorate of Immigration (IGI) Most of them come from Nepal, Turkey and Sri Lanka and are between 18 and 60 years old. According to the analysis , based on the information we obtained from the IGI, over 64% of foreigners working in Romania are employed as unskilled workers.

Shipbuilding sector

MAN Energy Solutions supplies diesel engines and diesel generator sets for Damen Naval’s ASW frigates

Damen Naval has contracted MAN Energy Solutions to supply the propulsion diesel engines and diesel generator sets for the new Anti- Submarine Warfare (ASW) frigates. The order consists of eight MAN 20V28/33D STC marine engines and sixteen marine variable speed 16V175D-MEV generator sets with sound enclosure and auxiliary installation equipment. The agreement also includes integrated logistics support for the four new frigates being designed and built for the Netherlands and Belgium.

Submarine Warfare (ASW) frigates. The order consists of eight MAN 20V28/33D STC marine engines and sixteen marine variable speed 16V175D-MEV generator sets with sound enclosure and auxiliary installation equipment. The agreement also includes integrated logistics support for the four new frigates being designed and built for the Netherlands and Belgium.

It is the second collaboration between the companies in just over a year: in September 2022, MAN Energy Solutions was chosen to supply the propulsion engines for the F126 frigates that Damen Naval is building for the German Navy.

“The MAN 20V28/33D STC engines are considered one of the most powerful and economical 1,000-rpm diesel engines in the world and we are convinced that they are the best solution for the ASW frigates,” said Roland Briene, Managing Director at Damen Naval. “Damen Naval and MAN Energy Solutions have worked together for years on various projects and we look forward to working together on this latest project.”

The main task of the ASW frigates will be anti-submarine warfare. The ships are designed to sail as quietly as possible to avoid detection by submarines. The advanced 175D marine generator sets meet the highest requirements for shock noise and vibration, making an important contribution to this fundamental task.

“At MAN Energy Solutions, we are pleased and honored that our marine solutions have been chosen for this important ASWF program,” said Ben Andres, head of Medium & High Speed at MAN Energy Solutions. “This project confirms our place at the forefront of High-End Naval Applications thanks to the exceptional performance of our products and services, in particular the 175D Naval generator sets. Damen Naval has deep knowledge and expertise in all facets of such complex and challenging projects and we eagerly look forward to another close collaboration between our companies.”

“At MAN Energy Solutions, we are pleased and honored that our marine solutions have been chosen for this important ASWF program,” said Ben Andres, head of Medium & High Speed at MAN Energy Solutions. “This project confirms our place at the forefront of High-End Naval Applications thanks to the exceptional performance of our products and services, in particular the 175D Naval generator sets. Damen Naval has deep knowledge and expertise in all facets of such complex and challenging projects and we eagerly look forward to another close collaboration between our companies.”

The ASW frigates will replace the current Karel Doorman-class multipurpose frigates. These were built between 1985 and 1991 by Damen Naval (then called Koninklijke Maatschappij de Schelde). With the end of the service life of these ships in sight, the Netherlands and Belgium decided to jointly replace the ships with the ASW frigates. The first engines and diesel generator sets are scheduled for delivery in August 2025. Damen Naval expects to deliver the first frigate in 2028.

Alewijnse opens new warehouse at Damen Yachting in Flushing

Bigger, more professional, more accessible Growth in the yachting industry requires growth in warehouse space. In cooperation with Damen Yachting, Alewijnse has created a new warehouse location at the Vlissingen shipyard, as much as twice the size of the previous location, to better and more professionally serve yacht projects.

“We were growing out of space at our old location,” says Tom Milder, COO at Alewijnse. “The new warehouse is larger, more professional, safer and logistically more accessible. We have more space for installation materials and cables and we can organize work packages and project stocks more clearly. This allows us to provide an even better service for all types of yacht projects at the Vlissingen shipyard.”

The new warehouse is set up to run four to five large yacht projects simultaneously. Some seventy installation workers can go there any time of the day for electrical and installation equipment with the professional service of three full time warehouse workers. And above the warehouse, an area with about 25 workstations has been created for commissioners, engineers and supervisors.

To serve customers quickly and professionally, Alewijnse has already set up ten warehouses at Alewijnse locations or at yards, not only in the Netherlands, but also in France, Romania and Vietnam. Freek Bosman, teamlead facility & logistics Netherlands: “The warehouses are set up in such a way that we can offer a fast and flexible service to our customers. We have a lot of contact with each other and use each other’s stock when necessary. That way we can provide the best service to all our customers in the yachting, marine and dredging & offshore sectors.”

A new chapter in Alewijnse’s successful future in providing high-quality services in the maritime industry.

Royal Van der Leun Vietnam built brand new workshop and office

For Royal van der Leun, the new year begins right away. The Vietnamese branch’s brand new office and workshop is now fully operational!

For Royal van der Leun, the new year begins right away. The Vietnamese branch’s brand new office and workshop is now fully operational!

The focus of the new facility is on improving customer support not only in Vietnam, but also in Asia and Australia.In addition, it promotes synergy between the in-house learning school and local schools.The workshop occupies an impressive 2500m2, while the office covers an area of 750m2.The strategic location near several shipyards in Hai Phong City including Damen Shipyards also brings additional benefits. For the same reason, they also have a branch in the Romanian city of Galati.

Although the new location will officially open in March, it is already operational.

Energy sector

Romania exports nearly 1,000 MW of electricity to the Republic of Moldova and Ukraine, in the context of massive wind energy production

Romania exports nearly 1,000 MW of electricity to the Republic of Moldova, but most of this energy goes to Ukraine, according to data analyzed by HotNews.ro. This in the conditions where the wind turbines that are in our country produce a huge amount of electricity.

Romania’s electricity production exceeds 9,000 MW, most of which comes from wind turbines.

They provide over 2,460 MW, in a context where the entire eastern part of our country is under the yellow code of high winds, snow and blizzard.

A total of 3,000 MW of wind turbines have been installed in Romania.

The second source of energy production is hydroelectric plants, which produced 2,415 MW at the time mentioned. Thus, more than half of the country’s production is represented by renewable sources.

Romanian exports to the two countriesin numbers

The country’s consumption is about 8,200 MW and total production exceeds 9,100 MW; the difference is exported.

According to Transelectrica data, nearly 1,000 MW will go to the Republic of Moldova.

For its part, the Republic of Moldova supplies almost all of its consumption (821 MW at the analyzed hour) from its own production (721 MW) and exports an amount of over 800 MW to Ukraine, as shown by Moldelectrica data.Therefore, almost the entire amount of energy exported from Romania goes to Ukraine.

ANALYSIS Europe’s victory in energy war with Russia: the new year begins with low prices and record gas supplies/ How is the situation in Romania

Although we are in the midst of the cold season, natural gas prices in European stock markets have reached their lowest levels in two years, with record stocks. And in Romania, the situation of gas stocks is unexpectedly good, as warehouses are fuller than ever. Practically speaking, as of now we can say that Europe is well past its second winter since the start of the energy crisis and the drastic reduction in Russian gas imports.

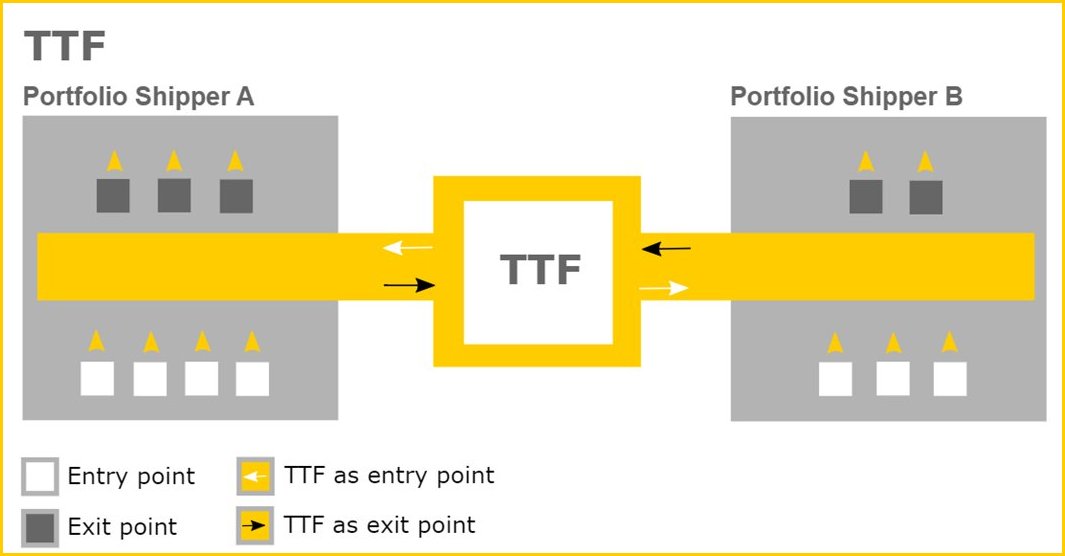

Pressure in gas lines

Ever lower gas prices in the middle of winter

Since the beginning of the calendar winter, gas prices in European markets have fallen continuously. According to data from the TTF gas hub in Amsterdam , which sets reference prices at the European level, futures quotes for natural gas with delivery reached 30-31 euros/MWh in February, where they were before January 2022 and before that from the start of the severe energy crisis. At the beginning of October 2023, they were 37-38 euros/MWh.

In comparison, last year, on the same date, the quotations were 82 euros/MWh.

Quotes for the following months are also low, around 31 euros/MWh in March, April and May.

In short, prices are almost 90% lower than the August 2022 records, from the period of the Russian-induced energy crisis, when they reached 300 Euro/MWh.

Russian gas imports increasingly insignificant

Prices are affected by both high temperatures and an abundant supply of liquefied natural gas.

European states have managed to get rid of much of their dependence on Russian gas by diversifying their sources of supply and increasing liquid gas imports from the US and Qatar.

Before the war in Ukraine, Russia exported 155 billion cubic meters of gas to Europe annually. In 2022 they dropped to about 60 billion cubic meters, and in 2023 they halved compared with the previous year to 28.3 billion cubic meters, according to Reuters calculations .

How full are the gas storage facilities in Romania?

According to data from Gas Infrastructure Europe, gas storage facilities in the EU are currently 86.29% full, with a record volume of 983.25 TWh. And in Romania, we are doing very well with gas stocks: warehouses are 82.93% full, with a quantity of 28.08 TWh.

According to data from Gas Infrastructure Europe, gas storage facilities in the EU are currently 86.29% full, with a record volume of 983.25 TWh. And in Romania, we are doing very well with gas stocks: warehouses are 82.93% full, with a quantity of 28.08 TWh.

In practice, since November, when stocks had reached the maximum level, only 15% of the stored quantities have been consumed, and there is a good chance that the winter will end with more than half of the warehouses full.By comparison, last year, during the same period, after exceptional storage measures were also taken, warehouses were 83.43% full at the EU level and 79.35% full at the Romanian level.

On Jan. 3, 2022, before Russia’s invasion of Ukraine and before the worst form of the energy crisis, gas storage facilities at the EU level were 53.67% full, and in Romania 52.56% full.

On Jan. 3, 2021, before the energy crisis, EU warehouses were 72.67% full, and Romania’s were 62.58% full.

In Romania, the price of gas is not free; it is capped from producers. They are required to sell at a price of 150 lei/MWh. This is the purchase price, plus shipping, distribution and supplier surcharge. For the ultimate household consumer, the price is limited to 0.31 lei/kWh, equivalent to 310 lei/MWh, and for the non-household consumer to 0.37 lei/kWh (370 lei/MWh), for annual consumption not exceeding 50,000 MWh.

Society and Labor Market Sector

Togetherness

Just 30 years ago, life in Romania looked very different than it does today. In one generation, the economy gained momentum. The youngest generation – Gen-Z – has embraced a new lifestyle with much greater affluence. They hardly differ from Dutch youth in their actions, thoughts and dreams. Older generations cling much more to the typical Romanian togetherness and close family ties. These differences between generations are much more pronounced in Romania than in the Netherlands. This is something to consider in the workplace.

A good example is the sacrificial spirit of parents for their children that I have mentioned many times. This can be called extreme from a Dutch point of view. With increased affluence, you see young software engineers earning sometimes as much as five times the combined income of their parents, who nevertheless continue to pay everything for them. The word boarding fee has not yet been invented in Romania. Neither do children with side or vacation jobs. Putting your life at the service of your children is firmly ingrained in Romanian culture. Still, I am sometimes curious if this will be the case for the coming generations.

The way parents take responsibility for caring for their young adult children is largely culturally and perhaps geographically determined, just look at the differences between, for example, the Netherlands and southern European countries such as Italy and Spain in this regard.

In Romania, the transformation from communism to parliamentary democracy and capitalism came on top of that. This has been going on now for over 30 years, or a generation and a half. You can rightly call out many negative things about communism, one of the main effects being its strong leveling effect on citizens. If no one has a lot of money, money is not a differentiator. And because everyone is in the same boat, you have to cope together. This togetherness still exists in many aspects of Romanian society today.

With the rapid increase in prosperity, though, all of this is changing rapidly. Those in their forties with children value regularity and permanence for their families. This manifests itself in great commitment to the work, a tremendous will to put their shoulders to the wheel and strong loyalty. Young people logically have a different outlook on life. They want to be able to go wherever they want. Work-life balance plays an important role, and rightly so.

In my personal belief, the adaptability of organizations to rapidly changing social conditions is a critical success factor. Understanding the mindset of software engineers in different age groups is logically extremely important to NetRom. In our branches in Craiova and Timisoara, people from the 1980s and 1990s work together with young people from the 00s. We are even starting a training for our managers this year to make generational differences more understandable. In our view, managers need the emotional intelligence that allows them to empathize with the perspective of employees, to take it into account in their methods of management. Leadership is not a kind of one size fits all. If you want employees to be central and function optimally you will need to understand their points of view and the stage of life they are in. This is a serious challenge, one that we at NetRom would like to, but also need to, meet.

Corporate social responsibility for a sustainable future

Mazars has published the Romanian Corporate Social Responsibility (CSR) report for the second consecutive year. Making a proactive contribution to our communities and the broader society has always been fundamental to Mazars and the way we do business. Therefore, this report is not only a reflection of our journey, but also a testament to our promise for a sustainable and prosperous future.

Mazars has published the Romanian Corporate Social Responsibility (CSR) report for the second consecutive year. Making a proactive contribution to our communities and the broader society has always been fundamental to Mazars and the way we do business. Therefore, this report is not only a reflection of our journey, but also a testament to our promise for a sustainable and prosperous future.

At Mazars in Romania, our journey to a purposeful future continues to be guided by our One24 strategy, which puts sustainability first. Since our first CSR report in 2021, our commitment to ESG initiatives has grown, strengthening our teams, increasing our impact and expanding our community outreach.

In our latest CSR report for 2022, we highlight our progress and outline future efforts on three key fronts: our people, customers and society.

In our latest CSR report for 2022, we highlight our progress and outline future efforts on three key fronts: our people, customers and society.

From empowering a diverse workforce to leveraging innovative digital solutions for clients and championing various social initiatives, we strive to promote collective progress.

Explore with our full CSR report and be part of our journey to a sustainable future.

For more information: Dino Ebneter(dino.ebneter@mazars.ro) and Edwin Warmerdam(edwin.warmerdam@mazers.ro)

The Dutch Romanian Network endorses the aforementioned and translates CSR in practice into “social investments.” The Romanian Business Award is then presented annually to the entrepreneur or company that has distinguished itself in this regard. See the “Wall of Fame” at https://www.dutchromaniannetwork.nl/informatie-roemenie/romanian-business-award/.

Kaufland’s mission to integrate people with disabilities into the workforce

Within Kaufland Romania, one of the top employers in Romania, as well as in Europe, everyone can find a place, including people with disabilities. All Kaufland locations have at least one disabled employee, and the company currently has more than 450 disabled employees. Wanting to continue offering a wide variety of positions for people with disabilities, the company created Kaufland ACCES, an employment and integration program in the Kaufland team dedicated to people with disabilities, launched in 2019.

Also follow it on Google News The pilot program included finding or creating suitable positions within Kaufland, starting the communication and recruitment process and analyzing the process of integrating new colleagues into the team to identify the changes and solutions needed to improve the team. The first step was to organize internal training for the Kaufland team to implement the program at all levels. This was followed by the organization of seven program popularization and recruitment events in the five cities that were part of the pilot program – Bucharest, Sibiu, Cluj-Napoca, Timișoara and Craiova – complemented by a recruitment program that enjoyed the support of the provincial departments of the DGASPC(Direcția Generală de Asistență Socială și Protecția Copilului- Directorate General for Social Assistance and Child Protection)

Also follow it on Google News The pilot program included finding or creating suitable positions within Kaufland, starting the communication and recruitment process and analyzing the process of integrating new colleagues into the team to identify the changes and solutions needed to improve the team. The first step was to organize internal training for the Kaufland team to implement the program at all levels. This was followed by the organization of seven program popularization and recruitment events in the five cities that were part of the pilot program – Bucharest, Sibiu, Cluj-Napoca, Timișoara and Craiova – complemented by a recruitment program that enjoyed the support of the provincial departments of the DGASPC(Direcția Generală de Asistență Socială și Protecția Copilului- Directorate General for Social Assistance and Child Protection)

The program includes three essential lines of action:

– Creating recruitment channels for people with disabilities and promoting them to interested people, potential beneficiaries or institutions that cater to people with disabilities.

– Transforming Kaufland into an inclusive employer by meeting the physical and mental needs of people with disabilities.

– Communication and internal training programs to support the integration of new colleagues into the Kaufland team.

The ACCES program aims to adapt Kaufland workspaces to increase the capacity for the inclusion of people with disabilities, whether employees or customers, allocate internal resources for this purpose, integrate people with disabilities and develop a disability-based  organizational culture-based organizational culture. On accepting and encouraging diversity, and providing education in this regard for team members, clients and society at large.

organizational culture-based organizational culture. On accepting and encouraging diversity, and providing education in this regard for team members, clients and society at large.

In 2023, Kaufland was named “Top Employer” for the eighth time in Romania and for the fifth time in Europe by the Top Employers Institute in the Netherlands, demonstrating the company’s concern for employees’ well-being, their needs, as well as for the opportunity development they need.

Kaufland Romania, part of the Schwarz Group, is one of the largest local and European retailers. The company has a team of 155,000 employees internationally and more than 17,000 nationally. People interested in joining the Kaufland company can do so by applying online at the website careere.kaufland.ro , by calling 021 91 32 or by visiting the Information Desk at any store in the country.

Macroeconomic developments Romania

World Bank interim report on Romanian economy

Report: Romania performs impressively economically, but convergence gaps remain and infrastructure does not reflect EU membership. Romania has made impressive progress in economic performance, but it still faces a large convergence gap with EU living standards and large regional and social disparities. To solve these problems, Romania must take advantage of its private sector, according to a new IFC report

Report: Romania performs impressively economically, but convergence gaps remain and infrastructure does not reflect EU membership. Romania has made impressive progress in economic performance, but it still faces a large convergence gap with EU living standards and large regional and social disparities. To solve these problems, Romania must take advantage of its private sector, according to a new IFC report

The private sector remains the engine of economic development and can help create new jobs of better quality, as well as boost connectivity, productivity and competitiveness, according to the report Diagnosticul private sector in Romania (CPSD), conducted by the International Finance Corporation (IFC), the investment arm of the World Bank. According to the paper, Romania has made impressive progress in terms of economic performance over the past 20 years, as EU integration has helped accelerate the convergence of incomes toward the bloc average.

Purchasing Power

Between 2000 and 2022, Romanian per capita income according to purchasing power parity (PPP, expressed in US dollars as of 2017) increased from 26.4% to 76.7% of the EU average. Real GDP per capita in PPP more than doubled (from $12,177 to $32,738), and the economy grew at an average annual rate of 3.5% – almost three times the EU average. Moreover, Romania’s economic growth has shown considerable resilience in the face of the pandemic, the Russian invasion of Ukraine and related economic shocks, notes IFC.

Horizontal constraints

The IFC report highlights five cross-cutting constraints that currently impede Romania’s development and which, if addressed, could create a more dynamic and agile private sector and boost growth: skills shortages and mismatches, governance and institutional deficiencies in the business environment, barriers to competition , limited innovation due to chronic underinvestment, and infrastructure and connectivity problems.

The transition to sustainable, well-governed and inclusive economic growth is still underway in Romania, but the private sector is facing turbulence Although economic growth in Romania is high on average, it has been highly volatile. It was primarily driven by consumption and was accompanied by major environmental impacts – such as high levels of air pollution in urban areas. According to the report, productivity gains – as a result of reforms spurred by EU accession in 2007 – have been eroded by gaps in governance and institutional quality, unfavorable demographics and acute skills shortages affecting the quantity and quality of the workforce.

The transition to sustainable, well-governed and inclusive economic growth is still underway in Romania, but the private sector is facing turbulence Although economic growth in Romania is high on average, it has been highly volatile. It was primarily driven by consumption and was accompanied by major environmental impacts – such as high levels of air pollution in urban areas. According to the report, productivity gains – as a result of reforms spurred by EU accession in 2007 – have been eroded by gaps in governance and institutional quality, unfavorable demographics and acute skills shortages affecting the quantity and quality of the workforce.

“The structural transformation is still ongoing: agriculture still accounts for a large share of employment, while the relative contribution of services to GDP and employment is the lowest in the EU.

Infrastructure underdeveloped

Despite the availability of significant EU funds, infrastructure remains underdeveloped relative to the country’s income level, limiting private investment and productivity in several key sectors,” says the IFC, which argues that unsustainable wage dynamics and an aging and declining labor force further jeopardize employment. Productivity. In addition, Romania’s huge underground economy, estimated at 21% of GDP, creates additional challenges. INS revises first 9-month GDP upward Informal workers are an important part of the labor market, especially for low-skilled positions.

Private investment

Private investment has been relatively high, but a shallow financial sector limits the availability of long-term financing, the paper cited. The combination of a rapidly growing economy, one of the highest emigration rates in the EU and a lagging education system has made skills shortages the main obstacle to private sector development, says IFC. “Romania has the lowest score in the EU in terms of the Human Capital Index (HCI): 0.58, meaning that the future productivity of children born in Romania today will be only 58% of what it could be if they benefited from education. Romania has the lowest participation in lifelong learning in the EU due to cultural and systemic barriers, while the country’s workforce has lower levels of digital skills and soft skills compared to EU standards,” the report said.

Private investment has been relatively high, but a shallow financial sector limits the availability of long-term financing, the paper cited. The combination of a rapidly growing economy, one of the highest emigration rates in the EU and a lagging education system has made skills shortages the main obstacle to private sector development, says IFC. “Romania has the lowest score in the EU in terms of the Human Capital Index (HCI): 0.58, meaning that the future productivity of children born in Romania today will be only 58% of what it could be if they benefited from education. Romania has the lowest participation in lifelong learning in the EU due to cultural and systemic barriers, while the country’s workforce has lower levels of digital skills and soft skills compared to EU standards,” the report said.

Business Environment

The lack of predictability of the business environment and governance deficiencies pose significant challenges to private sector development in Romania Inefficient tax administration, perceived corruption and political instability are major constraints to the business environment, notes IFC. “Although Romania has made progress in improving the business environment, many tasks (e.g., obtaining building permits and connecting to the electricity grid, resolving insolvency cases, protecting minority investors and enforcing contracts) remain difficult for businesses. Romania also stands out for its restrictive regulations on professional services and transportation services (including airlines). Moreover, in 2018 Romanian companies reported that about 18% of senior management’s time was spent dealing with tax regulations (more than in 2009), compared with the average of 13.5% in comparable countries.”

The lack of predictability of the business environment and governance deficiencies pose significant challenges to private sector development in Romania Inefficient tax administration, perceived corruption and political instability are major constraints to the business environment, notes IFC. “Although Romania has made progress in improving the business environment, many tasks (e.g., obtaining building permits and connecting to the electricity grid, resolving insolvency cases, protecting minority investors and enforcing contracts) remain difficult for businesses. Romania also stands out for its restrictive regulations on professional services and transportation services (including airlines). Moreover, in 2018 Romanian companies reported that about 18% of senior management’s time was spent dealing with tax regulations (more than in 2009), compared with the average of 13.5% in comparable countries.”

State control and uneven playing field

High state control over the economy, an uneven playing field between state-owned and private firms, and barriers to market entry hamper competition in Romania The 2018 OECD Product Market Regulation Index (PMR) – which reflects state control, barriers to market entry, and barriers to trade and investment – shows that state control over the economy is higher in Romania than in most OECD countries.

High state control over the economy, an uneven playing field between state-owned and private firms, and barriers to market entry hamper competition in Romania The 2018 OECD Product Market Regulation Index (PMR) – which reflects state control, barriers to market entry, and barriers to trade and investment – shows that state control over the economy is higher in Romania than in most OECD countries.

Entry barriers that can be removed to boost competition and GDP growth include: Cumbersome administrative procedures; unnecessary entry requirements for road freight and professional services and minimum and maximum fees for legal services, as well as recommended fee guidelines for engineering and architectural services.

Budget deficit versus state aid

Good news on the budget deficit for the government In addition, SOEs enjoy significant regulatory privileges, including exemptions from legal requirements on corporate governance, the absence of rules requiring the separation of commercial and non-commercial functions, and the absence of requirements that the companies’ investments provide a positive return. Enforcement of existing rules suffers from fragmented responsibilities for the supervision of SOEs, inconsistent reporting, unclear conditions for compensation of public service obligations and low transparency regarding state aid allocation.

Innovativeness

The innovation capacity of the Romanian economy is limited, mainly due to chronic under-investment, a lack of skills and governance shortcomings Romania ranks last on the EU’s innovation scoreboard, indicating a reduced ability of Romanian companies to advance up the value chain. Romanian companies score lower than those in the EU in terms of product and process innovation, marketing and organizational innovation, research and development expenditures, patent applications and ICT training. Romania has by far the lowest share of innovative companies in the EU: in 2019, only 10% of Romanian companies introduced a new or significantly improved product or service in the last 12 months, less than countries in the region such as Bulgaria, Hungary or Poland. Moreover, there is no single agency responsible for the overall management and coordination of innovation policy.

The innovation capacity of the Romanian economy is limited, mainly due to chronic under-investment, a lack of skills and governance shortcomings Romania ranks last on the EU’s innovation scoreboard, indicating a reduced ability of Romanian companies to advance up the value chain. Romanian companies score lower than those in the EU in terms of product and process innovation, marketing and organizational innovation, research and development expenditures, patent applications and ICT training. Romania has by far the lowest share of innovative companies in the EU: in 2019, only 10% of Romanian companies introduced a new or significantly improved product or service in the last 12 months, less than countries in the region such as Bulgaria, Hungary or Poland. Moreover, there is no single agency responsible for the overall management and coordination of innovation policy.

Infrastructure

Romania’s infrastructure reflects neither its EU membership status nor its generally high level of development Romania’s infrastructure measurement parameters lag behind those of the rest of the EU, with the country occupying last place on the  infrastructure quality rankings. According to the Global Competitiveness 2019-(At the time of writing, the World Forum is taking place in Davos and an updated update can be expected) report, Romania performed particularly poorly on road quality, ranking 119th out of 141 countries – the lowest position in the EU and, despite being a high-income country, well below some upper-middle-income countries. The large role of SOEs in the country’s infrastructure sector (especially in transportation and energy) leads to insufficient investment and/or exclusion of the private sector. Public investment averaged 4.2% of GDP between 2000 and 2020, above the EU-27 average of 3.2% of GDP, but was highly volatile. The government’s use of investment cuts as a tool to meet budget deficit targets has been a major driver of volatility. Insufficient coverage of transportation infrastructure networks hinders competitiveness and job creation.

infrastructure quality rankings. According to the Global Competitiveness 2019-(At the time of writing, the World Forum is taking place in Davos and an updated update can be expected) report, Romania performed particularly poorly on road quality, ranking 119th out of 141 countries – the lowest position in the EU and, despite being a high-income country, well below some upper-middle-income countries. The large role of SOEs in the country’s infrastructure sector (especially in transportation and energy) leads to insufficient investment and/or exclusion of the private sector. Public investment averaged 4.2% of GDP between 2000 and 2020, above the EU-27 average of 3.2% of GDP, but was highly volatile. The government’s use of investment cuts as a tool to meet budget deficit targets has been a major driver of volatility. Insufficient coverage of transportation infrastructure networks hinders competitiveness and job creation.

On the other hand, the digital infrastructure is reasonably well developed, although there are significant regional differences. “Romania’s private sector holds the key to accelerating growth, greening the economy and creating better jobs. But the public sector must continue to invest in retraining the workforce, improving institutional foundations and creating better infrastructure,” said Anna Akhalkatsi, World Bank country manager. for Romania and Hungary.

A convergence can be described as a new collaborative model of research, combining social, technical and medical knowledge and methods. Indeed, convergence is seen in scientific literature worldwide as the best way to solve complex contemporary problems in the areas of health care, energy, food, climate or water. TU Delft, Erasmus University Rotterdam and Erasmus MC are embarking on a Convergence Alliance to achieve a better understanding and approach to the challenges facing the Rotterdam delta and urban deltas worldwide.

In a derived sense, one can also refer to the 0nderdernemersplatform Dutch Romanian Network as a convergence where sharing experiences and knowledge can lead to a better approach to the challenges an entrepreneur faces.

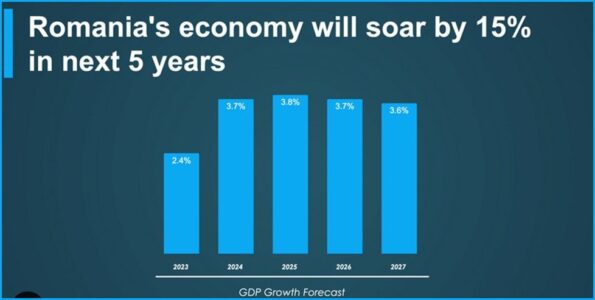

Romania is becoming an economic force in Southeast Europe and the region.

The Romanian economy will reach a value of 350 billion euros by 2024 and already ranks second Southeast and in the region, after Poland, but ahead of Greece and the Czech Republic.

The Romanian economy will reach a value of 350 billion euros by 2024 and already ranks second Southeast and in the region, after Poland, but ahead of Greece and the Czech Republic.

“If we have an economy that matters more, it becomes imperative for the OECD, for example, to stop ignoring it; it becomes ridiculous for them as well,” said Aurelian Dochia, professor of economics and affiliated with the BRD Société Générale.

GDP expressed in nominal terms, which practically represents a country’s gross economic power, is projected to reach 350 billion euros by 2024.The figure places Romania second in Southeastern Europe and in the region, behind Poland. Romania’s GDP of €350 billion by 2024 exceeds that of Bulgaria (€100 billion), Hungary (€205 billion) and even the Czech Republic (€240 billion).

Unfortunately, it is still common for less informed journalists to include Romania in the Balkans. So again: The Balkans includes the countries from the former Yugoslav Republic (Serbia, Croatia, Slovenia, Montenegro, Northern Macedonia, Kosovo and Bosnia-Herzegovina), but it also includes countries that were never Yugoslav, namely Albania, Bulgaria and Greece. See also “Balkans in map” ISSN 0921-9293, volume 55, Leiden University Library(Limited edition)

Financial Sector – Banking

Which banks will disappear from Romania by 2024?

How is the banking system divided according to the origin of capital invested?

How is the banking system divided according to the origin of capital invested?

A total of five banks are disappearing from Romania, but a new one is also appearing. More precisely, by the end of 2024, after the mergers and integration of assets into new entities, we will have only 27 banks, compared to the 32 we have today. The same steps will also change the structure of bank capital, meaning that by the end of 2024, domestic capital will have a weight of about 35% of the total banking system, followed by Austrian at 23% and Italian at about 14%. of the system, French 11% and Dutch 10%. Which banks are disappearing and how is the banking market divided between foreign, Romanian and state investors?

At the end of 2008, there were 43 credit institutions operating in Romania (42 banks and the CREDITCOOP cooperative network). Depending on the origin of capital, two banks had wholly state capital or majority ownership (CEC Bank and Eximbank), three banks had domestic private majority capital, 27 banks had foreign majority capital and 10 were branches of foreign banks. Banks with full or majority private capital held 94.8 percent of assets (and banks with full or majority foreign capital held 88.2 percent of total assets), while banks with full or majority state capital held a share of only 5.2 percent, according to BNR’s annual report. From 2024, things will change: we will have 27 banks, and the share of domestic capital will be the majority in our banking system.

The proportion of institutions with

domestic capital, both private and state capital

, will approach 35% by 2024. The increase in the share of Romanian capital in the total banking sector is mainly due to acquisitions by Banca Transilvania (Ideea Bank, included in the banking sector). Structure herein and by the NBR not included in the 2022 report and the still anticipated but certain acquisition of OTP Bank).

Also playing an important role is the development of CEC Bank, a majority state-owned bank, whose evolution from 2023 is expected to increase the bank’s market share to over 9% through organic growth. Moreover, a new capital increase is expected at this institution, allowing it to expand its activities. In addition, the creation of the Investment and Development Bank will allow most of the state capital to house part of its total banking assets in Romania.

Also playing an important role is the development of CEC Bank, a majority state-owned bank, whose evolution from 2023 is expected to increase the bank’s market share to over 9% through organic growth. Moreover, a new capital increase is expected at this institution, allowing it to expand its activities. In addition, the creation of the Investment and Development Bank will allow most of the state capital to house part of its total banking assets in Romania.

The Austrian capital

, which constituted the majority in the Romanian banking system until two or three years ago, has been reduced to 23% of the total banking system. The only banks with Austrian capital remaining are Erste BCR, which is still on the second  place in the market, and Raiffeisen Bank, which is dropping in the overall ranking of banks (until recently it was number three in the banking system), even if the bank’s activity and profitability do not suffer, it maintains its constant market share.

place in the market, and Raiffeisen Bank, which is dropping in the overall ranking of banks (until recently it was number three in the banking system), even if the bank’s activity and profitability do not suffer, it maintains its constant market share.

A sharp increase in Italian capital on

A sharp increase in Italian capital on![]() the Romanian market, which could reach a 14% market share in total bank assets by 2024, or even more. The two acquisitions in 2023, the merger of UniCredit Bank Romania with Alpha Bank Romania and the acquisition of First Bank by Intesa San Paolo Bank, increase the market share of the two Italian banks from 9.5% to about 14% in the total banking system.

the Romanian market, which could reach a 14% market share in total bank assets by 2024, or even more. The two acquisitions in 2023, the merger of UniCredit Bank Romania with Alpha Bank Romania and the acquisition of First Bank by Intesa San Paolo Bank, increase the market share of the two Italian banks from 9.5% to about 14% in the total banking system.

France

remains a constant investor in the Romanian banking sector, maintaining its market share at around 11% even as BRD Societe Generale drops in  the overall ranking of Romanian banks from the third place it currently holds, with a 10.2% market share in fourth place, following the transaction carried out by UniCredit Bank Romania.

the overall ranking of Romanian banks from the third place it currently holds, with a 10.2% market share in fourth place, following the transaction carried out by UniCredit Bank Romania.  BNP Paribas Romania’s presence remains consistently below 0.5%, and the closure of BNP Paribas Personal Finance’s businesses in Romania does not seem to have an impact on the capital distribution. Before the announcement of the voluntary share closure, it held 0.23% of total bank assets, according to BNR.

BNP Paribas Romania’s presence remains consistently below 0.5%, and the closure of BNP Paribas Personal Finance’s businesses in Romania does not seem to have an impact on the capital distribution. Before the announcement of the voluntary share closure, it held 0.23% of total bank assets, according to BNR.

Similarly, the total

Similarly, the total

of Dutch assets

in the Romanian banking sector next year around 10% or even slightly more. ING Bank, the main investor in the Romanian banking market, continues to rely on organic growth, a growth that has taken it to the top five in the banking market. The other investor is an Amsterdam-based investment fund that owns Patria Bank, which is also growing organically after its merger with Patria Bank.

The US

still owns about 3.5% of Romania’s banking sector. Interests run through Citibank Romania, with a market share of over 2%, which has stuck to its vision of large corporate clients and has shown no signs of wanting to expand, especially after the basket of private clients produced during the lending period was taken away and sold to Raiffeisenbank. In the case of Libra Bank, also with a market share of nearly 1.5%, it is an American investment fund, but apparently managing the money of Romanians who left for America many years ago.

Romania, with a market share of over 2%, which has stuck to its vision of large corporate clients and has shown no signs of wanting to expand, especially after the basket of private clients produced during the lending period was taken away and sold to Raiffeisenbank. In the case of Libra Bank, also with a market share of nearly 1.5%, it is an American investment fund, but apparently managing the money of Romanians who left for America many years ago.

It is worth noting the huge decline in

It is worth noting the huge decline in

Greek capital

in the composition of the assets of our banking system. Total assets of Greek banks fell to no more than 2.5% of the sector, due to the merger of Alpha Bank with Unicredit. Alpha Bank will own only 9.9% of the future entity. The only bank with Greek capital remains Vista Bank, with a market share of 1.16% at the end of 2022, according to the NBR. In late 2008, when the crisis erupted, Greek banks were the largest investor in our banking system, accounting for 22.4% of total assets.

Top investors in the Romanian banking system

- Romania approx. 35% (Romanian state capital 12.5%)

- Austria 23%

- Italy approx. 14%

- France about 11%

- Netherlands about 10%

- US 3.5%

- Greece 2%

- Turkey below 2%

- Germany below 0.5%

- Others about 1%

Source: BNR and Economica.net estimates based on market data

Three banks disappear due to merger or acquisition by other banks

The number of credit institutions operating in Romania decreased from 34 to 32 credit institutions by 2022. The changes at the level of credit institutions were also reflected in market share depending on capital size. For example, the share of credit institutions with majority state capital in the total capital of the banking system (excluding branches of foreign credit institutions) fell from 16.6 percent at Dec. 31, 2021, to 13.9 percent at Dec. 31, 2022. domestic private capital increased from 23.0 percent at Dec. 31, 2021, to 25.5 percent at Dec. 31, 2022, according to BNR’s 2022 annual report.

In 2024, the number of credit institutions will decrease further and the total number of banks on the market will be 27 credit institutions, under the condition that Salt Bank, formerly Idea Bank, which is part of Banca Transilvania, was not included. , as it also did not take into account Raiffeisen Digital Bank or Revolut Bank, institutions that will operate exclusively in the digital environment and that are not fully structured and integrated into the Romanian banking system and we do not know exactly how they will report their financial data to the NBR, either as separate entities or as part of the group to which they belong. Theoretically as separate entities, but the numbers are currently too small.

First Bank

is one of the banks that will disappear in 2024, after the

Intesa San Paolo Bank

Group announced the acquisition of 99.98% of First Bank Romania’s shares from U.S. investment fund JC Flowers. The transaction is expected to close in the first part of 2024. The market share of the future universal bank will be somewhere around 2% in terms of bank assets.

Intesa Sanpaolo Bank has operated as a universal bank in Romania since 1996. It had a 1.09% market share at the end of 2022, compared with 1.10% held by First Bank at the end of 2022, according to BNR.

Alpha Bank Romania is the largest credit institution to disappear from the banking firmament after Alpha Services and Holdings and UniCredit agreed on the main financial terms of the merger between UniCredit Bank Romania and Alpha Bank Romania, as part of a strategic partnership at the international level. . The merger between Alpha Bank Romania and UniCredit Romania leads to the creation of the third largest bank in Romania in terms of total assets. In the future bank, Alpha Bank will hold a 9.9% stake and receive about 300 million euros after due diligence. The combined market share of the future bank will be 12% in terms of total assets. The transaction is expected to close in 2024.

OTP Bank Romania is the fourth bank that Banca Transilvania has acquired in nearly a decade, following the acquisition of Volksbank Romania, Bancpost and Idea Bank. OTP Bank Romania had mid-year assets of about 20 billion lei and ranked 10th in the market. OTP is valued at 300 to 400 million euros, to which would be added the repayment of funding lines to Budapest. OTP Bank Romania has a market share of almost 2% and records sustained organic growth over the past 3-4 years.

Banca Transilvania reached first place in the market mainly thanks to acquisitions. The group then bought and merged with Volksbank (2015) and Bancpost (2018), the 10 largest banks at the time of the deals. It also bought Idea Bank in 2022, which remains separate. By mid-year, it had assets of 153 billion lei and a market share of about 20%.

After completed mergers and acquisitions, how many banks will still be operating in the banking system in 2024?

| Bank Market share of total assets 2022 Source of capital |

| 1. Banca Transilvania ca. 22% (after OTP acquisition)* mostly Romanian |

| 2. BCR 13.95% Austrian |

| 3. Unicredit approx. 12% (after merger with Alpha Bank)* Italian |

| 4. BRD 10.2% French |

| 5. ING Bank 9% Dutch |

| 6. CEC** 8.83% (69.08 billion lei Q3 2023) Romanian state |

| 7. Raiffeisen Bank** 8.85% (67.5 billion lei Q3 2023) Austrian |

| 8. Exim Banca Românească 3.27% Romanian state |

| 9. Citibank 2.05% American |

| 10. Intesa San Paolo Bank about 2% (after the acquisition of First Bank)* Italian |

| 11. Garanti Bank 1.91% Spanish and Turkish |

| 12. Libra Bank 1.39% American |

| 13. Views 1.16% Greek |

| 14. Patria Bank 0.59% Dutch |

| 15. Credit Europe 0.57% Turkish |

| 16. BNP Paribas 0.49% French |

| 17. Pro Credit 0.37% German |

| 18. TBI Bank 0.29% Bulgarian |

| 19. Creditcoop 0.23 Romanian |

| 20. BCR Bank for Housing 0.10% Austrian |

| 21. Techventures Bank 0.12% Romanian |

| 22. Porsche Bank 0.07% German |

| 23. Banq Banorient France 0.09% French-Arabic |

| 24. Alior Bank 0.07% Polish |

| 25. BRCI 0.04% Romanian |

| 26. Bank of China 0.01% Chinese |

| 27. Investment and Development Bank – Romanian state |

The table does not include Ideaa Bank, which was bought by Banca Transilvania, even though it will operate as a separate entity from BT under the name Salt Bank.

*Economica.net estimates, based on market shares of commercial banks at the end of 2022, according to BNR

**CEC Bank was moved to 6th place, ahead of Raiffeisen, as the two banks’ nine-month results for 2023 point to accelerated asset growth for CEC Bank, with assets already exceeding those of the Austrian bank.

Two banks suspend operations on their own initiative

The shareholders of

Aedificium Banca pentru Locuinte SA

(ABL), 99.9% owned by Raiffeisen Bank Romania, decided in the fall of 2023 to start the process of canceling the license for the credit institution, which entails the dissolution, followed by the voluntary liquidation of ABL. “The voluntary liquidation process will ensure an orderly and transparent procedure, respecting the law and the rights of all ABL’s creditors,” Raiffeisen officials said in an announcement at the stock exchange.

BNP Paribas Personal Finance

announced in March 2023 the start of procedures to cease operations in Romania of the consumer finance division Cetelem, as the French group has not found a financial partner to continue the activity locally. “BNP Paribas Personal Finance, founded in 2005 in Romania under the brand name Cetelem, has been successful from a commercial point of view, but the company’s activity has not reached the size necessary to absorb the large investments in IT required for competitiveness. Therefore, BNP Paribas Personal Finance conducted a strategic analysis to identify the existing options, in the interest of customers and employees. Unfortunately, the process of identifying a financial partner with the ability to define and guarantee a stable future for the company did not materialize,” said a statement from the company.

Three new banks appear, one state-owned bank and two digital-only banks

BID, the Investment and Development Bank,

was established as a private limited liability company, credit institution, legal entity under private law, owned by the Romanian state throughout its operating period, through the Ministry of Finance, as sole shareholder, under the supervision of the National Bank of Romania. The subscribed capital is 3 billion lei, of which the capital paid in when the bank is registered with the Trade Register is 119 million lei, the difference is to be paid in 2 installments until the end of 2024.

The overall mission of the BID is to support economic and social development, economic competitiveness, innovation and sustainable economic growth, to address financial market dysfunctions, based on independent ex-ante analysis.

Revolut Bank UAB is operational in Romania, based on the license obtained in Lithuania (passport license). The bank’s local branch will be operational from the first half of next year. It will offer Revolut local IBAN and customers will benefit from products adapted to the local market, but it will not have bank branches with a physical presence, it will still be a 100% digital bank.

Revolut has more than 3 million customers in Romania and is aiming for 10th place in the banking system. From the point of view of active accounts, the financial application ranks second after Banca Transilvania.

Raiffeisen Digital Bank AG

will be active in the Romanian market by mid-2023. Raiffeisen’s digital bank offers digital banking services in Poland and Romania. The digital bank has an Austrian banking license and a motivated team behind it. In order to offer services to customers, banking technology specific to payment systems (interbanking) – including Romanian IBANs – offered by … Libra Internet Bank.

Idea:Bank becomes Salt Bank and becomes the first 100% digital bank made in Ro. ” When choosing the name Salt Bank, we were looking for something that would resonate with us, the people here. It is a name that expresses our ambitions. We have the courage to innovate today to be better tomorrow and we are determined to develop a safe and reliable bank in the long run,” said Gabriela Nistor, chief executive officer of Salt Bank. Salt Bank will launch in 2024. Idea Bank was the third bank acquired by Banca Transilvania (2021), after Bancpost (2018) and Volksbank Romania (2015).

Geopolitical developments

Geopolitical developments – Introduction

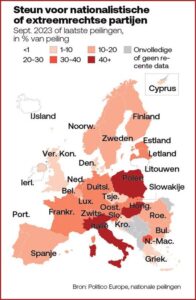

As is well known, 2024 is an election year throughout Europe, even in the Russian Federation, the outcome of which, however, has already been determined. We limit ourselves to broad outlines and try to emphasize the economic aspects. These cannot all be visualized at stage (cause and effect). We highlight three topics, namely: Schengen, European elections and emerging Right-wing Extremism.

As is well known, 2024 is an election year throughout Europe, even in the Russian Federation, the outcome of which, however, has already been determined. We limit ourselves to broad outlines and try to emphasize the economic aspects. These cannot all be visualized at stage (cause and effect). We highlight three topics, namely: Schengen, European elections and emerging Right-wing Extremism.

Right-wing extremism according to the AIVD

Right-wing extremists pose a threat to national security and democratic rule of law because they pursue anti-democratic goals, with or without undemocratic means.

Hatred toward the strange

The AIVD speaks of right-wing extremism when the definition of extremism is met and involves one or more of the following views:

The AIVD speaks of right-wing extremism when the definition of extremism is met and involves one or more of the following views:

- Xenophobia (including anti-Semitism and anti-Muslims)