Page 20 - Economic Outlook Romania 2019

P. 20

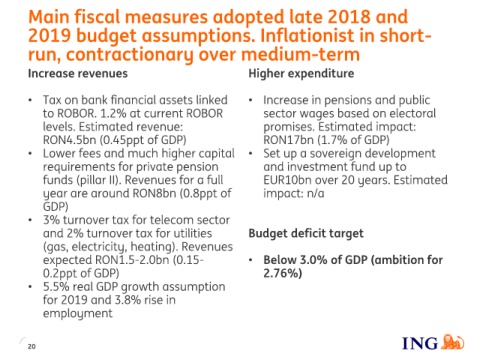

Main fiscal measures adopted late 2018 and

2019 budget assumptions. Inflationist in short-

run, contractionary over medium-term

Increase revenues Higher expenditure

• Tax on bank financial assets linked • Increase in pensions and public

to ROBOR. 1.2% at current ROBOR sector wages based on electoral

levels. Estimated revenue: promises. Estimated impact:

RON4.5bn (0.45ppt of GDP) RON17bn (1.7% of GDP)

• Lower fees and much higher capital • Set up a sovereign development

requirements for private pension and investment fund up to

funds (pillar II). Revenues for a full EUR10bn over 20 years. Estimated

year are around RON8bn (0.8ppt of impact: n/a

GDP)

• 3% turnover tax for telecom sector

and 2% turnover tax for utilities Budget deficit target

(gas, electricity, heating). Revenues

expected RON1.5-2.0bn (0.15- • Below 3.0% of GDP (ambition for

0.2ppt of GDP) 2.76%)

• 5.5% real GDP growth assumption

for 2019 and 3.8% rise in

employment

20