Page 32 - Economic Outlook Romania 2019

P. 32

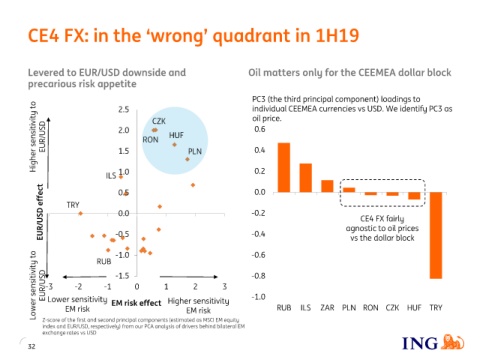

CE4 FX: in the ‘wrong’ quadrant in 1H19

Levered to EUR/USD downside and Oil matters only for the CEEMEA dollar block

precarious risk appetite

PC3 (the third principal component) loadings to

Higher sensitivity to EUR/USD 2.0 RON HUF PLN oil price.

individual CEEMEA currencies vs USD. We identify PC3 as

2.5

CZK

0.6

0.4

1.5

ILS 1.0 0.2

EUR/USD effect TRY -0.5 -0.2 agnostic to oil prices

0.0

0.5

0.0

CE4 FX fairly

-0.4

vs the dollar block

Lower sensitivity to EUR/USD -3 -2 RUB EM risk effect 1 Higher sensitivity -0.6

-1.0

-1.5

-0.8

3

-1

0

2

-1.0

Lower sensitivity

EM risk

EM risk

Z-score of the first and second principal components (estimated as MSCI EM equity

index and EUR/USD, respectively) from our PCA analysis of drivers behind bilateral EM RUB ILS ZAR PLN RON CZK HUF TRY

exchange rates vs USD

32