Newsletter March 2025

FROM THE NETWORK

Newsletter renewal

As Dutch Romanian Network we have thought it prudent to make some modest changes to the newsletter in the near future. This will take place in the coming editions and we thought it wise to inform you about this in advance.

As a first step, starting from this edition we will regularly report on the neighboring country Moldova, with which Romania is closely related. In addition, we will also start paying attention to the tourism sector and the topics of culture and history.

We hope you will find these changes to be an improvement but suggestions for further improvement are always welcome.

ING Romania, Fast Forward

For ING Romania, 2024 was a record year and the bank hopes to continue this upward trend in 2025. ING’s loan portfolio grew more than 14% in 2024 and the bank hopes to continue this trend in 2025. The banking system’s assets have grown 72% over the past 5 years.

Mihaela Bîtu, CEO ING Romania:

“Our calling is to innovate and use technology for the benefit of people, and we will continue to do so. In 2024, we managed to increase the bank’s loan portfolio by over 13% and we are pleased to have added almost 100,000 new customers. With this, we are approaching the milestone of 1.9 million customers, both individuals and legal entities. We hope to continue this positive development this year.”

ING’s CEO sees investment as another growth driver this year. Romania’s accession to the Schengen area could bring favorable economic effects in the coming years. Economists estimate these effects at about 1% of GDP. PNNR and European funds are likely to boost economic growth.

ING’s CEO sees investment as another growth driver this year. Romania’s accession to the Schengen area could bring favorable economic effects in the coming years. Economists estimate these effects at about 1% of GDP. PNNR and European funds are likely to boost economic growth.

However, political uncertainty may delay or postpone certain investments, which is certainly not desirable. According to Mihaela Bîtu, the country’s medium- and long-term economic potential is still very good and Romania is still an interesting market for companies interested in nearshoring, or moving their operations from Asia to Europe. The banking system is robust and can deal well with the volatility and uncertainties we will face in 2025, both from Romania and from the international context. “Unlike previous situations, we rely on a solid banking system and are much better prepared for challenges, with extremely healthy liquidity and capitalization levels,” Bîtu said.

In this context, 2025 is also likely to be a positive year, even though 2024 already brought record profits based on a significant increase in assets and liabilities. The banks’ results in 2025 will obviously depend on macroeconomic developments and on the extent to which government agencies manage to maintain a good balance between economic growth and fiscal consolidation. This is not an easy task.

DN Agrar submits ambitious investment plans to shareholders’ meeting

At the shareholder meeting scheduled for March 25, DN Agrar is asking shareholders to approve a total investment package worth 3.4 million euros.

The planned investments include a new compost plant on the Lacto Agrar farm, the second in the group, and the installation of solar panels on the roofs of the Apold, Lacto Agrar and Cut (DN AGRAR Service) farm buildings.

According to the company, the compost plant at the Lacto Agrar farm will have a capacity of 7,000 tons of organic fertilizer per year.

The project will start this year and should be fully operational in the fourth quarter of the year. It involves an investment of 1.7 million euros, financed through a bank loan. Upon completion of the project, DN AGRAR will expand organic fertilizer production capacity by another 7,000 tons per year. As of 2026, total annual production will then reach 14,000 tons.

“Following the start of operations at our first composting unit at Apold Farm, which generated significant market interest, we are pleased to announce plans to expand by installing a second composting unit at Lacto Agrar Farm. This new unit is expected to be fully operational by the fourth quarter of 2025,” said Peter de Boer, Board Member & Strategy and IR Director, DN AGRAR Group.

Regarding the installation of solar panels on the roofs of buildings on the farms Apold, Lacto Agrar and Cut, the project involves a total investment of about 1.7 million euros. This investment is financed with non-refundable funds from the PNRR (60% of the total value, the project already has all necessary approvals). The remaining 40% will be financed through a bank loan.

Installation is scheduled for Q2/2025. In the second phase, the farms will also be equipped with storage batteries to increase the efficiency of this project. “We expect this project to make us completely energy independent on our farms Lacto Agrar, Cut and Apold,” said Peter de Boer.

DN AGRAR Group is the largest producer of cow’s milk in Romania. Founded in 2008 by Jan de Boer, the company operates in central Transylvania, in the provinces of Alba, Sibiu and Hunedoara. DN AGRAR’s main activities are animal husbandry, agricultural and plant breeding, agricultural services, logistics, transportation, tourism and business and management consulting services. The company has been listed on the Bucharest Stock Exchange since February 2022.

Damen, 150 years of naval shipbuilding in Vlissingen

Damen Naval this year celebrates 150 years since the founding of Koninklijke Maatschappij De Schelde and 25 years as Damen Naval, the specialized marine division of Damen Shipyards Group. Damen Naval traces its roots back to 1875, when Koninklijke Maatschappij De Schelde was founded in Vlissingen. A new chapter began in 2000 when Damen Naval was founded, a company specializing in complex, unique and innovative naval vessels. So 2025 will mark a double anniversary: 150 years since the founding of De Schelde and 25 years as Damen Naval, the only Dutch Original Equipment Manufacturer (OEM) in the field of naval shipbuilding. In the past 150 years, Damen Naval has delivered more than 420 ships worldwide.

As Damen celebrates its 150th anniversary, the world is changing rapidly, with increasing security challenges for Europe and the Netherlands. Anno 2025, there is a renewed awareness of the need to modernize and strengthen armed forces and naval fleets. Across Europe, countries are taking steps in this direction. Therefore, Damen has recently started working as a strategic partner of the Ministry of Defense, on the renewal and replacement of the fleet of the Royal Netherlands Navy, strengthening the Netherlands’ capability while contributing to much-needed European defense cooperation.

Friesland Campina showcases local operations

Dutch group FrieslandCampina, owner of the Napolact brand, one of the strongest brands in the Romanian dairy sector, wants to sell its local operations, sources at Ziarul Financiar (ZF) said.

Napolact was the FrieslandCampina group’s last major acquisition in Romania, a transaction valued at the time, in 2004, at more than $10 million.

FrieslandCampina has two production sites in Romania, in Baciu (Cluj County) and Târgu Mureş. If the entire company were to be sold now, including the two plants, the proceeds are estimated at about 60-70 million euros.

According to sources at ZF, Sole Mizo, part of Hungary’s Bonafarm group, and French group Danone, among others, are interested in acquiring the dairy producer. Danone has a production plant in the capital, while Sole Mizo only handles import and distribution. Behind Sole Mizo is Hungarian billionaire Sandor Csanyi, chairman of banking group OTP (part of Banca Transylvania). In the milk processing market, Friesland Campina is the fifth player in terms of turnover, after Albalact, Danone, Olympus and Hochland, all of which are part of foreign groups. In 2023 (latest available data), Friesland Campina Romania realized sales of 564 million lei, down 2% from the previous year, according to data from the Ministry of Finance. The company also reported a loss of 200,000 lei, compared with a profit of over 200,000 lei in 2022. In 2023, the company had an average of 491 employees.

According to the latest data, the company works with more than 1,000 local farmers and collects 300,000 liters of milk daily. FrieslandCampina Romania is part of the Dutch company Royal FrieslandCampina, one of the world’s largest dairy producers. FrieslandCampina is present in the Romanian market with the Napolact, Campina and Dots brands and offers a wide range of products: drinking milk, yogurt, cheese, butter and milk snacks. Napolact is by far the strongest brand in the group’s portfolio in Romania. Currently, Napolact is one of the best-selling dairy brands, with milk, yogurt, cheese, butter and other products in its range.

Friesland Campina is one of the world’s largest dairy cooperatives. In total, the cooperative has more than 9,400 member farms and 14,600 farmers in the Netherlands, Belgium and Germany. Big question is why FrieslandCampina chooses to sell its operations in Romania. As soon as we have information on that, we will inform you.

Do you have a contribution for the newsletter?

DRN is a network for and by entrepreneurs.

If you have news about your company that might be of interest to the other members of the network, we would like to hear from you.

A simple email with your news to info@dutchromaniannetwork.nl is all it takes. We will then contact you to discuss possible placement of your news.

ECONOMIC NEWS

Number of new companies with foreign capital decreases

In 2024, 6,084 companies with foreign capital were established in Romania, down 13.21% from the previous year, National Trade Register (ONRC) data show,

The 6,084 new companies had a total issued share capital of nearly $18.407 million, a decrease of 85.35% compared with the issued capital of the 2023 registered companies, which was $125.664 million, Agerpres said .

The 6,084 new companies had a total issued share capital of nearly $18.407 million, a decrease of 85.35% compared with the issued capital of the 2023 registered companies, which was $125.664 million, Agerpres said .

Depending on the fields of activity, most registrations were recorded in wholesale and retail trade, automobile and motorcycle repair (30.04% of the total), services (17.54% of the total) and transportation, warehousing and communications. (17,54%).

At the end of December 2024, there were 290,930 companies in Romania with foreign shareholdings. The value of the issued capital was $74.208 billion.

The largest number of companies with foreign shareholdings was among investors from Italy, 53,743 (invested capital of $3.641 billion), but the largest value of share capital belongs to Dutch companies, $13.231 billion, distributed among 6,221 companies.

Economic development expectations

For over 13 years, CFA Society Romania has been conducting a monthly survey of its members asking for their (expert) opinions on the state of the economy and expected developments for the coming year. Currently, the CFA Romania Association has over 250 members, all holders of the title Chartered Financial Analyst (CFA) and working in supervisory bodies, supranational institutions, banks, insurance companies, securities brokerage firms, asset managers, pension funds, the public sector, etc, etc. The survey results thus provide a good indicator of the expectations of financial analysts in Romania regarding economic developments for the coming year.

The survey questions financial analysts on a number of topics; the business climate, the labor market, and the development of personal wealth at the economic level.

In addition, the survey gauges expectations, also for a one-year time horizon, for the inflation rate, interest rates, the EUR/RON exchange rate, the BET stock index and global macroeconomic conditions.

The results of the survey held during the last week of February 2025 are now available.

Regarding the EUR/RON exchange rate, all participants expect a depreciation of the leu in the next 12 months. The average value for the 6-month period is 5.0759 lei for one euro, while the average value of the expected exchange rate for the 12-month period is 5.1595 lei for one euro.

The expected inflation rate for the 12-month period (February 2026) averages 4.97%, compared with the current level of 4.95%. Financial analysts expect little change in this area.

Analysts were also surveyed about the development of house prices in cities. 39% of survey participants expect urban home prices to stagnate over the next 12 months, while 45% expect an increase and 29% a decrease.

In addition, 62% of participants believe the current prices are overvalued, while 33% believe they are correctly valued.

The forecast for the state budget deficit for 2025 remained at the average forecast value of 7.3% of GDP.

Expectations for economic growth in 2025 are slightly higher than the previous year, averaging 1.5%. Government debt as a percentage of GDP is expected to rise to 55% in the next 12 months.

“This year, the biggest challenges for the Romanian economy will be the high budget deficit, below-potential economic growth and inflation. “Survey participants expect the budget deficit to decrease by only one percentage point, economic growth to be similar to that of the previous year and current inflation to stagnate,” said Adrian Codirlasu, president of the CFA Society Romania.

RETAIL SECTOR

Action enters Romanian market

Action, a discounter selling mainly non-food products from the Netherlands is expanding into Romania. The Dutch retailer has more than 2,650 stores in 12 countries, more than 80,000 employees and total annual sales of more than 11 billion euros by 2023, according to company information. The main competitors for Action in Romania are Pepco and Kik.

Action, a discounter selling mainly non-food products from the Netherlands is expanding into Romania. The Dutch retailer has more than 2,650 stores in 12 countries, more than 80,000 employees and total annual sales of more than 11 billion euros by 2023, according to company information. The main competitors for Action in Romania are Pepco and Kik.

Action Retail Romania, the Romanian subsidiary of the Dutch company, is currently recruiting staff for the stores it will open in Bucharest and Cluj. People with experience in retail as cashiers, commercial employees or in the fast-food industry get an edge in hiring, according to job advertisements consulted by Economica.net.

Employers offer a base salary from 3,300 lei net per month, depending on experience.

The exact date for opening the stores is not yet known.

Unilever moves ice cream production from Bulgaria to Romania

Seven years after purchasing the Denny’s ice cream factory in Veliko Tarnovo, Bulgaria, London-based multinational Unilever is closing the plant. The company did not give specific reasons for the closure. According to sources at Economica, production will move to Romania, where Unilever has a plant in Ploiesti and one in Suceava, while the administrative part will remain in Bulgaria.

Seven years after purchasing the Denny’s ice cream factory in Veliko Tarnovo, Bulgaria, London-based multinational Unilever is closing the plant. The company did not give specific reasons for the closure. According to sources at Economica, production will move to Romania, where Unilever has a plant in Ploiesti and one in Suceava, while the administrative part will remain in Bulgaria.

The company told the publication Dnevnik that production will be transferred to other factories of the group. The closest one is in Ploiesti. Unilever also has an ice cream plant in Suceava, after it acquired the entire Betty Ice plant from entrepreneur Vasile Armenean in 2018, in a market-estimated €80-100 million deal.

Recently, the company announced an investment plan for the Suceava plant of €4 million for 2024-2025.

“The development of the Suceava ice plant is our constant concern. The investments already started will amount to about 4 million euros by the end of 2025 and aim to modernize the production lines and equip the unit with new generation equipment to maximize productivity.  The market segment in which we operate is very dynamic and innovation is a key ingredient. The ability to diversify the product portfolio and maintain high quality standards always makes the difference, and the long tradition of the brands we produce here, in Suceava, confirms our commitment to consumers,” stated last year for Monitorul de Suceava, George Barbu, director of the Betty Ice plant.

The market segment in which we operate is very dynamic and innovation is a key ingredient. The ability to diversify the product portfolio and maintain high quality standards always makes the difference, and the long tradition of the brands we produce here, in Suceava, confirms our commitment to consumers,” stated last year for Monitorul de Suceava, George Barbu, director of the Betty Ice plant.

The decision to move production from Bulgaria to another market is not the first within the Unilever group. In 2007, for example, the group stopped producing Kaliakra brand oil in Bulgaria and now imports it from its plant in Romania. According to unofficial sources, the company, like many others in the country, is having trouble finding qualified personnel in Bulgaria. Unilever has been operating in the Romanian market since 1995. Unilever has import, distribution and production operations in Romania, with plants in Suceava (ice cream), Ploiești (detergents and food) and Bucharest (food).

AGRICULTURE

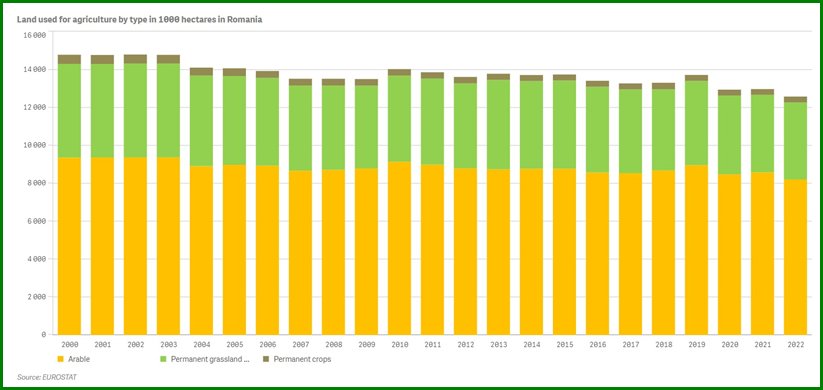

Romania could lose about 10% of its arable land

Over the past 25 years, Romania has “lost” over 1.1 million hectares of arable land, and the situation is worsening year after year due to soil degradation from desiccation and desertification. 2024 was the warmest year in the history of meteorological measurements in Romania.

The area susceptible to degradation from desiccation and possible desertification is 251,876.27 hectares at extremely high sensitivity and 529,760.71 hectares at very high sensitivity, according to information from the Department of Agriculture. In other words, over 781,600 hectares are at risk of being lost to agriculture. And since Romania has a total of about 8.2 million hectares of arable land, this means that degradation could affect 9.5% of the land area that farmers regularly cultivate in a crop rotation system.

However, the country’s arable area has been steadily decreasing in recent years.

Regarding the situation of sandy soils, another category of difficult soils for practicing agriculture, MADR says they allow agricultural production, but better results can only be achieved if farmers apply technologies recommended by the Research-Development Station for growing plants on Dăbuleni Sands. According to Ministry data, the area of sandy soils at risk of wind erosion amounts to 321,463 hectares.

The agricultural area in Romania represents about 13.5 million hectares (ha), of which 8.2 million ha are arable land. Desertification and land degradation are current and increasing threats at the EU level. While land degradation affects all EU countries, the risk of desertification is increasing, especially in southern Europe and the Black Sea bordering areas of Bulgaria and Romania.

First EU funds for Romania this year: food processing, small farmers and (established) young farmers

Romanian Agriculture and Rural Development Minister Florin Barbu, in a recent meeting with Romanian farmer leaders, outlined the estimated calendar of calls for EU-funded projects for the first part of 2025.

The projects that can be submitted in the upcoming period focus on the vegetable and potato sector; food processing; small farms; and farmers who established themselves as young farmers through projects funded in the previous programming period (2014-2020, including the 2021-2022 transition period) or who established themselves as young farm managers in the past 5 years and are still under 45 years of age. The purpose of the latter measure is to consolidate farms already established by young farmers.

As usual, European funds will be accessed through the AFIR agency – the Agency for Financing Rural Investment.

As usual, European funds will be accessed through the AFIR agency – the Agency for Financing Rural Investment.

According to information provided to farmers’ organizations, the following funds will be launched in the first quarter of 2025:

DR 16 – Investments in the vegetable and/or potato sector.

RD 23 – Investments for processing and marketing agricultural products in food and processed products.

RD 14 – Investments in small farms.

DR 12 – Investments in the consolidation of farms of young and newly established farmers.

The following project sessions are expected to be launched in the second quarter of 2025

The following project sessions are expected to be launched in the second quarter of 2025

DR 26 – Construction of irrigation systems.

DR 18 – Investments in floriculture, medicinal and aromatic plants.

Minister Florin Barbu also indicated that the measure aimed at purchasing irrigation equipment should start in July 2025, with a budget of about 100 million euros.

Food processing, livestock sector development, improved irrigation, are all top priority policy issues of the current (and previous) government. Generational renewal of the agricultural sector is also of great importance in an aging society like Romania’s, not only from a food security perspective, but also to ensure the vitality of rural areas.

TOURISM INDUSTRY

Tourism in 2024

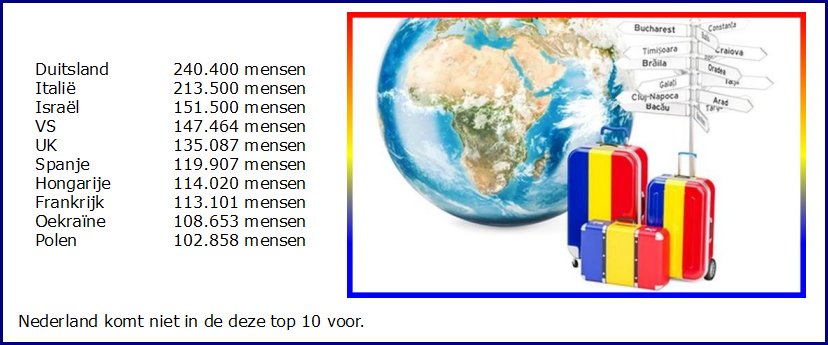

What were the favorite destinations and the top 10 countries that attracted the most tourists to Romania?

Tourism that is a source of income in many countries is hardly developed in Romania while the country has so much to offer.

Tourism that is a source of income in many countries is hardly developed in Romania while the country has so much to offer.

The number of arrivals in tourist accommodations (including apartments and rooms for rent) totaled 14.263 million people in 2024, up 4.5% from 2023, according to data from the National Institute of Statistics.

Last year, the number of overnight stays in tourist accommodations (including apartments and rooms for rent) reached 30.191 million, up 3.5% from 2023. The number of overnight stays by Romanian tourists was 83.7%, while the number of overnight stays by foreign tourists was 16.3%.

The average length of stay in 2024 was 2.1 days for both Romanian and foreign tourists, which is low.

The net occupancy rate of tourist accommodations in 2024 was 30.9% of the total number of tourist accommodations (including apartments and rooms for rent). This is an increase of 0.2 percentage points from 2023.

Below are the countries that attracted the most tourists to Romania in 2024.

By country, most foreign tourists came out:

The number of foreign visitors visiting Romania, registered at border crossings, was 13.352 million people. Road transport was the most common means of transportation used by foreign visitors (82.1% of the total number of arrivals during the period).

The number of Romanian tourists who departed abroad at border crossings in December 2024 was 1.007 million people. 81% of them preferred road transport and 18.1% preferred air transport

MOLDAVIE

Market opportunities in the horticultural sector

The Republic of Moldova is keen to further develop and professionalize its horticultural sector. In addition to support from other countries, Moldova is particularly seeking to learn from and strengthen ties with Dutch public and private actors.

In late 2024, Moldova announced the first comprehensive legal framework for the horticulture sector. A cornerstone of the law is the creation of the Horticulture Office, designed to foster sustainable growth in the sector through public-private partnerships and the adoption of innovative production and post-harvest practices. The Horticulture Office board builds on successful examples such as the Moldovan National Office of Vine and Wine, as well as the former Horticulture Product Board of The Netherlands.

At the request of the Dutch embassy in Moldova and the Netherlands Enterprise Agency (RVO), the opportunities for Dutch companies in the Moldovan horticultural sector were investigated.

This reconnaissance study shows that opportunities lie primarily in:

- the entire fruit chain: from cultivation and storage to trade and distribution;

- the entire vegetable chain: outdoor cultivation, greenhouse production and storage;

- technology and services for sustainable cultivation and water management;

- Knowledge transfer: training, research, education and consulting.

The results of the study will be presented at a seminar at the World Horti Center in Naaldwijk on March 27. The language of the seminar is English. Admission is free but registration is required. The seminar can also be followed online.

Register via this link.

If you have any questions or would like more information about this study and/or the Moldovan fruit and vegetable sector, please contact the Dutch agriculture team in Romania at bkr-lvvn@minbuza.nl.

CULTURE

Spring – Mărţişor

On March 1, spring began! In Romania, this day is celebrated grandly as Mărţişor (Roughly pronounced: “Mahrtzi-Shjor”) and is also seen as the beginning of the new (agricultural) year.

On March 1, spring began! In Romania, this day is celebrated grandly as Mărţişor (Roughly pronounced: “Mahrtzi-Shjor”) and is also seen as the beginning of the new (agricultural) year.

During Mărţişor, people give each other Mărţişoare. These are red and white intertwined threads with a pendant. You can wear them as wrist ornaments, brooches or necklaces. You give this gift to someone you like or enjoy or people who play a very important role in your life. For example, children give this to their teacher or their grandparents. According to tradition, you wear the Mărţişoare until the first blossoms appear. After that, you do not throw away the Mărţişoare but tie it to the flowering tree or bush. So it is important to make the Mărţişoare from environmentally friendly materials.

This tradition is said to have originated as early as Roman times. On March 1, the god Mars was worshiped. Mars was not only the god of war and victory but also the god of agriculture and spring.

This tradition is said to have originated as early as Roman times. On March 1, the god Mars was worshiped. Mars was not only the god of war and victory but also the god of agriculture and spring.

The red and white braids have a symbolic meaning. Red represents the blood or life that can flow again after the cold winter when everything more or less stands still. White represents new beginnings or new hope and victory over winter.

The pendants on the Mărţişoare can have all kinds of shapes. What you often see are of course shapes from nature such as flowers and plants or ladybugs but of course also hearts and even symbolic keys. If you like someone very much, you give them a key to your heart.

“BRANCUSI DAY” in ROMANIA

“Brancusi Day” was celebrated in Romania on Feb. 19 as a national holiday in honor of Constantin Brancusi, one of the most influential sculptors of the 20th century and a pioneer of modernism, also called patriarch of modern sculpture.

“Brancusi Day” was celebrated in Romania on Feb. 19 as a national holiday in honor of Constantin Brancusi, one of the most influential sculptors of the 20th century and a pioneer of modernism, also called patriarch of modern sculpture.

This year marks the 145th anniversary of Constantin Brancusi’s birth in Hobita, Romania, on Feb. 19, 1876. A passionate woodcarver, he produced numerous wood sculptures, often with a vernacular touch, and he often carved prototypes for works that were later executed in other materials. He is best known for his abstract sculptures of egg-shaped heads and flying birds.

Perhaps Brâncuși’s most significant works in Romania can be found in Târgu Jiu, where he presented the Monumental Ensemble of the Heroes of World War I between 1937 and 1938. This ensemble consists of three iconic sculptures aligned along an axis that spans the city:

– The Endless Column – A symbol of infinity and spiritual exaltation, this 29.35-meter-high figure is assembled from stacked diamond-shaped modules, representing an eternal cycle of existence

.- The Gate of the Kiss – A sculptural gateway representing love and unity, celebrated with the motif of stylized eyes

– The Table of Silence – A round table surrounded by twelve stone chairs, symbolizing reflection and remembrance. This monumental ensemble is considered one of Brâncuși’s greatest achievements, combining Romanian folk traditions with modernist principles to create a timeless artistic statement.

POST CRAIOVA

NetRom Software among one of the most financially powerful IT companies

A couple of weeks ago we received a note from Computable: we are back in 6th place in the Top 100 most financially powerful Dutch IT companies in 2025. Last year we were also on the sixth spot and the year before that on spot 11.

Usually these kinds of lists don’t do much for me knowing that the angle is often commercial and that companies pay to finish high. In this case, this is not the case. Computable compiles this list completely objectively based on criteria such as revenue growth, solvency, ebitda margin and revenue per employee. Revenue growth, ebitda margin and solvency count by a factor of three, while revenue per employee counts once. The final financial score on the list is indexed to the number one. It is well thought out.

What I like about this list is not necessarily NetRom’s spot six, but some of the other companies we’re in between. Companies like AFAS, which as always is at the stiff top. There was more news about AFAS recently; employees there work 4 days, but get paid for 5 days. Did you also know they will soon be donating as much as 30% of their shares to charity, generating an annual dividend of 20 million? Hats off! Those are names on lists I like very much as a NetRom.

A stark contract with the tech giants in the U.S. who are wagging back their inclusivity and sustainability programs as a new political wind blows. So was it all just for form? The cynical little voice in my head sadly says “yes” to this question.

In the last few editions of my Post Craiova blog, it was often about the NetRom campus. This is most likely indirectly one of the reasons we are high on this list of financially strong IT companies. Besides the fact that we have passed the 500 FTE mark, the cornerstone of our philosophy is to put the employee first. We have been slowly but steadily building our campus for 20 years and everything is owned by us. This is for the reason that we ourselves have the control to create an environment that is inviting, stimulating and inspiring for people to work. For us, this is essential to laying the foundation for long-term relationships.

Being financially sound is nice, of course, but the core of NetRom revolves around our ability to not only attract talented engineers but, more importantly, retain them for the long term. For our customers, that means stability, confidence, quality and security.

Actually, that’s even more important than the Computable list.

CN ROMARM SA and Germany’s Rheinmetall will build a powder plant in Romania.

Romanian company ROMARM and Germany’s Rheinmetall will implement the project to build a gunpowder factory in Romania. The European Commission has allocated 47 million euros for this investment under the ASAP (Act in Support of Ammunition Production) initiative.

On Friday, Romanian Economy Minister Radu Oprea announced on the Digi24 television channel that it would be “the most effective gunpowder in the world.” Oprea also reported that the joint factory project is in the preparation phase and that German technicians have already arrived in Romania. In an interview with Radio Free Europe, Oprea revealed that the ministry is preparing a law that would speed up the process of obtaining permits to build facilities for the arms industry.

On Friday, Romanian Economy Minister Radu Oprea announced on the Digi24 television channel that it would be “the most effective gunpowder in the world.” Oprea also reported that the joint factory project is in the preparation phase and that German technicians have already arrived in Romania. In an interview with Radio Free Europe, Oprea revealed that the ministry is preparing a law that would speed up the process of obtaining permits to build facilities for the arms industry.

As Radio Free Europe acknowledges, it is currently unknown where the https://defence-industry.eu/rheinmetall-and-romarm-to-build-powder-factory-in-romania/fabriek might be located. Romania shares a 650-km (400-mile) border with Ukraine and has repeatedly seen Russian drone fragments stray into its territory over the past year. Romanian territory is a few hundred meters from Ukrainian Danube ports,  frequent Russian targets. One possible location is Fagaras, as there were powder production facilities there in the past. The website defenseromania.ro noted that EU support is a positive sign in the context of the post-1990 decline and degradation of gunpowder production facilities in the country. Romanian media stress that Romania is currently forced to import gunpowder from Serbia, which has close relations with Russia and is in a politically unstable situation.

frequent Russian targets. One possible location is Fagaras, as there were powder production facilities there in the past. The website defenseromania.ro noted that EU support is a positive sign in the context of the post-1990 decline and degradation of gunpowder production facilities in the country. Romanian media stress that Romania is currently forced to import gunpowder from Serbia, which has close relations with Russia and is in a politically unstable situation.

Romanian sources gave no details on the total value of the investment or possible timelines for its completion. On Friday, the European Commission decided to allocate 500 million euros to European arms companies to increase production of artillery ammunition meant to replenish their own stockpiles and also intended for aid to Ukraine.

The EC’s decision aims to enable the European defense industry to increase its production capacity to 2 million shells per year by the end of 2025. Currently, these capacities are estimated at just over 1 million per year. The EU funds are also expected to stimulate additional industry investment through co-financing, which is expected to result in a total investment amount of about €1.4 billion.

In summary, the strategic partnership between CN ROMARM SA and Rheinmetall to build a state-of-the-art gunpowder factory underlines the growing importance of European cooperation in defense technology and production. The initiative not only strengthens military capabilities, but also shows an important step towards European self-reliance in munitions production.

Kudos to both teams for pioneering this project that is ready to set new benchmarks in the industry!!!

Disclaimer

The newsletter of the Dutch Romanian Network is compiled with great care. The Dutch Romanian Network cannot accept any liability for a possible inaccuracy and/or incompleteness of the information provided herein, nor can any rights be derived from the content of the newsletter. The articles do not necessarily reflect the opinion of the board.