Page 17 - CEE Tax Guide 2024

P. 17

Czech Republic mass transport of passengers. The supply of books is VAT- VAT payers are obliged to submit VAT returns, EC Sales Lists

exempt subject to certain conditions. VAT-exempt services

and Control Statements (detailed evidence for selected

include financial and insurance services, the transfer transactions) on a monthly or quarterly basis (depending

of buildings/apartments/non-residential premises (from on the status of the VAT payer).

5 years following the building approval), renting of real Other indirect taxes include excise duties (on mineral oils,

estate, mail services, radio and TV services, education spirits, beer, wine, and tobacco products) and an energy

Mazars, s.r.o. services, and medical and social care services. tax (on natural gas, electricity, and solid fuels).

Pod Dráhou 1637/4,170 00 Praha 7 –

Česká republika VAT options in Personal income tax / Social security system

Phone: (+420) 224 835 730 Applicable / limits

www.mazars.cz Czech Republic Personal income tax is applied at progressive rates

Distance selling EU threshold – EUR 10,000/year OSS of 15% and 23% on all types of income (employment,

system applicable self-employment, rental incomes, capital gains, interest)

Call-off stock ü with exemptions of certain types to dividends and interest

VAT group registration ü – only for Czech legal entities or director fees paid to non-residents, which are taxed

at a flat rate of only 15%.

Cash accounting – yearly

Corporate taxes and other direct taxes Investment incentives in a form of tax relief (tax holiday) amount in EUR (approx.) No Income from employment and self-employment

are available for up to 10 taxable periods. activities is subject to social security and health

The general corporate income tax (CIT) rate is 21%. A CIT Import VAT deferment ü insurance contributions. In the case of employment, the

rate of 5% applies to basic investment funds and 0% A special corporate tax referred to as a windfall tax applies Construction works, waste, gold, selected employee’s contribution is equal to 7.1% (social security)

applies to pension funds. to selected taxpayers in the fossil fuel sector and energy cereals and industrial crops, cell phones, and 4.5% (health insurance). For the employer, these

Tax losses may be carried forward for up to 5 taxable sector and to banks in the calendar years 2023-2025. integrated circuits, notebooks, tablets, are equal to 24.8% and 9%, respectively. Social security

videogame consoles, used real estate,

periods. Tax losses may also be carried back for 2 taxable The windfall tax rate is 60% and is applied on a specifically Local reverse charge supply of natural gas and electricity contributions are not paid on income exceeding the

periods. The maximum amount that may be carried back calculated tax base. to traders, provision of telecommunication maximum assessment base (CZK 2,110,416). The example

services to traders, outplacement

from one taxable period is limited to CZK 30 million Generally, a withholding tax of 15% applies to dividends, of construction workers, and immovable below shows the employer’s and employee’s costs in the

(approx. EUR 1.2 million). royalties, interest, and to income originating in the Czech property in forced insolvency sales. case of the minimum wage and average wage in the

R&D tax allowance of up to 110% of eligible R&D costs can Republic. Tax rates may be reduced by double tax treaty Option for taxation private sector.

be claimed as a tax base deduction.

(DTT). The Czech Republic has a wide international treaty ü – only to Czech VAT payers for the

Thin capitalization rules apply – financial expenses related network with over 90 DTTs concluded. If there is no DTT letting of real estate performance of economic activities

to credits, loans, and other instruments from related or agreement for the exchange of information in place, the supply of used real estate ü (5-year time test)

parties that exceed four times the equity (six times for payments are subject to a 35% withholding tax. VAT registration Approx. EUR 83,000/ year –

banks and insurance companies) are not tax-deductible. Tax exemption applies to dividend distributions, provided threshold only for Czech based legal entities.

that certain conditions are met. Similar rules apply

The EU Anti-Tax Avoidance Directive (ATAD) applies - to tax exemption on capital gains from the sale of shares

Limitation of tax deductibility of exceeding borrowing in subsidiaries.

costs; CFC rules; Exit taxation; Hybrid mismatch rules.

In line with the EU Interest and Royalty Directive, the tax Average wage

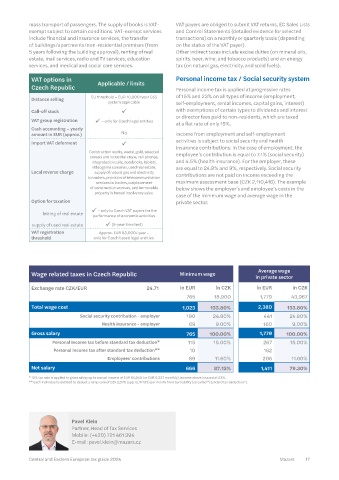

exemption on interest and royalty payments also applies Wage related taxes in Czech Republic Minimum wage in private sector

Transfer pricing in Czech Republic when approved by the tax authority.

Exchange rate CZK/EUR 24.71 in EUR in CZK in EUR in CZK

Arm's length principle ü Since 1993 When certain conditions are met, the transactions that are

generally subject to withholding tax but are thus exempt 765 18,900 1,779 43,967

Since 2006 (scope from tax must still be reported to the tax authority.

Documentation liability ü of documentation is only Total wage cost 1,023 133.80% 2,380 133.80%

recommended) Road tax is imposed on selected heavy trucks and trailers. Social security contribution - employer 190 24.80% 441 24.80%

APA ü Since 2006 A real estate tax applies to land and buildings, with tax Health insurance - employer 69 9.00% 160 9.00%

Country-by-Country From FY 2016 rates generally depending on the type of property, while Gross salary 765 100.00% 1,779 100.00%

liability ü the final amount of tax may also be influenced by local

rates (applied by local authorities). Personal income tax before standard tax deduction* 115 15.00% 267 15.00%

The recommended scope

Master file-local file of the TP documentation There is no real estate transfer tax. Personal income tax after standard tax deduction** 10 162

(OECD BEPS 13) ü corresponds to the OECD Employees' contributions 89 11.60% 206 11.60%

applicable VAT and other indirect taxes

Guidelines. Net salary 666 87.13% 1,411 79.30%

Penalty For 2024, the standard VAT rate is 21%. The reduced * 15% tax rate is applied to gross salary up to annual income of EUR 64,040 (or EUR 5,337 monthly), income above is taxed at 23%.

VAT rate of 12% is applicable, for example, on foodstuffs ** Each individual is entitled to deduct a lump sum of CZK 2,570 (app. EUR 105) per month from tax liability (so called “standard tax deduction”).

lack of documentation No – and additives usually intended for food preparation,

20% on tax underpayment products used as food supplements or substitutes, tap

tax shortage ü or 1% of decreased tax loss water, feed for animals, seeds, plants, medicines, medical

+ late payment interest devices meeting certain conditions, construction works

Direct or indirect control on residential housing, accommodation, catering services

Related parties > 25%

or personally related. except serving beverages other than tap water and specific Pavel Klein

Low value-added services: beverages (such as milk, soya milk, milk- and soya-milk Partner, Head of Tax Services

Safe harbors ü 3%–7% mark-up. based beverages and similar products), water distribution Mobile: (+420) 721 461 394

Level of attention paid by Tax and wastewater removal, heating and cooling, magazines E-mail: pavel.klein@mazars.cz

Authority 9/10 and newspapers meeting certain conditions, and the

16 Mazars Central and Eastern European tax guide 2024 Central and Eastern European tax guide 2024 Mazars 17