Page 21 - CEE Tax Guide 2024

P. 21

Germany the tax authority. Goods imported into Germany from Personal income tax / Social security system

a non-EU country are subject to an "import VAT" on entry.

Sales of goods within the EU in the B2B sector are tax- Individuals are subject to unlimited income tax liability

if they have their residence or habitual abode in Germany.

free (intra-community supply). Sale of goods to a private Nationality is irrelevant for German income tax liability.

person is generally subject to German VAT. In addition

Mazars GmbH & Co. KG to VAT, there are various excise duties on imported goods, In this case, the worldwide income of the individual

is subject to German income tax. Individuals who are not

Wirtschaftsprüfungsgesellschaft as well as real estate transfer tax. subject to unlimited income tax liability in Germany but

Steuerberatungsgesellschaft receive income from German sources are subject to limited

Alt-Moabit 2 | 10557 Berlin | VAT options in income tax liability on these sources.

Deutschland Germany Applicable / limits Individuals can earn the following types of income

Phone: +49 30 208 88-1878 in Germany: Income from business operations, income

Fax: +49 30 208 88-1999 Distance selling As of July 1, 2021, from self-employed or employed work, income from

www.mazars.de the OSS system is applicable. capital assets, income from agriculture and forestry,

Call-off stock No income from renting and leasing, and other income.

VAT group registration No Individuals are subject to a progressive income tax rate

Corporate taxes and other direct taxes additionally on corporate income tax. The total corporate Cash accounting – yearly EUR 600,000/year of 14% to 45%. A solidarity surcharge of 5.5% is levied

income tax burden amounts to a maximum of 15.825%. amount in EUR (approx.) in addition to income tax. A basic allowance of EUR 11,604

Corporations are subject to unlimited corporate income In addition, German municipalities levy trade tax if the Import VAT deferment No to secure the minimum subsistence level is exempt

tax liability if they have either their registered seat or their company has a domestic permanent establishment. from German income tax. In principle, taxable income

effective place of management in Germany. In this case, The average trade tax burden is 15.225% (2023). Construction work, emission is calculated as the surplus of income over income-related

the worldwide income of the corporation is subject The determination of taxable income is generally based Local reverse charge permits, gold, cleaning of buildings, expenses, or of operating income over operating expenses.

turnover covered by the Real Estate

to German corporate income tax. Corporations that are on the result of the income statement under commercial Transfer Tax Act, natural gas and Personal expenses can also be deducted under certain

not subject to unlimited corporate income tax liability law. However, taxable income often differs from the profit electricity. conditions. Investment income, e.g. interest and dividends,

in Germany but receive income from German sources and loss reported in the commercial balance sheet. German Option for taxation is generally subject to a separate tax rate of 25%, plus

are subject to limited corporate income tax liability tax law provides tax exemptions for certain income, e.g. a 5.5% solidarity surcharge.

on these sources. The corporate income tax rate is 15%. dividends and capital gains are generally 95% exempt from letting of real estate ü Income from employment falls within the scope of the

The solidarity surcharge amounts up to 5.5% and is levied supply of used real estate ü German social security system. This system is divided

German corporate income tax (minimum holding ≥ 10%) into unemployment, pension, health, nursing, and

Transfer pricing in Germany and trade tax (minimum holding > 15%). The tax losses for VAT registration EUR 22,000/year accident insurance. Social security contributions are

a fiscal year can be offset against the profits of the previous threshold

Arm's length principle ü Since 1983 year up to an amount of EUR 10 million (loss carryback; EUR The real estate transfer tax is levied on the selling price usually paid half and half by the employer and the

employee. The statutory minimum amount for health

Documentation liability ü Since 2003 1 million from 2024). Any loss exceeding this amount can or other disposal value of land and or buildings whenever insurance is 14.6% and is divided equally. The contribution

be carried forward indefinitely and offset in the following

APA ü Since 2006 fiscal years (loss carryforward). In subsequent years, the there is a change of ownership. The tax rate is determined for pension insurance is 18.6% and is borne equally

Country-by-Country From FY 2016 remaining losses can be deducted without limitation by the individual federal states and ranges from 3.5% by the employer and the employee. The sum of social

liability ü up to an amount of EUR 1 million. In addition, a loss offset to 6.5%. The average rate of land transfer tax is 5.63% contributions averages 40.45% (excl. accident insurance)

Master file-local file of up to 60% of the total amount of income exceeding EUR of the realizable value. of an employee's gross salary.

(OECD BEPS 13) ü From FY 2017

applicable 1 million is possible.

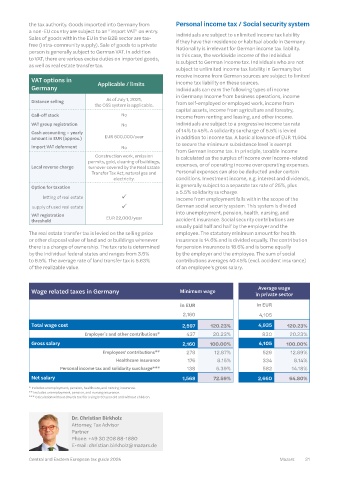

Penalty Partnerships are not subject to either income or corporate Wage related taxes in Germany Minimum wage Average wage

Violation of duty income tax at the company level, but may be subject to trade in private sector

to cooperate: Reversal tax. The profit of a partnership is subject to either income

of burden of proof, Violation tax or corporate income tax at the level of the partners. in EUR in EUR

of duty to cooperate: 2,160 4,105

Reversal of burden of proof, Germany has concluded double taxation treaties with

authorities may estimate 136 countries. A withholding tax rate of 25% (15% Total wage cost 2,597 120.23% 4,935 120.23%

the tax basis. Failure if the recipient is a corporation) applies to dividends.

lack of documentation ü to submit: Penalty 5%-10% Interest income is subject to a withholding tax of 25%. Employer´s and other contributions* 437 20.23% 830 20.23%

of the additional amount A withholding tax of 15% (30% under certain conditions) Gross salary 2,160 100.00% 4,105 100.00%

of income based on the

authorities’ estimate (min. is levied on royalty payments and other special types Employees' contributions** 278 12.87% 529 12.89%

5,000). Late submission: of income. The withholding tax rates may be reduced under Healthcare insurance 176 8.15% 334 8.14%

EUR 100 p.d. (max. the applicable Treaty, the EU Parent-Subsidiary Directive

EUR 1 mio.). or the EU Interest and Royalties Directive. Personal income tax and solidarity surcharge*** 138 6.39% 582 14.18%

Up to EUR 50,000 tax Net salary 1,568 72.59% 2,660 64.80%

reduction – fine. From EUR VAT and other indirect taxes

tax shortage ü 100,000 – imprisonment * Includes unemployment, pension, healthcare, and nursing insurance.

and/or high fine. Interest The VAT rate in Germany is 19%. A reduced rate of 7% ** Includes unemployment, pension, and nursing insurance.

on the additional tax. applies to certain basic foodstuffs, books, newspapers, *** Calculation without church tax/for a single 30 year old and without children.

Direct or indirect antiques, livestock, hotel accommodation, railway

control, or entitlement

Related parties ≥ 25% transport services, and certain other items. Banking

of profits or the proceeds services and insurance premiums are generally exempt Dr. Christian Birkholz

of liquidation. from VAT. If goods are supplied from the EU to non- Attorney, Tax Advisor

Safe harbors No – EU countries, the supply is generally not subject to German Partner

Level of attention paid by Tax VAT (export). Nevertheless, the input tax associated with Phone: +49 30 208 88-1880

Authority 9/10 the goods can be claimed by the domestic company from E-mail: christian.birkholz@mazars.de

20 Mazars Central and Eastern European tax guide 2024 Central and Eastern European tax guide 2024 Mazars 21