Page 22 - Economic Outlook Romania 2019

P. 22

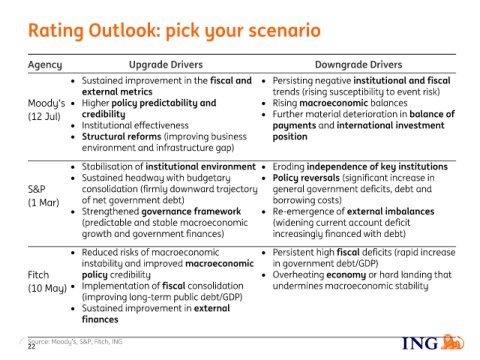

Rating Outlook: pick your scenario

Agency Upgrade Drivers Downgrade Drivers

Sustained improvement in the fiscal and Persisting negative institutional and fiscal

external metrics trends (rising susceptibility to event risk)

Moody’s Higher policy predictability and Rising macroeconomic balances

(12 Jul) credibility Further material deterioration in balance of

Institutional effectiveness payments and international investment

Structural reforms (improving business position

environment and infrastructure gap)

Stabilisation of institutional environment Eroding independence of key institutions

Sustained headway with budgetary Policy reversals (significant increase in

S&P consolidation (firmly downward trajectory general government deficits, debt and

(1 Mar) of net government debt) borrowing costs)

Strengthened governance framework Re-emergence of external imbalances

(predictable and stable macroeconomic (widening current account deficit

growth and government finances) increasingly financed with debt)

Reduced risks of macroeconomic Persistent high fiscal deficits (rapid increase

instability and improved macroeconomic in government debt/GDP)

Fitch policy credibility Overheating economy or hard landing that

(10 May) Implementation of fiscal consolidation undermines macroeconomic stability

(improving long-term public debt/GDP)

Sustained improvement in external

finances

Source: Moody’s, S&P, Fitch, ING

22