Newsletter March 2023

Noaberschap(neighborliness) in Romania

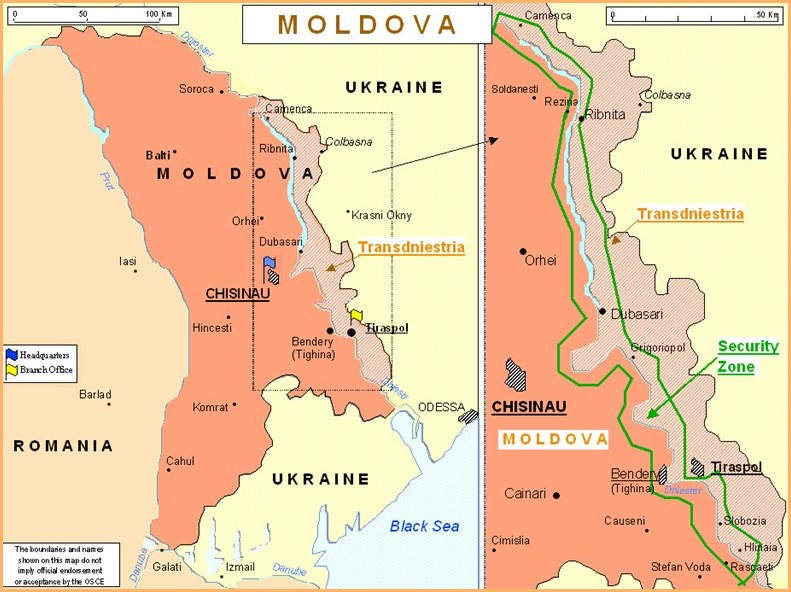

Looking at the geopolitical situation in Southeastern Europe, it seems as if Romania has adopted the culture of the Eastern Netherlands. It may also be because Romania is called a Romanian island surrounded by a Slavic sea.

Looking at the geopolitical situation in Southeastern Europe, it seems as if Romania has adopted the culture of the Eastern Netherlands. It may also be because Romania is called a Romanian island surrounded by a Slavic sea.

Without much ado, they opened their neighboring Ukraine and its borders to them so they could export their grain. The same attitude they took toward Moldova in which they also secured energy supplies to some extent. And with the latter country, they have pledged support now that Russian Federation is causing unrest there.

Romania also praised in U.S. Congress for helping Ukraine

Democratic and Republican members of the House of Representatives serving on the Information, Armed Services, Homeland Security, Judiciary and Helsinki committees namely: Bill Huizenga, Jason Crow, Sylvia Garcia, Eric Swalwell, Victoria Spartz, Linda Sanchez, Joe Wilson, Steve Cohen, Jim Costa and Robert Aderholt also recognized Romania’s prominent role in managing a humanitarian and security crisis with strong  consequences in the region and globally. Its importance, they said, was reaffirmed by the two countries’ cooperation in the context of Russia’s invasion of Ukraine. They presented bipartisan support for Ukraine, saying it is essential to maintaining a rules-based international order.

consequences in the region and globally. Its importance, they said, was reaffirmed by the two countries’ cooperation in the context of Russia’s invasion of Ukraine. They presented bipartisan support for Ukraine, saying it is essential to maintaining a rules-based international order.

Along with Ambassador Andrei Muraru, Romania was represented by Senator Titus Corlățean, the chairman of the Senate Foreign Policy Committee, Minister of Culture Lucian Romașcanu, and MPs Ben-Oni Ardelean, Alexandru Muraru, Pavel Popescu and Dan Cristian Popescu, all of whom were part of the governing coalition made up of Social Democrats, Liberals and the Hungarian minority party UDMR.

Romanian political stability contributes to Dutch companies investing in the country in large numbers (over 5800) and this is still growing! And the DRN as a business organization continues to support the entrepreneurs in doing so to also shape good noaberschap in the business sense of the word!

Agri and Food Sector

Dutch bakery ingredients producer Royal Zeelandia Group will invest €800,000 in Romania by 2023

“We plan to cover the entire production and warehouse hall with solar panels, so we should be able to generate much of the energy consumed ourselves. Investments will then be made to continue with redesign, increasing worker safety and digitalization.  For next year, we have allocated investments of over €800,000,” said Ovidiu Bocaniciu, general manager of Zeelandia Romania.

For next year, we have allocated investments of over €800,000,” said Ovidiu Bocaniciu, general manager of Zeelandia Romania.

He added that the biggest challenge for 2023 would have to do with macroeconomic stability and then rearranging the supply chain. In Romania, Zeelandia’s activity started in 1998 with the acquisition of the Polish group Superbake, including its local subsidiary. Zeelandia previously had a factory in Bucharest, but then invested 3 million euros in another factory, in Iasi. In Iasi, the company has about 100 employees. The manager says 2022 was more difficult than 2021 because of the war in Ukraine and inconsistency in the supply chain, as well as rising energy prices. “Nevertheless, we are achieving similar levels of profitability and sales increased significantly. We expect RON 73 million in sales for 2022.” [1EUR =ong. 5RON] In 2021, Zeelandia had RON 61.4 million in revenue and RON 2.9 million in net profit.

Romania’s average price for 1 ha of agricultural land rose to 7,601 euros

According to the latest data published at the European level and cited by Agrointeligenta, the average price of a hectare of arable land in the European Union in 2021 ranged from €3,661 in Croatia to €47,290 in Luxembourg, according to data published by Eurostat.

The average land price in Romania increases year by year In the case of Romania, the average price of a hectare of arable land was €7,601 in 2021, up from €7,163 in 2020. By comparison, the average price of a hectare of arable land in 2021 was €6,096 in Bulgaria, €5,940 in France and €5,187 in Hungary. Other member states where the average price per hectare of arable land is lower than in Romania are Lithuania, Estonia, Latvia, Slovakia and Croatia.

The average land price in Romania increases year by year In the case of Romania, the average price of a hectare of arable land was €7,601 in 2021, up from €7,163 in 2020. By comparison, the average price of a hectare of arable land in 2021 was €6,096 in Bulgaria, €5,940 in France and €5,187 in Hungary. Other member states where the average price per hectare of arable land is lower than in Romania are Lithuania, Estonia, Latvia, Slovakia and Croatia.

For Romania, the highest prices for arable land are in the Bucharest-Ilfov region (€10,707 per hectare) and the lowest in the Northwest region (€6,206 per hectare), in both cases lower than in 2020. According to Eurostat, the price of arable land depends on several factors, including national legislation, climate, proximity to transportation networks, soil quality, irrigation systems and market forces related to supply and demand.

Source: agrointel.ro

How many dairy cows have disappeared in Romania in recent years?

According to data published in the National Strategic Plan (NSP), both the dairy cow herd and total raw milk production in Romania decreased by 3.3% and 18.4%, respectively, between 2010 and 2020, reads the news on Agrointeligenta. “Compared to 2015, when 1,311,000 head of dairy cows were registered, the number of dairy cows in 2020 decreased to 1,2,300,000 head, the difference of 81,000 head, representing a reduction of 6.17%, leading to a decrease in raw milk production by 6.47 %, from 42,663,000 hl in 2015 to 39,901,000 hl in 2020,” the data quoted shows.

Per capita milk consumption increases

The same document also shows that between 2015 and 2020, annual per capita milk consumption increased by 9.19% from 237 liters/capita to 259 liters/capita, while total annual milk production decreased by 7.54% during the same period. By granting subsidies from 2023, the Ministry of Agriculture, Nature and Food Quality aims to maintain dairy farming at a certain level, taking into account the following: – lack of alternative employment opportunities in rural areas; – the risk of discontinuing this activity, not meeting the needs of domestic consumption and thereby jeopardizing food security; – the need to supply local markets with milk and dairy products to take advantage of existing production capacities, some of which are currently closed. Although Romania considers itself a major livestock farming country, dairy products are among the most imported foods. For cream, for example, the ratio of domestic production to imports is 1 to 4. For every ton of cream produced domestically, Romania gets another four tons from abroad to cover consumption. “The solution is to develop the production and processing segment,” said recently Tudorel Andrei, president of the National Institute of Statistics (INS).

Source: agrointel.ro

Focus on calf farming

Calf farming is under pressure in the Netherlands. Should the ammonia reduction plans go forward it will have major consequences especially for cattle and veal farming.

Growth in the sector is no longer taking place in the Netherlands. Due to the challenges mentioned above, the sector will shrink in the coming years, by an estimated 10-15% from 2021. Biggest question mark here is how the government’s buyout schemes will work out for the calf sector. More clarity on this is likely by mid-2023, said Jeroen van den Hurk Sector Manager Rabobank Food & Agri, intensive livestock farming.

No growth, yet strong international position

In Romania, calf farming is yet to be developed. Now, moreover, a large number of calves are transported by ship via Constanta to the Middle East for halal slaughter. This is expected to be drastically reduced by EU policies over the next decade. Again, what is a threat in the Netherlands is an opportunity in Romania.

This applies not only to calf farming but also to other sectors (specifically pigs, arable farming, dairy chains, conventional and organic, inclusive) in the agrifood sector. Dutch knowledge is valued.

The role of Agriprogess

Agriprogress, in cooperation with the DRN Taskforce Agri & Food and the Association of Calf Farmers (VVK), organized a study tour to Romania last June. During the trip – which was a nice alternation between business and culture – a number of key players in this sector in Romania were visited, for example Dutch Agritrading of Gert Bronkhorst (major player in the calf trade), a number of Romanian slaughterhouses, Jan de Boer of DN Agrar (the largest dairy farm in Romania) and Karpaten Meat (Black Angus based on grass). This interspersed with good wine from Tohani in Mizil, Sergiana in Poiana Brasov and tours of Sibiu and Bucharest. In response to this visit, two missions by slaughterhouses and beef farmers to beef bulls, veal farmers, suppliers and slaughterhouses in the Netherlands were then organized in the fall. Discussions are currently underway to develop a calf barn, improve and develop a slaughterhouse and acquire a chain

Agriprogress, in cooperation with the DRN Taskforce Agri & Food and the Association of Calf Farmers (VVK), organized a study tour to Romania last June. During the trip – which was a nice alternation between business and culture – a number of key players in this sector in Romania were visited, for example Dutch Agritrading of Gert Bronkhorst (major player in the calf trade), a number of Romanian slaughterhouses, Jan de Boer of DN Agrar (the largest dairy farm in Romania) and Karpaten Meat (Black Angus based on grass). This interspersed with good wine from Tohani in Mizil, Sergiana in Poiana Brasov and tours of Sibiu and Bucharest. In response to this visit, two missions by slaughterhouses and beef farmers to beef bulls, veal farmers, suppliers and slaughterhouses in the Netherlands were then organized in the fall. Discussions are currently underway to develop a calf barn, improve and develop a slaughterhouse and acquire a chain

Agriprogress is happy to help Dutch investors and entrepreneurs get a foothold in this country with lots of space. The site lists a number of businesses currently for sale. We are happy to organize a number of missions to Romania again this year. RFO also lends a hand, 50% of the costs can be paid by RFO.

More info: www.agriprogress.com.

Dutch group DN Agrar, the largest producer of raw milk in Romania, buys 800 Holstein cows

DN Agrar, a company controlled by a group of Dutch investors listed on BVB’s AeRO market, bought 800 Holstein cows to expand one of its farms. The goal is to reach 12,500 animals, compared to the 11,000 they currently have, through organic expansion or farm acquisitions.

DN Agrar Group SA (DN) is continuing its investment in the Apold farm by purchasing 800 Holstein cows, according to a company announcement. According to the company, the investment is aimed at increasing production capacity and renewing the herd of dairy cows and young stock.

“At DN AGRAR, we continue to invest for the development of the farm. So far, purchases for the Apold farm reach a herd of 1,200 animals, part of which will be used to renew the dairy cow herd and another part to complete the farm’s new production capacity. The investments made last year, for the modernization and expansion of the milking parlors, allow us to increase both herd size and milk production, without compromising the quality standards that define our business,” said Jan Gijsbertus de Boer, chairman of the DN Agrar Group board.

“At DN AGRAR, we continue to invest for the development of the farm. So far, purchases for the Apold farm reach a herd of 1,200 animals, part of which will be used to renew the dairy cow herd and another part to complete the farm’s new production capacity. The investments made last year, for the modernization and expansion of the milking parlors, allow us to increase both herd size and milk production, without compromising the quality standards that define our business,” said Jan Gijsbertus de Boer, chairman of the DN Agrar Group board.

In 2016, Jan de Boer was awarded the Romanian Business Award by the Dutch Romanian Network.

Advice to Romanian farmers to establish (more) agricultural windbreaks

“The (forestry) windbreaks made from agricultural species have been proposed as a novelty by the specialists of the Academy of Agricultural and Forestry Sciences (ASAS) “Gheorghe Ionescu-Sisesti,” announced the president of this high forum, PhD Prof. Ionescu-Sisesti. Valeriu Tabără to.

He reiterated that climate change is not a vague story, but a reality. Professor Tabără also spoke about the efforts of specialists to create new solutions to protect crops through forest barriers (windbreaks). “Windscreen is absolutely necessary. We come up with a novelty that we want to patent as a kind of fence. We don’t go for forest species, we go for agricultural species.

We are talking about black walnut, wild cherry, possibly also linden trees, to increase the area of honey plants and then, at the bottom of the curtain, (…) we will add wax cherry trees and hazelnuts – where it will work, so something that will close the curtain around the base,” Prof. Valeriu Tabără, former Minister of Agriculture, announced. The ASAS president said during the Agrostrategia program that the specific climate of each part of the country must be taken into account when creating forest windbreaks made from agricultural species. “We have a type of windbreak for fruit trees in Marculești, based on a thesis of a forester years agoWe have to take into account the conditions of each area (…) We are not disputing windbreaks in forestry, which certainly have their value, but we are coming up with some additions, including environmental issues,” Prof. K. K. said. Tabără.

We are talking about black walnut, wild cherry, possibly also linden trees, to increase the area of honey plants and then, at the bottom of the curtain, (…) we will add wax cherry trees and hazelnuts – where it will work, so something that will close the curtain around the base,” Prof. Valeriu Tabără, former Minister of Agriculture, announced. The ASAS president said during the Agrostrategia program that the specific climate of each part of the country must be taken into account when creating forest windbreaks made from agricultural species. “We have a type of windbreak for fruit trees in Marculești, based on a thesis of a forester years agoWe have to take into account the conditions of each area (…) We are not disputing windbreaks in forestry, which certainly have their value, but we are coming up with some additions, including environmental issues,” Prof. K. K. said. Tabără.

Romanian entrepreneur invests 1 mln euros in organic sea buckthorn

Timisoara is home to the latest production line of Frootya organic sea buckthorn nectar, a brand developed by a local entrepreneur who has invested 1 million euros in growing the plant since 2013. The investment was covered by private and European funds.

Frootya’s production line includes raw sea buckthorn juice, as well as combinations of sea buckthorn nectar with mango, aronia, ginger, orange and honey. Romanian sea buckthorn grows in the Mures Valley, on a farm equipped with all necessary facilities, under controlled and

Frootya’s production line includes raw sea buckthorn juice, as well as combinations of sea buckthorn nectar with mango, aronia, ginger, orange and honey. Romanian sea buckthorn grows in the Mures Valley, on a farm equipped with all necessary facilities, under controlled and certified organic conditions. In the first year after the launch of the Frootya brand, they are aiming for a turnover of 250,000 euros, of which 100,000 euros will come from the sale of juice and nectar and the rest from the wholesale sale of sea buckthorn fruit,” said Lucian Popa, managing partner at PALD Biofarm, the company that operates the Frootya brand. Lucian Popa decided to start an investment in agriculture in 2013. He chose sea buckthorn, a suitable product for organic farming, and the first investment was to purchase a 42-hectare plot of land in an area with a tradition of fruit growing – the Mureș Valley in Arad Province. In 2014, the first 10 hectares of buckthorn were planted and in 2019, the project successfully secured the first round of European funds. In the early years, sea buckthorn was sold to internal and external processors, wholesale. “After a market analysis and the desire to be closer to the end consumer, we decided to add juice and nectar to our offerings,” says Lucian Popa. By 2023, the entrepreneur plans to expand with a new automated production line, with European funding, and optimize costs by installing energy independence through photovoltaic panels.

certified organic conditions. In the first year after the launch of the Frootya brand, they are aiming for a turnover of 250,000 euros, of which 100,000 euros will come from the sale of juice and nectar and the rest from the wholesale sale of sea buckthorn fruit,” said Lucian Popa, managing partner at PALD Biofarm, the company that operates the Frootya brand. Lucian Popa decided to start an investment in agriculture in 2013. He chose sea buckthorn, a suitable product for organic farming, and the first investment was to purchase a 42-hectare plot of land in an area with a tradition of fruit growing – the Mureș Valley in Arad Province. In 2014, the first 10 hectares of buckthorn were planted and in 2019, the project successfully secured the first round of European funds. In the early years, sea buckthorn was sold to internal and external processors, wholesale. “After a market analysis and the desire to be closer to the end consumer, we decided to add juice and nectar to our offerings,” says Lucian Popa. By 2023, the entrepreneur plans to expand with a new automated production line, with European funding, and optimize costs by installing energy independence through photovoltaic panels.

Sea buckthorn ( Hippophae rhamnoides L.) is a deciduous shrub or tree also known as Siberian pineapple, sand maple, sea berry, and fawn. Hippophae L. originated in the Hengduan Mountains and eastern Himalayas and is widely distributed in the temperate regions of Eurasia. Every part of this plant (fruits, leaves, stems, branches, roots and thorns) has traditionally been used in medicine, nutritional supplements, soil and moisture conservation and establishing wildlife habitats. That is why sea buckthorn is popularly known as “Wonder Plant,” “Golden Bush” or “Gold Mine.”

Sea buckthorn ( Hippophae rhamnoides L.) is a deciduous shrub or tree also known as Siberian pineapple, sand maple, sea berry, and fawn. Hippophae L. originated in the Hengduan Mountains and eastern Himalayas and is widely distributed in the temperate regions of Eurasia. Every part of this plant (fruits, leaves, stems, branches, roots and thorns) has traditionally been used in medicine, nutritional supplements, soil and moisture conservation and establishing wildlife habitats. That is why sea buckthorn is popularly known as “Wonder Plant,” “Golden Bush” or “Gold Mine.”

In recent years there have been numerous reports on the pharmacological activities of sea buckthorn, including its anti-cancer, anti-inflammatory, antimicrobial and antiviral activities, and its ability to work in cardiovascular protection). There is no doubt that sea buckthorn has great medicinal and therapeutic potential, which can be attributed to the fact that sea buckthorn contains various vitamins, carotenoids, polyphenols and fatty acids.

Shipbuilding sector

Romania urgently needs additional maritime clout and not declarations of intent and/or vague promises

Given the security situation in and around the Black Sea, there is an urgent need for the Romanian government to make up its mind and stop letting itself be bullied by French Naval which is a state-owned company.

What preceded

France and Romania signed a memorandum of understanding on June 15, 2022, aimed at developing the capabilities of the Romanian Navy. None other than President Macron traveled to Romania, where, on the sidelines of his visit, the Memorandum of Understanding was signed. With the signing, the Naval Group construction project of the new Romanian corvettes may be moving forward. This project has been running for about seven years, without much site gain. And in 2023, it still won’t.

Damen or Naval Group?

The four new Romanian corvettes were initially to be built by the Dutch company Damen. However, when a new government had taken office in Romania, they decided to proceed with a tender anyway. This was won by Naval Group in 2019. The French state-owned company was supported in this by President Macron. The project involved 1.6 billion euros.

Damen then filed another official objection. According to Damen, there were several irregularities in the tendering and awarding process. For example, information was allegedly leaked during the tender process, including elements of the financial bid. In the end, the price Naval Group offered was 50 million euros lower than Damen’s.

Damen filed official objections with Romania’s anti-corruption authorities and the Bucharest tribunal. However, this had no effect, leaving Naval Group as the final winner.

Delay due to disagreement between France and Romania

However, construction of the corvettes has not yet begun. Naval Group and the local Constanta shipyard, where the corvettes are to be built,  cannot agree on where the responsibility of construction lies. Naval Group wants the responsibility to be taken over by its Romanian partner, since it has to build the corvettes. For Romania, however, this is out of the question.

cannot agree on where the responsibility of construction lies. Naval Group wants the responsibility to be taken over by its Romanian partner, since it has to build the corvettes. For Romania, however, this is out of the question.

That responsibility has to do with where the bill ends up if something goes wrong. Naval Group wants the ships built in a yard where no naval ship has ever been built. That is why the French do not want to take full responsibility. The chosen yard, however, was the choice of the French.

This makes the extra sour for Damen, which has two shipyards in Romania where naval vessels have been built for 20 years. The supply ship Den H elder is being built in the Galati shipyard; the Mangalia shipyard is even partly owned by the Romanian government.

Due to the disagreement between France and Romania, the actual signing of the contract was a long time coming. The Romanian government set a deadline several times, but it was pushed back each time. This gave Damen hope that it would regain control of the tender after all, it turned out in April 2022. Incidentally, the deadline of the end of April was also missed, after which it was pushed back until this fall. And the Memorandum of Understanding signed on June 15, 2022, did not break this deadlock.

Romanian Navy’s limited capacity

Meanwhile (2023), Romanian plans and opportunities seem to have grown. Romanian Defense Minister Vasile Dincu recently noted that the original program is out of date: “It no longer fully meets our needs. We need a much more complex program.”

Meanwhile (2023), Romanian plans and opportunities seem to have grown. Romanian Defense Minister Vasile Dincu recently noted that the original program is out of date: “It no longer fully meets our needs. We need a much more complex program.”

That Romania needs additional maritime clout is indisputable. Currently, the Romanian Navy has very limited capabilities with three multipurpose frigates, two of which are second-hand vessels from the United Kingdom. There are also seven corvettes in service, the three Tarantul types inherited from the Soviet era. In addition, Romania has one Kilo-class submarine. However, it has not sailed since 1996.

Romania’s naval forces plan to start submarine acquisition procedures in 2023. Other procurement programs include minesweepers, amphibious assault vehicles and helicopters.

“Together with the SIML (Mobile Anti-Ship Missile Launch System) program, the Romanian Naval Forces attach great importance in the short term to the  launch of the “Submarine Against Surface and Underwater Threats” program and the acquisition of mine-hunting vessels, diver intervention ships, amphibious assault vehicles and helicopters with surface combat capabilities.

launch of the “Submarine Against Surface and Underwater Threats” program and the acquisition of mine-hunting vessels, diver intervention ships, amphibious assault vehicles and helicopters with surface combat capabilities.

With regard to endowment and modernization, the Chief of the General Staff of the Naval Forces cited the non-starter of the major program to purchase multipurpose corvettes as the main reason for the failure of our country to meet the capability goals set with respect to – vis-à-vis NATO.

“In the year 2022, the efforts of the structures of the Romanian naval forces were focused on the implementation of the permanent combat service, the surveillance of the maritime and river space in our area of responsibility, as well as the combat operation against sea mines, which we launched from Ukraine after the outbreak of the war,” Vice Admiral Mihai Panait said at the beginning of his presentation.

And the French?

President Macron called Romania’s new wishes an “ambitious plan” and so they are likely to be more elaborate or advanced than the Gowind corvette from Naval Group previously chosen by the Romanians.

France also wants to serve Romania in its plans to have new submarines. In 2018, Romania still decided not to purchase Type 214 submarines from the German tkMS due to lack of funds. Now, however, the defense budget is being increased to 2.5 percent of GDP and more seems possible. The new submarines could be built by Naval Group.

France’s new defense minister Sébastien Lecornu (left) signs the letter of intent with his Romanian counterpart Vasile Dincu. (Photo: French Defense)

The thought then arises that a donkey does not stumble twice on the same stone, because if the French Naval first failed to fulfill its obligations, doubts will arise about the implementation of the new orders. After all, one still has the same counterpart in Constanta who cannot execute such a project. The Romanian government will probably opt for a public tender because the French experts they consulted Hugo Decis(International Institute for Strategic Studies) and Xavier Vavasseur(former French diplomat) turned out to be affiliated with the French Naval.

if the French Naval first failed to fulfill its obligations, doubts will arise about the implementation of the new orders. After all, one still has the same counterpart in Constanta who cannot execute such a project. The Romanian government will probably opt for a public tender because the French experts they consulted Hugo Decis(International Institute for Strategic Studies) and Xavier Vavasseur(former French diplomat) turned out to be affiliated with the French Naval.

Damen Shipyards received the Romanian Business Award in 2014 from the Dutch Romanian Network

Damen Shipyards Mangalia builds two structures for offshore platforms that will reach an offshore wind farm near New York

Romania’s Damen Mangalia Shipyard (DSMa), the group’s largest unit, announced that it is currently working on two HVDC (High-Voltage Direct Current) offshore transmission projects, two superstructures intended for offshore platforms.

Offshore structures under construction at Damen Mangalia Photo: Damen Shipyards

The two superstructures are being built under contracts with Aker Solutions and work began last year(2022) and with the start of assembly and equipment, the first project will be completed in the first half of 2023 and the second in the first quarter of 2024.

Upon completion, the HVDC platforms will depart for Aker Solutions’ site in Stord, Norway, where the HVDC equipment will be installed and commissioned before being delivered to their final destination, Damen announced.

Upon completion, the HVDC platforms will depart for Aker Solutions’ site in Stord, Norway, where the HVDC equipment will be installed and commissioned before being delivered to their final destination, Damen announced.

The HVDC platforms will then be shipped to the Sunrise Offshore Wind Farm , about 30 miles east of Montauk Point in Long Island, New York.

This shows that Damen Shipyards is a versatile company.Damen announces that within these projects it deals with structural construction, surface protection, equipment, insulation, lighting, piping, local wiring and others, as well as the construction of transportation networks.

Sector Logistics and Transport

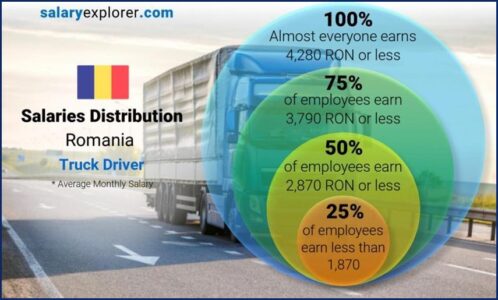

How much do Romanian transport and distribution workers earn?

More than 2,600 jobs in transportation and distribution have been posted by employers since the beginning of the year and to date. This is one of the sectors that recruits massively, but also attracts a large number of applications each month. Most are aimed at novice and inexperienced candidates, followed by mid-level candidates (those with between two and five years of experience in the field).

At the beginning of the year, seniors and managers are much less in demand. “This is happening because we are talking about a field with high staff turnover in these segments – entry-level and mid-level. In addition, the business volumes of employers in the sector have grown substantially over the past two years, so the need for natural expansion

g of the teams came from here. For couriers alone, one of the most sought-after candidate profiles in transportation and distribution, for example, we currently have more than 700 job openings on the platform,” said Roxana Drăghici, Head of Sales within eJobs .

g of the teams came from here. For couriers alone, one of the most sought-after candidate profiles in transportation and distribution, for example, we currently have more than 700 job openings on the platform,” said Roxana Drăghici, Head of Sales within eJobs .

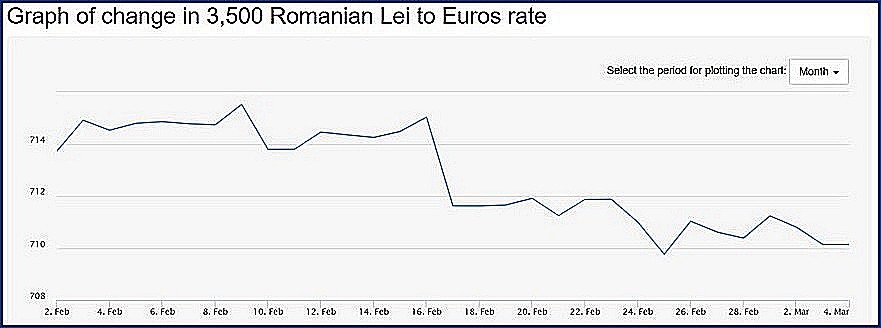

The average salary of those working in transportation and distribution is 3,500 lei (€710) per month. A promoter earns 2,800 lei(€ 568), while the average for an auto-dispatcher reaches 4,000 lei (€ 811 ).

Drivers have an average salary of 2,700 lei(€548), but this ceiling applies only to those whose work does not involve traveling to other cities or abroad.

As for drivers, the salary range is very wide and depends on the schedule, the time the vehicle is driven and, of course, the distances they have to cover.

For example, a truck driver’s salary rises to an average of nearly 3,800 lei (€771)per month, and that of a truck driver on international routes can exceed 14,000 lei(€2,840).

For example, a truck driver’s salary rises to an average of nearly 3,800 lei (€771)per month, and that of a truck driver on international routes can exceed 14,000 lei(€2,840).

Although the salary average in this area is 3,500 lei (€710) and more than half of the open positions are aimed at entry-level candidates, the salaries offered for specialist or manager positions may be higher than the overall market average for similar positions. Thus salaries of 20,000 lei(€4058) were introduced for the position of economic director, 18,000 lei( €3652) for Chief Technological Officer, 16,000 lei(€3246) for project manager or 13,000 lei(€2637) for an administrative director.

In the past month, 61,000 applications for jobs in transportation & distribution were recorded. 90% of applications are for jobs in the country and 5.3% for jobs abroad.

For entry-level jobs, the salary difference between Romania and Western European countries can be 1 to 5. 4.7% of job applications involve remote jobs.

The lowest average net salaries introduced so far by workers in transportation and distribution are for: Computer operator – 2,300 lei(€ 467) Courier – 2,500 lei(€ 507) Warehouse manager – 2,700 lei(€507) Technician – 2,700 lei(€ 547) Junior accountant – 2,800 lei(€ 568)

The cities with the lowest average net wages in transportation & distribution are: Galatia: 1,800 lei(€ 365) Vaslui: 2,300 lei( € 467) Buzau: 2,500 lei( € 507) Brăila: 2,500 lei(€ 507) The cities with the highest average net wages in transport & distribution are: Bucharest: 4,000 lei(€ 812) Cluj – Napoca: 3,800 lei(€ 771) Timișoara: 3,500 lei(€ 710) Sibiu: 3,300 lei(€ 670) Arad: 3,000 lei(€ 609)

Movement of Lei to Euro conversion rate until March 4, 2023)

The positions for which the highest salary values were recorded in this field: Economic director: average net salary at national level – 6,500 lei( 1319), maximum salary – 20,000 lei( € 4058) Project manager: average net salary at national level – 6,000 lei( € 1217), maximum salary – 16,000 lei(€ 3246) Transport director: average net salary at national level – 6.000 lei(€ 1217), maximum salary – 15,000 lei(€ 3043) Transportation planner: average net salary at national level – 4,000 lei(€ 812), maximum salary – 13,000 LEI(€ 2638) Recruitment specialist: average net salary at national level – 3,500 lei(€ 710), maximum salary – 12,000 lei(€ 2435)

Romania transport sector projections in 2023

The market continues to grow and Romania is becoming an important point on the map of international transportation

DSV Road, the third-largest freight transportation company in Romania and Europe, estimates that the freight transportation market in Romania will continue to grow in 2023, but not at last year’s levels, Romania will become an important point on the map of international transportation , and transportation services that help companies reduce their costs will be most in demand throughout the year, these are the main predictions of the transportation market in 2023, according to an analysis by the company.

DSV Road, the third-largest freight transportation company in Romania and Europe, estimates that the freight transportation market in Romania will continue to grow in 2023, but not at last year’s levels, Romania will become an important point on the map of international transportation , and transportation services that help companies reduce their costs will be most in demand throughout the year, these are the main predictions of the transportation market in 2023, according to an analysis by the company.

“The evolution of the market in Romania is closely linked to the situation at the macro level, to what is happening in the other markets, the regional context. We always follow the external factors and, looking at the year 2023, we mainly expect a consolidation of the important progress we made last year, after the pandemic period. Although the effects of inflation are being felt, we see the growth potential of transport services, especially groupage and intermodal services, and the resettlement of some transport routes, after the war, will provide new increases,” said Sergiu Iordache, Managing Director DSV Road.

Transport market continues to grow

DSV Road forecasts that the transportation market in Romania will continue to grow this year, but will not exceed 2022 levels. To be more precise, in 2023 the growth rate of this industry will slow down due to lower consumption, due to inflation growth.

In fact, the transportation sector in Romania is one of the most stable branches of the economy, with continuous growth even in times of crisis.

In this context, DSV Road estimates a 10% growth of its business, which will lead to a consolidation of the accelerated advance from 2022, when it recorded a turnover of 70 million euros, 40% higher than the previous year.

Romania becomes increasingly important on the international transport map

Romania is becoming an increasingly interesting destination on the international freight transport map, which is also expected to grow in 2023, although the evolution will be lower than last year, when activity returned strongly after the pandemic.

From the point of view of goods transport, Romania has gained importance at the international level for several reasons, including the war in Ukraine, which shifted part of the traffic to our country, the infrastructure projects for the development of highways and railroads and the projects made with European money that have contributed to the development of companies in Romania.

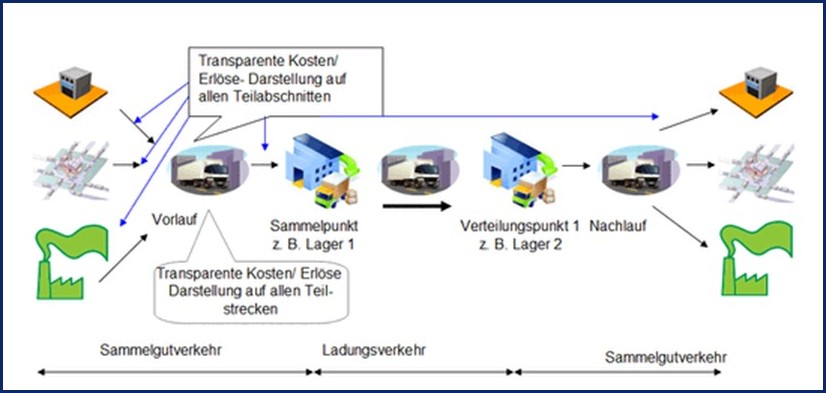

Groupage transport remains the most widely used form of transport

Groupage transportation, where a single truck can be loaded with the goods of multiple companies, remains the most requested mode of transportation at the market level, especially for imports, but increasingly for exports due to its advantages. Among these, there is the ability to transport any weight between 10 kg and 2,500 kg without the obligation to load a full truck, optimizing costs for companies by up to 80%, and the speed of transport to different recipients.

The growth of groupage transportation is increasingly supported by the development of e-commerce and online services and minimizing inventories.

Within DSV Road, groupage transport is the most requested service, accounting for 60% of the company’s revenue. By 2022, the demand for groupage within the transportation company has increased by 40%.

Intermodal transportation growing rapidly

Intermodal transport, which is the combination of two modes of transport (e.g. rail and road), is becoming increasingly important in the Romanian transport market due to lower costs and positive effects on the environment, an increasingly important concern for companies.At DSV Road, intermodal transport ranks second on the list of the most requested services, with an increase in demand for this type of transport estimated at a minimum of 20% by 2023.

Green transport solutions gaining speed in Romania

Affiliation with EU standards and European directives has led to an increase in companies’ interest in reducing CO2 and thus implementing Green Transport solutions.

Although it is still in its infancy in Romania, the sustainability part is gaining ground, especially in the context where ESG strategy has become an essential part of companies’ business strategy.

Although it is still in its infancy in Romania, the sustainability part is gaining ground, especially in the context where ESG strategy has become an essential part of companies’ business strategy.

For example, DSV Road developed the CO2 Reporting Tool solution, a system for monitoring the impact of the carbon footprint on the environment due to the use of fuel in road freight transport, leading to a reduction in real time the amount of CO2 emissions per batch of goods transported and standard per truck.

Also, the DSV Group, which includes DSV Road, recently launched its most ambitious sustainability program to reduce its carbon footprint. the next five years.

Through this special program, DSV Road of Romania is joining the race of initiatives to protect the environment, accelerating the growth of the Green Transport Division with new projects to reduce carbon emissions.

“We are placing increasing importance on green services and by using our technology to monitor the amount of carbon emissions removed from the air, companies can see the impact on the environment. It is also in line with DSV Road’s mission to reduce carbon emissions by up to 40% by 2030,” explained Sergiu Iordache, Managing Director DSV Road.

Export activity, increasingly intense

Another important trend is the increase in export activity, with progress recorded in both traditional export categories and new ones. The diversification of the local economy grew more and more, and Romania climbed on the international charts analyzing the level of complexity of the world’s economies, as the 19th most complex and advanced country out of 133 countries in the world, after a lead of 20 places in just a few years, according to an analysis by Harvard University.

Digitalization is increasingly visible in the transportation sector

Last but not least, the logistics and transportation market in Romania will experience an ongoing transformation, in a context where digitalization is redefining the way operations and services are viewed in this sector. Solutions such as tracking freight directly to the customer, such as DSV Road’s ETA app, will be especially useful as the current environment will continue to see the problem of increasing wait times at the border.

DSV Road expects that this year’s trends in the sector will lead to positive dynamics and strengthen the position of the Romanian market, one of the most important markets in the region.

Source: DSV Road

Historical record of Romanian grain transport through the port of Constanta

Cargo traffic through the Port of Constanta experienced an increase of about 10% in the first 11 months of 2022 compared to 2021, which was also a record year, Agrointeligența said.

The port of Constanta played a strategic role for the transit of goods to and from this country in 2022, after the outbreak of war in Ukraine, so government agencies and private companies have invested massively in the Romanian port, adevarul.ro reported.

The port of Constanta played a strategic role for the transit of goods to and from this country in 2022, after the outbreak of war in Ukraine, so government agencies and private companies have invested massively in the Romanian port, adevarul.ro reported.

According to estimated data from the National Company for the Administration of Sea Ports SA (CN APM), cargo throughput in the first 11 months of 2022 was 69.7 million tons, up about 10% from 2021, a record year. ‘Based on the results so far, 2022 represents a year with a new historical traffic record for the Port of Constanta,’ said Florin Vizan, general manager of CN APM.

Cereals were the main goods transported by the Port of Constanta According to the data, cereals represent the freight group with the largest share in total transport, more than 30%, with the Port of Constanta consolidating its position for this type of cargo. Quantitatively, grain throughput in the first 11 months was 22.4 million tons. The main countries to which grain shipments were directed were Egypt, Jordan, the Philippines, Saudi Arabia, Spain, Turkey, Israel, Sudan and Tunisia.

According to CN APM, the structure of cargo traffic through Romanian seaports shows that grains rank first, followed by crude oil, miscellaneous items, petroleum products, iron ore and fertilizer. Of the total traffic of nearly 70 million tons of goods, imports represent more than 23 million tons, exports more than 22 million tons, transit – 20.5 million tons, cabotage about 4 million tons.

The main importing countries are Turkey, Brazil, Greece, Georgia, Ukraine and Italy. In terms of exports, the top countries are: Egypt, Spain, Turkey, Jordan, Iran, the Netherlands, Algeria, USA and Morocco. Port of Constanta now has a strategic role Vizan added that the Port of Constanta plays a strategic role in the current context.

‘In the current context, the Port of Constanta’s strategic role as a regional cargo hub has become more prominent than ever and has become an important, essential route for cargo traffic in the area. The Port of Constanta has become a vital maritime hub connecting West and East Central Europe with Central Asia, the Far East and North Africa.

The port’s importance is also due to its strategic sea connections to the Danube, as well as rail and road connections,” Florin Vizan added. This year, the Romanian government and the port administration have invested hundreds of millions of euros to increase the port’s capacity, and private companies with port activities have also increased their investments. These include rehabilitation of the port’s rail and road infrastructure, as well as projects to modernize electricity distribution infrastructure and public services. At the same time, in the field of private investment, a RORO and cargo terminal is being set up at the Port of Constanta, a €75 million project implemented by DP World.

Source: agrointel.ro

IT Sector

Investcorp steps into Romanian-Dutch NetRom Software

NetRom Software kri

NetRom Software kri jgt a new majority shareholder. Investment house Investcorp Technology Partners, belonging to the Bahrain-based group of the same name, is stepping into the software company, which has nearly five hundred employees with offices in Utrecht, Arnhem and the Romanian cities of Craiova and Timisoara.

jgt a new majority shareholder. Investment house Investcorp Technology Partners, belonging to the Bahrain-based group of the same name, is stepping into the software company, which has nearly five hundred employees with offices in Utrecht, Arnhem and the Romanian cities of Craiova and Timisoara.

With an undisclosed capital injection, Investcorp joins the incumbent shareholders. Those are founder and ceo Han in ‘t Veld, other members of the management team and Amsterdam-based investor IceLake, which came on board in 2019 after acquiring shares from informal investors. The parties provide no further financial information about their transaction.

According to the latest available annual report, that of 2021, NetRom Software achieved net sales of €21.5 mln, on which the company made an after-tax profit of nearly €3 mln. NetRom Software moved its headquarters from Breda to larger premises in Utrecht’s Papendorp business park in the same year. Customers include cable and telecom company VodafoneZiggo, car leasing company LeasePlan and public transport company Transdev.

‘Key player’

With Investcorp as its main capital provider, NetRom Software plans to continue to grow and enter new geographic markets. In a press statement, founder In ‘t Veld called the entry of the investment house an essential step in becoming a “major player” in his industry.

With Investcorp as its main capital provider, NetRom Software plans to continue to grow and enter new geographic markets. In a press statement, founder In ‘t Veld called the entry of the investment house an essential step in becoming a “major player” in his industry.

The Bahrain-based investor was in the news last year as a possible buyer of AC Milan. Founded in 1982, Investcorp invests in numerous industries, but in the past garnered particular notoriety for its involvement with luxury brands such as Gucci and Tiffany.

Sources: NetRom, Financieel Dagblad and Profit

Han in ‘t Veld is a board member of the Dutch Romanian Network and NetRom was awarded the Romanian Business Award in 2015

Blog: Post Craiova: Schiphol or Schiphel?

Twice a week I can be found at Schiphol Airport. Nowadays also known as “Schiphel. Despite the recent negative coverage, I feel I should make a stand for the airport. Everything is subjective, but for decades Schiphol was for me an oasis of efficiency and luxury. One of the airports that was always to be found in the lists of best airports in the world. Invariably in the top three in Europe and the top ten worldwide.

Now many people seem to be eager to burn down the airport completely. I think that’s too easy. It is a bit panting and perhaps unfair to judge companies – or people – solely or primarily by their latest performance.

Now many people seem to be eager to burn down the airport completely. I think that’s too easy. It is a bit panting and perhaps unfair to judge companies – or people – solely or primarily by their latest performance.

Indeed, in the vast majority of cases, this is completely unjustified.

In the case of Schiphol, you thereby wipe out 150 years of aviation history in one fell swoop, based on the special circumstances, the hype, of today.

To really judge something, you need to know the context. The circumstances in which choices are made and work must be done.

In the system in which we all work, speed and efficiency must be achieved at the lowest possible cost. That’s just the world we live in.

Squeezing out outside suppliers – for Schiphol’s baggage handling operations, there are no fewer than eight – is best practice for virtually every industry.

In the process, Schiphol experienced an unprecedented corona crisis, with millions less travelers than normal. Not a situation where you generously and pre-emptively pull out the purse strings to improve working conditions of your employees.

One of the plausible reasons for the current staff shortages is the side effect of the “flash economy” in which groceries, meals and packages are delivered instantaneously.

That new delivery industry works like a magnet on the job market. The hospitality industry suffers as much as Schiphol.

Can you blame Schiphol for not seeing this turnaround in the labor market coming?

Perhaps they – like virtually all airports in our neighboring countries – did not adequately anticipate the long-term effects of their policies. You cannot expect loyalty from people who are paid minimally for hard work. Certainly not with new competitive employment.

Whether you are critical of personnel policies at Schiphol, or of air traffic in general in relation to climate change: from our comfortable and easily accessible position in the center of Europe, it’s all easy shouting. More on the periphery of Europe, the opening up of cities and regions by regional airports really gives a tremendous economic boost. My personal long-term assessment of Schiphol remains largely unchanged for the time being, partly because of this.

Aviation Sector

HiSky, the airline founded by two Moldovan entrepreneurs, tripled its number of passengers by 2022

The HiSky airline had over 900,000 passengers in the 2021-2022 period and in the first two months of 2023, with a 300% increase in 2022 over the previous year.

The airline says it estimates a doubling of passengers for the year 2023, to 1.3 million. The company, founded by two entrepreneurs from the Republic of Moldova, celebrated the first two years of operating scheduled and charter flights for the market in Romania and the Republic of Moldova on Sunday, March 5.

“More than 900,000 passengers traveled with HiSky in the 2021-2022 period and in the first two months of 2023, with a reported increase for 2022 of 300% over the values recorded in the previous year. At the end of 2021, in the context of global passenger air traffic being more than 50% lower than in the pre-pandemic period, the airline reported 200,000 passengers carried,” the statement said.

In the first two years of activity, with the five aircraft in the fleet, HiSky conducted more than 8,600 flights, accounting for an estimated 19,000 hours and more than 8.6 million miles. The aircraft, which are part of the Airbus A320 family, namely one A319-100 aircraft and four A320-200 aircraft, have an average age of less than seven years and are distributed across the company’s three operational bases in Bucharest , Cluj-Napoca and Chisinau.

The airline’s portfolio includes both domestic destinations (Bucharest – Cluj-Napoca and Bucharest – Timisoara) and 14 international routes, departing from Romania and the Republic of Moldova, from the airports of Bucharest, Cluj, Iasi, Baia Mare and Chisinau.

In terms of performance indicators, despite the acute ground staff crisis that caused problems at most airports, 8% of flights operated by HiSky were delayed, with an average wait time of less than 50 minutes.

Source photo: HiSky

Wizz Air suspends all flights to and from Chisinau as of March 14

“Wizz Air has been closely monitoring the security situation in Moldova and has been in constant contact with various local and international authorities and agencies to ensure the highest level of safety and security of operations. The safety of passengers and crew remains Wizz Air’s first priority, and due to the recent developments in Moldova and the high, but not imminent, risk in the country’s airspace, Wizz Air has taken the difficult but responsible decision to suspend all flights to Moldova. Chisinau as of March 14,” according to a Wizz Air press release.

“Wizz Air has been closely monitoring the security situation in Moldova and has been in constant contact with various local and international authorities and agencies to ensure the highest level of safety and security of operations. The safety of passengers and crew remains Wizz Air’s first priority, and due to the recent developments in Moldova and the high, but not imminent, risk in the country’s airspace, Wizz Air has taken the difficult but responsible decision to suspend all flights to Moldova. Chisinau as of March 14,” according to a Wizz Air press release.

According to the quoted source, Wizz Air will offer additional flights from Iasi after March 14, which could help Moldovan citizens. This is a new route from Iasi to Berlin and increases the frequency of flights to Barcelona, Milan Bergamo, Bologna, Rome Ciampino, Rome Fiumicino, Dortmund, Larnaca, London Luton and Treviso from Iasi, the closest destination in the Wizz Air network.

Routes from Chisinau to Budapest and Prague are suspended with no immediate alternative to replace them. The remaining capacity currently used with the Chisinau destination will be moved to other destinations in the Wizz Air network.

Affected customers who booked tickets directly through wizzair.com or the airline’s mobile app will be notified by email and can choose to book another ticket free of charge, for a 120% refund of the original fare paid as credit for future bookings or a 100% refund of the ticket price, the company said.

Wizz Air says it will continue to assess the situation on an ongoing basis.

On Feb. 14, the Republic of Moldova temporarily closed its airspace Tuesday after Romanian authorities informed Chisinau that “a small unidentified object similar to a weather balloon” had been detected. According to the Civil Aviation Authority, flights were suspended for more than three hours.

The move comes in the context in which both Ukrainian President Volodymyr Zelensky and Maia Sandu warned that there was a plan by Russian secret services to destroy the Republic of Moldova.

The President of the Republic of Moldova, Maia Sandu, recently announced that Moscow has a plan to undermine the country, “with the involvement of subversives with military training, camouflaged in civilian clothes, who will undertake violent actions, attacks on some state buildings and hostage taking.”

A new low-cost airline enters the Romanian market, in a race abandoned by Blue Air

From then the ticket gets more expensive Norwegian low-cost carrier Norwegian, which is preparing to operate regular commercial flights to and from Romania from June this year, has decided to increase ticket prices by about 20%, including from summer.

The operator will launch the first route on June 23 between the capitals of Norway and Romania. This route was operated by Blue Air until September 2022, and now only Wizz Air operates flights to Sandefjord Torp airport, 120 kilometers from Norway’s capital.

Statistics office confirms recovery of air traffic in Romania by 2022

Air passenger traffic increased 87.6% year-on-year in Romania by 2022, from 11.17 million to more than 20.97 million passengers, according to data from the National Institute of Statistics (INS)

Air passenger traffic increased 87.6% year-on-year in Romania by 2022, from 11.17 million to more than 20.97 million passengers, according to data from the National Institute of Statistics (INS)

With about 6.33 million passengers boarding and about 6.25 million disembarking, Henri Coanda Airport in Bucharest ranked first in passenger traffic last year. Next were the Avram Iancu Airport in Cluj-Napoca and the international airport in Iasi.

The main airports of origin were London Luton – 868,364 passengers, Milan Bergamo – 496,551, Vienna – 299,126 passengers, Munich – 292,591, Madrid Barajas – 284,023 and Istanbul International – 273,928.

Meanwhile, the most passengers on regular flights boarded for London Luton – 857,602 passengers, Milan Bergamo – 505,191, Vienna – 317,634 and Munich – 313,603.

Energy Sector

Dutch investor Photon Energy launches 5.7 MWp PV farm in Romania

The Dutch at Photon Energy have connected the first Romanian photovoltaic installation to the grid, in the municipality of Şiria, which will provide approximately 8.7 GWh of renewable energy annually to the grid managed by Enel E-Distribuţie Banat

Photon Energy Engineering, a subsidiary of the Dutch Photon Energy group dedicated to engineering, procurement and construction services, has completed and connected to the grid its first Romanian photovoltaic installation in the municipality of Şiria, with a capacity of 5.7 MWp.

The panels will provide about 8.7 GWh of renewable energy annually to the grid managed by Enel E-Distribuţie Banat.

The company expects the plant to generate revenues of 1.4 million euros over the next 12 months based on current projected base-load electricity prices in Romania.

“We are very pleased with the commissioning of our first power plant in Romania, one of our key markets in CEE, which supports the growth of a recurring revenue stream from clean electricity generation,” said Georg Hotar, CEO of Photon Energy Group.

“We are very pleased with the commissioning of our first power plant in Romania, one of our key markets in CEE, which supports the growth of a recurring revenue stream from clean electricity generation,” said Georg Hotar, CEO of Photon Energy Group.

The power plant, located near Şiria, in Arad province, covers 9.3 hectares of land and is equipped with about 10,600 solar panels. The plant is owned and operated by Siria Solar SRL, a special company wholly owned by Photon Energy Group.

Photon Energy’s portfolio includes 89 solar plants with a combined generating capacity of 97.6 MWp. Currently, with a total capacity of over 80 MWp, clean electricity is sold directly on the energy market without subsidies.

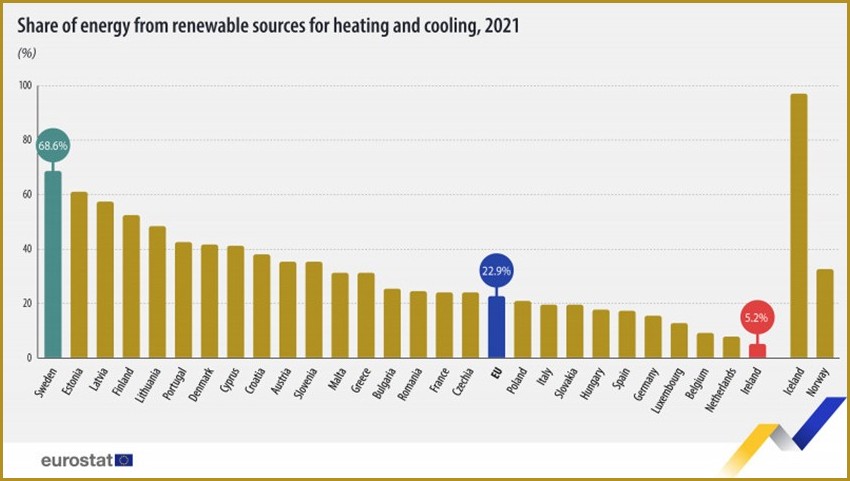

Renewable energy consumption by country

Among EU member states, Sweden ranks first in 2021, with more than two-thirds (68.6%) of the energy used for heating and cooling coming from renewable sources (mainly heat pumps and biomass).

Sweden is followed by Estonia (61.3%), Latvia (57.4%), Finland (52.6%), Lithuania (48.6%), Portugal (42.6%), Denmark (41.5%), Cyprus (41.3%), Croatia (38%) ), Austria (35.4%), Slovenia (35.2%), Malta (31.1%), Greece (31.1%), Bulgaria (25.6%) and Roemenië (24.48%), above the EU average of 22.9%.

On the other hand, the lowest share of renewable sources for heating and cooling was in Ireland (5.2%), the Netherlands (7.7%) and Belgium (9.2%).

All EU member states reported increases between 2004 and 2021. The largest gains were in Cyprus (32.1 percentage points), Malta (30.3 percentage points), Estonia (28 percentage points) and Sweden (22.7 percentage points). Smaller increases were in Ireland (2.3 pp), Belgium (6.3 pp) and the Netherlands (5.5 pp).

Romania becomes Ukraine’s main fuel supplier

Ukraine imported a record amount of gasoline in January to avoid a possible fuel shortage after the EU embargo on supplies of petroleum products from Russia took effect. A third of the fuel came from Romania, by far Kiev’s new main supplier.

OMV Petrom and Rompetrol were responsible for 40% of gasoline exported to Ukraine by Romanian companies in January.

Ukraine imported a total of 202,600 tons of gasoline in the same month, a record level in recent years, a third of which came from Romania, according to the Ukrainian press quoted by Profit.ro . Romanian companies shipped no less than 63,400 tons of gasoline to Ukraine, an amount equal to half of the gasoline exported to the neighboring state in the first 9 months of last year, 130,000 tons, according to data from the National Institute of Statistics (INS).

The 63,400 tons of gasoline supplied to Ukraine is only 10,000 tons less than the average monthly consumption of gasoline by cars in Romania.

More than 40% of Romanian gasoline deliveries to Ukraine in January were said to come from Petrobrazi, an OMV Petrom refinery, and Petromidia, a Rompetrol refinery. By comparison, Ukraine’s other major gasoline suppliers, namely Poland, Lithuania and Greece, together exported 81,600 tons of gasoline to Ukraine.

Ukrainian companies wanted to stockpile fuel in January ahead of the introduction of the EU embargo on fuel imports from Russia, which came into effect Feb. 5. Several parts of Ukraine have also experienced power outages due to Russian attacks and bombings, leading some to resort to generators, which need fuel.

The spectacular increase in fuel exports from Romania to Ukraine can also be explained by the fact that the latter no longer imports significant volumes from Bulgaria, due to tensions between the authorities in Sofia and Russian giant Lukoil.

Financial-Economic and Fiscal Sector

Mazars research on mergers and acquisitions in Central and Eastern Europe available

The beginning of 2022 ushered in a turbulent year for both the European and global markets when Russia invaded Ukraine on Feb. 24. Trends already in play in 2021, rising inflation and higher borrowing costs, were greatly amplified. The war caused supply shocks, especially in the wholesale gas market.

Meanwhile, the imposition of economic sanctions against Russia has further complicated the dealmaking landscape. Against this backdrop, supply chain bottlenecks and labor shortages, a legacy of the pandemic, continued to dampen growth. The terms of the deal could hardly have been more challenging. But as our report shows, the impact on M&A activity in the CEE region was far less pronounced than many initially feared. In fact – and with the exception of 2021, a somewhat abnormal record year for mergers and acquisitions – deal volumes and total deal value in 2022 both reached new highs in CEE. The top four countries for the volume of mergers and acquisitions in CEE in 2022 were Poland (with 235 deals), Austria (120), the Czech Republic (81) and Romania (76).

Meanwhile, the imposition of economic sanctions against Russia has further complicated the dealmaking landscape. Against this backdrop, supply chain bottlenecks and labor shortages, a legacy of the pandemic, continued to dampen growth. The terms of the deal could hardly have been more challenging. But as our report shows, the impact on M&A activity in the CEE region was far less pronounced than many initially feared. In fact – and with the exception of 2021, a somewhat abnormal record year for mergers and acquisitions – deal volumes and total deal value in 2022 both reached new highs in CEE. The top four countries for the volume of mergers and acquisitions in CEE in 2022 were Poland (with 235 deals), Austria (120), the Czech Republic (81) and Romania (76).

In terms of total deal value, Poland and Austria also took the top two spots, followed by Hungary and then Croatia. New reporting requirements for digital platform operators DAC7 has been transposed into national legislation, with Romania being one of the first states in the EU to transpose the DAC7 regulations, along with Austria, Denmark, France, Hungary, Croatia and Belgium. The new European Directive DAC7 is being implemented in the Netherlands with the Act Implementing the EU Data Exchange Directive Digital Platform Economy.

To download the study, please visit https://www.mazars.ro

ING considers Romania’s year-end inflation 7.4%, interest rate cuts not entirely impossible

Overall inflation in Romania will reach 7.4% with downside risks, and the policy rate will remain at 7%, although a certain rate cut is not completely ruled out, said Valentin Tataru, chief economist of ING Bank Romania.

Overall inflation in Romania will reach 7.4% with downside risks, and the policy rate will remain at 7%, although a certain rate cut is not completely ruled out, said Valentin Tataru, chief economist of ING Bank Romania.

Base effects, energy price caps and the stabilization of international energy and food prices are pushing down inflation rates, while upside forces include cost increases that have not yet been fully reflected in consumer prices, wage pressures and still negative real rates, he explained.

As for interbank market rates, which are important for private loan interest rates, Tataru believes that “a minimum has been reached,” but that prices will not necessarily bottom out.

“We expect stability around current levels. The liquidity situation is likely to remain accommodative, although the surplus could fall to more manageable levels. Should the inflation trajectory surprise (even if only slightly) downward, we do not rule out a modest rate cut in late 2023,” he said.

Henk Paardekooper, CEO of First Bank: We don’t have an economic crisis. Romania’s economy has much better numbers than we expected. It is one of the best performances in Europe

Romania’s economy is performing better than expected, said Henk Paardekooper, CEO of First Bank. Although there is a perception of an economic crisis, Romania and Europe are not going into recession, he said.

Romania’s economy is performing better than expected, said Henk Paardekooper, CEO of First Bank. Although there is a perception of an economic crisis, Romania and Europe are not going into recession, he said.

“I don’t think the times today are more uncertain than usual. We went through a pandemic, then we experienced the economic consequences of that pandemic, and then the crisis in Ukraine. People tend to think that we are going through a crisis from an economic perspective, but we are not facing a crisis. We have PNRR, created in response to the pandemic, but the economy of Romania and Europe has proven to be much more resilient.”

The European Commission believes that the Romanian economy will grow by 2.5% in 2023, a forecast that has been revised upward, compared to the expected economic growth of +1.8% in 2023. The National Institute of Statistics (INS) announced a real increase of 4.8% in Romania’s GDP.

The good part that remained after the pandemic is this resilience plan. The war raised inflation and energy prices, but now we see that the economy of Romania and Europe is much more resilient. Six months ago everyone was talking about a recession and how big it would be, but we are not facing a recession. Yesterday, the European Commission and the European Union updated their GDP growth forecast for Europe and Romania, and we will not face a recession. Romania has better numbers than we expected. It is one of the best performing in Europe.

Romania leads Eastern Europe in economic growth. In Hungary and Poland, inflation and rising credit prices have done great damage to the economy. In Budapest, the press draws attention to the fact that the gross monthly wage in the economy is lower than that in Romania, 578 euros, compared to 600 euros

In Hungary, the press draws attention to the fact that Hungary stands alone behind Bulgaria, considered the poorest economy in the EU. While Romania has the highest average wage growth in the EU, over 14% per year, in the January 2013-2023 period, the indicator for Hungary is below 6%.

The European Union economy was saved from recession in part by warmer-than-normal weather. Among Eastern European countries, Romania did best in last year’s fourth quarter, which was heralded as the most difficult of all. They helped consumption and investment in assets such as machinery and infrastructure.

The modest 1% increase in GDP from the previous quarter is huge compared to the results of peers in the region and even of the more eastern eurozone economies. Poland avoided recession thanks to the contribution to consumption by the millions of Ukrainian refugees it received.

Bulgaria stood out for its return of exports. In Hungary, on the other hand, fears have been realized that the country is falling behind in living standards and wages, while prices are skyrocketing. The economy ended 2022 in recession, with prices for some Hungarian products higher than in the West and with only the gross minimum wage higher than that of Bulgaria. Investment and consumption have slowed, and severe drought has hit agricultural production.

Even the Czech Republic, the most mature economy in the region, did not escape the recession, as consumption slowed, due in part to the sharp rise in energy bills, the price paid to reduce dependence on Russian natural gas.

The European Commission’s recently released winter economic forecast shows that Romania’s economy grew 1% in the last three months of last year compared to the previous quarter, while Hungary’s GDP fell 0.3%. The Czech economy declined at the same rate. Bulgaria rose 0.7%. The EC did not have data for Poland. But the 1% increase in the third quarter shows that Poland’s economy, the largest in Eastern Europe, has avoided recession for now (two consecutive quarters of GDP decline), although there were signs of an impending recession last year. What’s next? Although the economic uncertainties created by Russia’s war on Ukraine, China’s policy to stop the Covid-19 pandemic, deficits and drought make models for long-term projections obsolete,

Supply chains are reset, economies and companies are rebalancing, and forecasting institutions have had time to recalibrate their algorithms. European Commission estimates show a dramatic slowdown in economic growth in Eastern Europe and across the Union in the first three months of this year, followed by a modest acceleration.

The GDP of Romania, Hungary and Bulgaria will grow 0.2% in the first quarter. Czech Republic will stagnate, which would represent an improvement over developments in previous quarters. In the rest of the EU, Germany is expected to enter a mild recession, with a maximum depth of minus 0.2%. Of the major economies, only Austria will suffer the same fate. Italy will stop falling somewhere on the edge of recession, Spain will slow to marginal growth and Francewill stagnate.

Regarding Romania, the European Commission noted that the economy grew in the first three quarters of last year, driven by fixed investment and private consumption against the backdrop of a strong labor market and wage increases. Government measures to soften the impact of higher energy prices also helped.

These results show that Hungary is only behind Bulgaria (with a minimum wage of less than 400 euros), which is considered the poorest economy in the EU. While Romania has the highest average salary growth in the EU, over 14% per year, the indicator for Hungary is below 6%. The continued devaluation of the forint plays a leading role in this weak evolution, writes the Budapest Business Journal.

A survey by the insurance company Aegon also showed that the majority of Hungarians believe that their standard of living has deteriorated in the past six months, and the main reason is the rise in food prices. A huge contributor to the rise in food prices is the depreciation of the forint, which makes imports more expensive. EC data says Hungary’ s GDP shrank 0.4% quarter-on-quarter in the third quarter of last year as the positive effects of previous fiscal stimulus faded and problems in agriculture caused by a severe drought. Investment and consumption slowed, while the resettlement of supply chains led to a rebound in exports. In the last quarter of last year, EC estimates show a decline in GDP caused by the erosion of demand due to expensive energy. Poland, instead, continued on a path of economic growth despite headwinds, aided by expansionary fiscal policies, a robust labor market and the large flow of refugees from Ukraine. However, growth slowed significantly in the fourth quarter, partly due to high inflation and higher lending.

The number of newly established companies with foreign capital in Romania increased by 25.5% by 2022

The number of newly established companies with foreign capital in Romania increased by 25.5% in 2022 compared to 2021, to 7,368 units, according to data centralized by the National Trade Registry Office (ONRC)

The 7,368 new companies had issued capital totaling $45.567 million, 5% lower than that of the companies registered last year, of $47.941 million.

The 7,368 new companies had issued capital totaling $45.567 million, 5% lower than that of the companies registered last year, of $47.941 million.

As of December 2022, 495 companies with foreign participation in the share capital were registered.Depending on the areas of activity, in December most registrations were registered in wholesale and retail trade, auto and motor repair (25.05% of the total), liberal professions, administrative, scientific and technical activities (20.81%), transportation, storage and communication (19.6%).

At the end of December 2022, there were 244,215 companies with foreign equity participation in Romania. The value of issued capital was $67.647 billion.The largest number of companies with foreign participation was among investors from Italy and 51,794 (issued capital of $4.053 billion), respectively, but the highest value of share capital belongs to Dutch companies, $12.64 billion, respectively, in 5,873 companies.

Romania’s economy will grow faster than its stagnant neighbors

The International Monetary Fund (IMF) expects Romania’s economy to grow 3.1% this year, supported by European Union financing, currency stability and foreign investment, allowing the economy to surpass stagnant neighbors such as Poland and Hungary. Romania’s growth is based on European Union funding, currency stability and foreign investment, driven in part by reshoring from  Russia and Ukraine. According to Reuters, the country has quietly closed in on its competitors to become Eastern Europe’s second-largest economy after Poland. GDP per capita expressed as purchasing power was 74% of the EU average in 2021, up 21% since 2010. In 1990, Romania’s GDP per capita was $5,277.5, while in 2021 it was $35,869.6. according to the World Bank. Despite Romania’s history of corruption and political instability, its prospects are supported by EU membership and good relations with Brussels, Reuters said in its report. Romania has already taken more than €6 billion in grants and low-interest loans from the EU and is aiming for €10 billion a year. About €90 billion of EU funding is available until 2027. A few months earlier, the European Commission lifted a mechanism overseeing Romania’s

Russia and Ukraine. According to Reuters, the country has quietly closed in on its competitors to become Eastern Europe’s second-largest economy after Poland. GDP per capita expressed as purchasing power was 74% of the EU average in 2021, up 21% since 2010. In 1990, Romania’s GDP per capita was $5,277.5, while in 2021 it was $35,869.6. according to the World Bank. Despite Romania’s history of corruption and political instability, its prospects are supported by EU membership and good relations with Brussels, Reuters said in its report. Romania has already taken more than €6 billion in grants and low-interest loans from the EU and is aiming for €10 billion a year. About €90 billion of EU funding is available until 2027. A few months earlier, the European Commission lifted a mechanism overseeing Romania’s  justice system. Meanwhile, neighboring Hungary and Poland are engaged in a battle with the EU for funding. The stability of the leu (RON) is another factor, especially compared to the Hungarian forint, which reached several record lows last year. Higher salaries across the border have already led some Hungarians to take jobs in industrialized western Romania. The forint lost 8% against the leu last year. A 2022 Ernst&Young survey found that more than half of the 101 foreign companies planned to set up or expand operations in Romania, mainly in the areas of supply chains and logistics, ranking it fourth in Europe in terms of intention to invest. Reshoring from Russia and Ukraine helped increase foreign direct investment in Romania to 9.39 billion euros in January-October 2022, the highest figure in 10 months since Romania joined the EU. Although economic hurdles and regional differences remain, and while Romania was kept out of the Schengen area in a December vote, the Romanian economy appears to be booming.

justice system. Meanwhile, neighboring Hungary and Poland are engaged in a battle with the EU for funding. The stability of the leu (RON) is another factor, especially compared to the Hungarian forint, which reached several record lows last year. Higher salaries across the border have already led some Hungarians to take jobs in industrialized western Romania. The forint lost 8% against the leu last year. A 2022 Ernst&Young survey found that more than half of the 101 foreign companies planned to set up or expand operations in Romania, mainly in the areas of supply chains and logistics, ranking it fourth in Europe in terms of intention to invest. Reshoring from Russia and Ukraine helped increase foreign direct investment in Romania to 9.39 billion euros in January-October 2022, the highest figure in 10 months since Romania joined the EU. Although economic hurdles and regional differences remain, and while Romania was kept out of the Schengen area in a December vote, the Romanian economy appears to be booming.

Where is the recession?

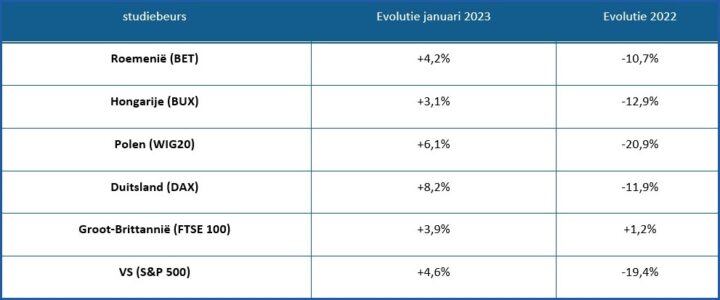

The IMF has changed its mind and is becoming more optimistic. Stock markets start the year with a bang

The first month of 2023 ended unexpectedly well for economies and financial markets, especially given the gloomy estimates of late last year, when the word “recession” was almost never missing from economists’ estimates. Thus, stock markets closed January with gains at stake, while International Monetary Fund (IMF) officials surprised by suddenly upgrading their global outlook and even announcing that recession will be avoided by most countries.