Page 11 - CEE Tax Guide 2024

P. 11

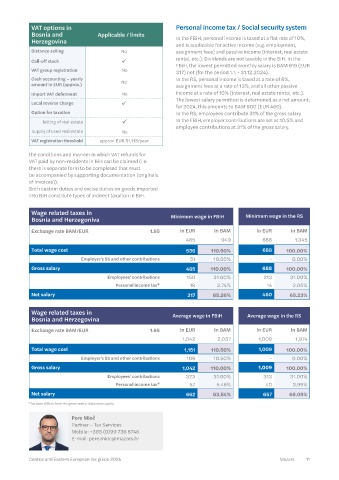

Bosnia and Herzegovina VAT options in Personal income tax / Social security system

Bosnia and Applicable / limits In the FBiH, personal income is taxed at a flat rate of 10%,

Herzegovina

and is applicable for active income (e.g. employment,

Distance selling No assignment fees) and passive income (interest, real estate

Mazars BH d.o.o. Call-off stock ü rental, etc.). Dividends are not taxable in the BiH. In the

FBiH, the lowest permitted monthly salary is BAM 619 (EUR

Bulevar Meše Selimovića 17a VAT group registration No 317) net (for the period 1.1. - 31.12.2024).

71000 Sarajevo, Cash accounting – yearly In the RS, personal income is taxed at a rate of 8%,

Bosnia and Herzegovina amount in EUR (approx.) No assignment fees at a rate of 13%, and all other passive

Phone: (00387) 33 265 800 income at a rate of 10% (interest, real estate rental, etc.).

Fax: (00387) 33 444 951 Import VAT deferment No The lowest salary permitted is determined as a net amount;

Local reverse charge ü for 2024, this amounts to BAM 900 (EUR 460).

Option for taxation In the RS, employees contribute 31% of the gross salary.

letting of real estate ü In the FBiH, employer contributions are set at 10.5% and

employee contributions at 31% of the gross salary.

Corporate taxes and other direct taxes of M&A transactions. In FBiH, interest expenses taken supply of used real estate No

from related parties are tax deductible in a debt/equity VAT registration threshold approx. EUR 51,113/year

It is important to note that Bosnia and Herzegovina (BiH) ratio of 4:1 (thin cap rule). In the RS, interest expenses are

is divided into three tax jurisdictions: the Federation of BiH not recognized for the amount of net interest expenses the conditions and manner in which VAT refunds for

(FBiH), the Republika Srpska (RS) and Brčko District (BD). that exceed 30% of the tax base (without financial items). VAT paid by non-residents in BiH can be claimed (i.e.

For simplicity’s sake, we will focus on the RS and FBiH. In the RS, R&D costs are recognized in line with IAS. In the there is separate form to be completed that must

CIT is set at a flat rate of 10%. A company in the FBiH/ FBiH and BD, R&D costs are recognized. be accompanied by supporting documentation (originals

RS is considered resident if it is registered as a legal Profit on dividends is not included in the calculation of the of invoices)).

entity in the relevant jurisdiction, or in case its activities tax base. In the FBiH, taxpayers who invest their own Both custom duties and excise duties on goods imported

in BiH, qualifies as PE. Losses can be carried forward for resources in production equipment to a value exceeding into BiH constitute types of indirect taxation in BiH.

up to 5 years in all tax jurisdictions. Loss carryback is not 50% of the profit for the current tax period see a reduction

permitted. There are no special limitations in the case

in corporate income tax liabilities for 30% of the amount Wage related taxes in

for the year of the investment. Minimum wage in FBiH Minimum wage in the RS

Transfer pricing in Bosnia and Herzegovina Any taxpayer who invests more than 20 million in BAM Bosnia and Herzegoniva

Arm's length principle ü Since 1998 (EUR 10.2 million) over five consecutive years (minimum Exchange rate BAM/EUR 1.95 in EUR in BAM in EUR in BAM

investment in the first year is equal to 4 million BAM 485 949 688 1.345

Necessary. Prescribed in the

Documentation liability ü transfer pricing documentation. (EUR 2.04 million) reduces its CIT liability by 50% of the

investment in each of the 5 years. Total wage cost 536 110.50% 688 100.00%

APA No – The withholding tax rate for dividends amounts to 5% Employer's SS and other contributions 51 10.50% - 0.00%

Annual consolidated group in the FBiH unless a DTT applies (currently, there are

Country-by-Country revenue equal to or exceeding around 38 active DTT’s). Interests, royalties, and technical Gross salary 485 110.00% 688 100.00%

liability ü EUR 750 million in the Employees' contributions 150 31.00% 213 31.00%

previous year. fees paid by a BiH company to a foreign company are

Master file-local file Deadline 45 FBiH/30 RS days subject to withholdings at a rate of 10%. In the RS, there Personal income tax* 18 3.74% 14 2.05%

(OECD BEPS 13) ü from the request made by the tax is a flat-rate withholding tax (10%) on all payments Net salary 317 65.26% 460 65.23%

applicable administration. to foreign legal persons in which there is an obligation

Penalty to pay withholding tax. The group taxation concept

RS: EUR 10,226.00-EUR is allowed in the BiH for a group of resident companies, Wage related taxes in

30,678.00 for legal persons and with a minimum of 90% (FBiH). Moreover, the parent Bosnia and Herzegovina Average wage in FBiH Average wage in the RS

EUR 2,556.00 – EUR 7,669.00 for company and its subsidiaries constitute a group

lack of documentation ü responsible person. Exchange rate BAM/EUR 1.95 in EUR in BAM in EUR in BAM

FBiH: EUR 1,524.00-EUR 50,867 of companies if they have direct or indirect control over

for legal persons and EUR 50% or more of the shares or stakes. 1,042 2,037 1,009 1,974

1,278.00 – EUR 5,113.00 for In cases of real estate acquisition in the FBiH, the transfer

responsible person. Total wage cost 1,151 110.50% 1,009 100.00%

tax shortage No – is taxable at the canton level. In the RS, there is no transfer

Direct or indirect control (25% for tax, but the owner of the real estate has to pay property tax Employer's SS and other contributions 109 10.50% - 0.00%

FBiH, 25% for RS), or a common of up to 0.20% of the market value. (Decreased rules for Gross salary 1,042 110.00% 1,009 100.00%

> 25% managing director, or significant production RE apply).

Related parties (25%) influence on decisions – directly Employees' contributions 323 31.00% 313 31.00%

or indirectly in the management, Personal income tax* 57 5.46% 40 3.95%

control or capital of the other VAT and other indirect taxes

person, etc. Net salary 662 63.54% 657 65.05%

In FBiH, the safe harbor rate for The general rate is 17%. There are no reduced rates apart

support services is 5%. Support from the 0% rate (mainly for the export of goods). Main *Tax base differs from the gross salary, deductions apply.

services include: IT maintenance VAT-exempt services include banking services, insurance,

services, accounting and auditing,

Safe harbors ü administration, legal services, healthcare, etc. Export exemption and exemption for Pere Mioč

HR management, training and deliveries to free zones apply. Specific thresholds are Partner – Tax Services

education and tax advisory as follows. Mobile: +385 (0)99 736 8746

services for employees.

Level of attention paid by Tax Amendments to the VAT rulebook have been officially E-mail: pere.mioc@mazars.hr

Authority 7/10 introduced as of August 2, 2020. The Rulebook prescribes

10 Mazars Central and Eastern European tax guide 2024 Central and Eastern European tax guide 2024 Mazars 11