Page 7 - CEE Tax Guide 2024

P. 7

The definition of employment income also encompasses

Albania VAT options in Applicable / limits income earned by a self-employed individual, if at least

Albania

80% of the revenue earned is derived directly or indirectly

Distance selling No from a single customer or if at least 90% of the total

revenue earned is derived from 2 clients. However, such

Call-off stock No criteria do not apply if the self-employed individual

Mazars SHPK VAT group registration No provides services only to non-tax residents in Albania.

Rr. Emin Duraku, Cash accounting – yearly A progressive rate is applicable on employment income;

Pall. “Binjaket”, Nr.5, Tirana amount in EUR (approx.) No no tax is applied to monthly incomes of up to ALL 50,000;

Albania Import VAT deferment No the rate is 13% for income up to ALL 60,000 for the amount

Phone: +355 (0) 42 278 015 over ALL 35,000; 13% for income up to ALL 200,000 for

www.mazars.al the amount over ALL 30,000. Above that level, ALL 22,100

For all services from non-resident plus 23% of the amount above ALL 200,000 is payable.

Local reverse charge entities that are subject to VAT

in their own country. – business income

The income derived from the business activity of self-

Corporate taxes and other direct taxes • Any entity which operates a 4- or 5-star hotel and that Option for taxation employed or entrepreneurs is considered as business

income and is taxed as such;

acquires the status of special investor by December letting of real estate ü Net business income up to ALL 14 million are taxed with

A new income tax was introduced with effect from January 1, 2024 will be exempt from CIT for the first 10 years 15% personal income tax and 23% personal income tax

2024. Resident companies are subject to corporate of their operation. supply of used real estate No is applied to net business income over ALL 14 million.

income tax on their worldwide income, while non-resident The assessment of CIT is based on the FS prepared VAT registration EUR 95,240/year Entrepreneurs and self-employed individuals

companies are taxed only on income that is derived from in accordance with the National Accounting Standards threshold realizing an annual turnover up to ALL 14 million shall

sources in Albania. or IFRS, subject to certain adjustments for tax purposes continue to be subject to 0% tax until 2029, with the

The standard Corporate Income Tax is assessed as specified in the Corporate Income Tax Law and other This will be possible in the special cases specified in the exception of self-employed individuals providing

on a current-year basis at the rate of 15%: supplementary legal acts. Fiscal losses may be carried Ministry of Finance directive. Customs duty rates range professional services.

A Reduced Corporate Income Tax Rate is applicable for forward for up to five consecutive years. The law does between 0% and 15%, depending on the type of goods and

certain specific industries: not provide for consolidated tax returns. Each company the country of the origin. – income from investments is taxed at a flat rate of 15%.

• 5% for entities dealing with software and forming part of a group must file a separate tax return. Mandatory social security and health insurance

IT development, up to December 31, 2025; Personal income tax / Social security system contributions are due on employment income. The social

• 5% for entities operating in the automotive industry, The gross amounts of interest, royalties, dividends, and According to the New Income Law, personal income security contribution is calculated based on the monthly

shares of partnerships’ profits paid to non-resident

up to December 31, 2029; gross salary, from a minimum amount of ALL 40,000

• 5% for entities performing their activities in accordance companies are subject to a withholding tax of 15%, unless is categorized in three types of income; (approximately EUR 380) to a maximum amount of ALL

a double taxation treaty (DTT) provides for a lower rate.

with the Law on Entities of Agriculture Collaboration, Albania has established agreements with 43 countries for – employment income 176,416 (approximately EUR 1,680). The social contribution

up to December 31, 2029; Employment income includes wages, salaries, allowances, payable by the employer is 15%, while the rate payable

• 5% for entities operating in the agritourism industry, the avoidance of double taxation. 41 of these have been other compensations, and bonuses derived from by the employee is 9.5%. The health insurance contribution

ratified and are currently in force.

up to December 2029; employment or similar relations. rate is 1.7% for both the employer and the employee.

Tax on dividends is 8%.

The customs duty rates range between 0% and 15%,

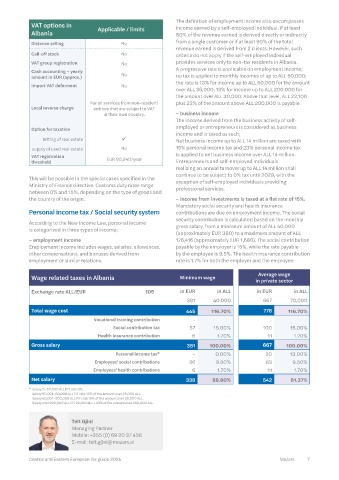

Transfer pricing in Albania depending on the type of goods and the country Wage related taxes in Albania Minimum wage Average wage

Arm's length principle ü Since 1998 of the origin. in private sector

Documentation liability ü Since 2014 Local taxes consist of different categories of taxes. Exchange rate ALL/EUR 105 in EUR in ALL in EUR in ALL

APA ü Since 2014 VAT and other indirect taxes 381 40,000 667 70,000

Country-by-Country Since 2019 Any person (entity or individual) that makes supplies in the Total wage cost 445 116.70% 778 116.70%

liability ü course of an independent economic activity is required Vocational training contribution - -

Master file-local file Social contribution tax 57 15.00% 100 15.00%

(OECD BEPS 13) ü – to pay VAT. For domestic supplies and for services

applicable subject to the reverse-charge mechanism, the Albanian Health Insurance contribution 6 1.70% 11 1.70%

Penalty taxable person will always be liable to account for VAT. Gross salary 381 100.00% 667 100.00%

The obligation to register for VAT purposes and charge VAT

~ Delayed submission Personal income tax* - 0.00% 50 13.00%

lack of documentation ü of documentation – EUR 80 / is triggered when annual turnover exceeds ALL 10 million

for each month of delay. (approx. EUR 95,240). Employees' social contributions 36 9.50% 63 9.50%

0.06% on a daily basis Persons involved in import or export activities and Employees' health contributions 6 1.70% 11 1.70%

(not more than 365 days) Net salary

tax shortage ü on tax underpayment taxpayers supplying professional services must register for 338 88.80% 542 81.37%

+ late payment interest VAT regardless of the amount of turnover. The applicable * Salary 0–50,000 ALL PIT rate 0%.

A person holding VAT regimes are: 0%, 6% and 20%. Salary 50,001–60,000 ALL PIT rate 13% of the amount over 35,000 ALL.

Salary 60,001–200,000 ALL PIT rate 15% of the amount over 30,000 ALL.

or controlling 50% or more Customs duties in the Republic of Albania are applied Salary over 200,000 ALL PIT 22,100 ALL + 23% of the amount over 200,000 ALL.

Related parties > 50% of shares, or directly by the customs authorities on the import of goods.

or indirectly controlling the

other company. The liability to pay duty always falls on the importer of the Teit Gjini

goods and is added to the cost of goods; in this way,

Safe harbors No – it is finally transferred to the consumer. Starting from Managing Partner

Level of attention paid by Tax 01/15/2020, credit obligations or surpluses, such as tax Mobile: +355 (0) 69 20 37 456

Authority 8/10 and customs, may be offset between them. E-mail: teit.gjini@mazars.al

6 Mazars Central and Eastern European tax guide 2024 Central and Eastern European tax guide 2024 Mazars 7