Page 27 - Economic Outlook Romania 2019

P. 27

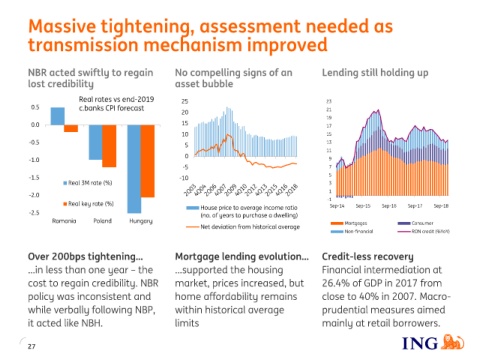

Massive tightening, assessment needed as

transmission mechanism improved

NBR acted swiftly to regain No compelling signs of an Lending still holding up

lost credibility asset bubble

Real rates vs end-2019 25 23

0.5 c.banks CPI forecast

20 21

19

0.0 15 17

10 15

-0.5 5 13

11

0

-1.0 9

-5 7

-1.5 -10 5

Real 3M rate (%) 3

1

-2.0

Real key rate (%) House price to average income ratio -1 Sep-14 Sep-15 Sep-16 Sep-17 Sep-18

-2.5 (no. of years to purchase a dwelling)

Romania Poland Hungary Mortgages Consumer

Net deviation from historical average

Non-financial RON credit (%YoY)

Over 200bps tightening... Mortgage lending evolution... Credit-less recovery

...in less than one year – the …supported the housing Financial intermediation at

cost to regain credibility. NBR market, prices increased, but 26.4% of GDP in 2017 from

policy was inconsistent and home affordability remains close to 40% in 2007. Macro-

while verbally following NBP, within historical average prudential measures aimed

it acted like NBH. limits mainly at retail borrowers.

27