Page 13 - CEE Tax Guide 2024

P. 13

Bulgaria printed or handwritten music editions), and periodical Services exempt from VAT include financial and insurance

services, transfer of buildings and certain parcels

printed works such as newspapers and magazines.

3. Provision of baby and small children's food, baby of land and rights related thereto, letting of real estate

diapers and similar items for baby hygiene according to individuals for housing, postal services and postage

to Appendix No. 4. stamps, educational services, gambling, supplies, culture,

religion, medical and social services, and supplies for

Mazars OOD which no tax credit was used.

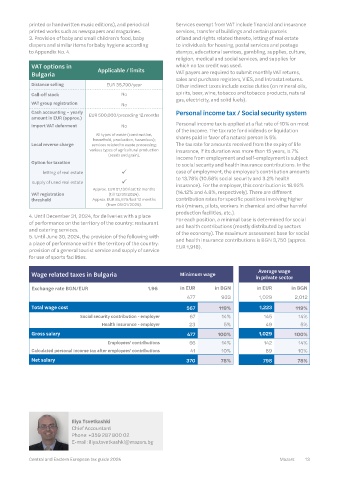

3A Moscovska str., VAT options in Applicable / limits VAT payers are required to submit monthly VAT returns,

1000 Sofia, Bulgaria Bulgaria sales and purchase registers, VIES, and Intrastat returns.

Phone: +359 287 800 02 Distance selling EUR 35,790/year Other indirect taxes include excise duties (on mineral oils,

www.mazars.bg

Call-off stock No spirits, beer, wine, tobacco and tobacco products, natural

VAT group registration No gas, electricity, and solid fuels).

Cash accounting – yearly EUR 500,000/preceding 12 months Personal income tax / Social security system

amount in EUR (approx.)

Import VAT deferment No Personal income tax is applied at a flat rate of 10% on most

Corporate taxes and other direct taxes royalties are paid in favor of a parent company registered All types of waste (construction, of the income. The tax rate for dividends or liquidation

in an EU Member State. household, production, hazardous); shares paid in favor of a natural person is 5%.

Bulgaria has a flat corporate income tax rate of 10%, Local taxes are determined by each municipality within Local reverse charge services related to waste processing; The tax rate for amounts received from the expiry of life

which is applied to the annual tax profit. The tax profit the ranges stated in the Law of Local Taxes and Fees. Local various types of agricultural production insurance, if its duration was more than 15 years, is 7%.

may be reduced by tax losses carried forward within taxes and fees include: (seeds and grain). Income from employment and self-employment is subject

five subsequent financial years. Bulgaria applies thin • real estate tax: the tax rate is in the range of 0.1% Option for taxation to social security and health insurance contributions. In the

capitalization rules to interest expenses from loans to 4.5%. The base for taxation of non-residential real letting of real estate ü case of employment, the employee’s contribution amounts

or leasing provided or guaranteed by related parties. estates of companies is the higher of the book value to 13.78% (10.58% social security and 3.2% health

The financial results of collective investment schemes and or the value calculated by municipality tax valuation. supply of used real estate ü insurance). For the employer, this contribution is 18.92%

enterprises with special purposes are not taxable through The base for taxation of all residential real estate is the VAT registration Approx. EUR 51,130/last 12 months (14.12% and 4.8%, respectively). There are different

(till 12/31/2024).

corporate income tax. municipality’s tax valuation; threshold Approx. EUR 84,875/last 12 months contribution rates for specific positions involving higher

Advance tax payments should be made each month • transportation vehicle tax: determined as an exact (from 01/01/2025). risk (miners, pilots, workers in chemical and other harmful

or quarter, based on the estimated tax profit for the amount, depending on vehicle type and power; 4. Until December 31, 2024, for deliveries with a place production facilities, etc.).

current year. • gift tax: applied to gifts of all kinds, with very limited of performance on the territory of the country: restaurant For each position, a minimal base is determined for social

Withholding tax rates are 5% for dividends and 10% exemptions. Applies also to forgiven payables. There and catering services. and health contributions (mostly distributed by sectors

for interests and royalties (double taxation treaties are two ranges of rates applicable: between 0.4% and 5. Until June 30, 2024, the provision of the following with of the economy). The maximum assessment base for social

between Bulgaria and other countries can also be applied 0.8% for gifts between siblings and their children; and a place of performance within the territory of the country: and health insurance contributions is BGN 3,750 (approx.

in order to decrease the withholding tax rate). There between 3.3% and 6.6% for all other gifts; provision of a general tourist service and supply of service EUR 1,918).

is no withholding tax if the dividends, interests, and

• tax on the acquisition of property for a consideration: for use of sports facilities.

applies to real estate, vehicles, and limited real estate

Transfer pricing in Bulgaria rights acquired for a consideration. The tax rate range Average wage

Arm's length principle ü Since 1989 is between 0.1% and 3% of the value of the property, Wage related taxes in Bulgaria Minimum wage in private sector

or, in the case of exchange, the value of the more

A TP local file is obligatory for Exchange rate BGN/EUR 1.96 in EUR in BGN in EUR in BGN

companies that have exceeded expensive property;

at least two of the following • inheritance tax: exempt to a limited extent 477 933 1,029 2,012

indicators by December (family members);

Documentation liability ü 31 in the previous year: assets Total wage cost 567 119% 1,223 119%

over BGN 38 million, • patent tax: applied to micro enterprises or individuals Social security contribution - employer 67 14% 145 14%

revenues over BGN 76 million, whose activities are small services such as tailoring, very

over 250 employees. small stores, carpentry, etc. These are fixed amounts, Health insurance - employer 23 5% 49 5%

APA No – determined by each municipality; Gross salary 477 100% 1,029 100%

• a wide range of other fees (such as tourist tax; tax on the

Country-by-Country – carriage of passengers by taxi; refuse collection fee) Employees' contributions 66 14% 142 14%

liability ü or other fees usually imposed for specific services, such Calculated personal income tax after employees' contributions 41 10% 89 10%

Master file-local file Where the company as social services, technical and other services, renting Net salary 370 78%

required to prepare

(OECD BEPS 13) ü an LF is an MNE member, 798 78%

applicable it must also have an MF. of plots for sale at marketplaces, pavements, etc.

Penalty VAT and other indirect taxes

0.5% of the transaction amount

– for lack of local file; BGN

lack of documentation ü 5,000 to BGN 10,000 penalty – For 2024, the standard VAT rate is 20% and the reduced

rate is 9%. The tax rate is 9% for:

for lack of a master file.

tax shortage ü BGN 1,500 to BGN 5,000 1. Provision of accommodation services in hotels and

similar facilities, including the provision of holiday

Related parties > 50% Direct or indirect control accommodation and the rental of campsites or caravans, Iliya Tsvetkashki

or personally related.

with a place to perform on the territory of the country. Chief Accountant

Safe harbors No – 2. Provision of books on physical or electronic media, or both Phone: +359 287 800 02

Level of attention paid by Tax (including textbooks, educational books and study sets, E-mail: iliya.tsvetkashki@mazars.bg

Authority 9/10 children's books with illustrations, for drawing or coloring,

12 Mazars Central and Eastern European tax guide 2024 Central and Eastern European tax guide 2024 Mazars 13