Page 19 - CEE Tax Guide 2024

P. 19

Estonia VAT options 3) The products listed in Annex V of the VAT Directive and

which can be placed into a licensed VAT warehouse;

in Estonia Applicable / limits 4) Supply of services which are not deemed to be supplied

Distance selling From 1 July, 2021, the OSS system in Estonia.

is applicable. Until December 31, 2025, a taxable person will be entitled,

ATTELA Law Firm Call-off stock ü on the basis of a written contract concluded before May 1,

2023, to apply the 20% VAT rate applicable to the supply

Ahtri 6a, Tallinn, VAT group registration ü of goods or services, provided that the relevant contract

Estonia Cash accounting – yearly – Cash accounting possible provides that the price of the goods or services includes

Phone: +372 5090647 amount in EUR (approx.) ü up to EUR 200,000 yearly. VAT at a rate of 20%, or a 20% VAT rate % is added to the

www.attela.ee/en

Import VAT deferment ü price and the contract does not provide for a change in the

Local reverse charge ü – on certain goods price resulting from a possible change in the rate of VAT.

Other indirect tax types in Estonia include excise duty and

Option for taxation the environmental protection charge.

letting of real estate ü – in some cases Personal income tax / Social security system

Corporate taxes and other direct taxes payments of income tax on the previous quarter's profit, supply of used real estate ü – in some cases

at a rate of 14%. These advance payments can be taken into VAT registration Estonia has a proportional (i.e. flat) tax rate of 20% which

Income derived by a resident company consideration when distributing profits and calculating threshold > EUR 40,000 applies to all items of income derived by any resident

is not taxed if retained. Upon distribution, CIT is levied income tax liability. From July 1, 2020, qualifying resident taxpayer. The gross income of resident individuals includes

at a rate of 20/80 (25%) of the net amount of the profit shipping companies have the option to apply the tonnage and the intra-Community supply of goods and certain their worldwide income from all sources, irrespective of the

distribution, corresponding to 20% on the gross amount tax regime to income earned from qualifying international services is 0% (i.e. exemption with credit). origin of the income.

(distribution + CIT) of the distribution. shipping activities, with a tax rate of 20%. From 2025 VAT and all other taxes are administered by the Estonian Taxable income includes both active income such

Dividends distributed in an amount lower than or equal onwards, the income tax rate will be 22/78, and the Tax and Customs Board (www.emta.ee). The following as employment and business income, as well as passive

to the amount of the average of distributed dividends reduced rate of 14/86 will be eliminated. transactions are subject to Estonian VAT: income. An annual basic exemption of EUR 7,848

in the preceding 3 years, on which income tax has been 1) The supply of goods and provision of services with is provided for an annual income of up to EUR 14,400.

paid by the resident taxpayer, are taxed at a rate of 14/86. The following payments are subject to withholding tax a place of supply in Estonia; If annual income increases from EUR 14,400 to EUR

If dividends are paid to individuals, whether resident (unless tax treaty restricts or reduces the rate): 2) The import of goods into Estonia; 25,200, the basic exemption decreases proportionally.

or non-resident, and the distributing company has paid 1) 7% withholding tax applies to dividend payments 3) Intra-Community acquisition of goods in Estonia; If annual income is above EUR 25,200, the basic

the lower 14/86 rate or operates under the tonnage tax made to resident or non-resident individuals (applies 4) The supply of goods or services specified in the Estonian exemption drops to 0.

regime, an additional 7% withholding tax is imposed to dividends taxed at a lower tax rate). VAT Act, providing the taxable person has opted for The Estonian social tax of 33% (comprising 20% social

on the individual recipient, unless a lower rate applies 2) Royalties (including payments for the use of industrial, taxation thereof. Certain forms of supply are subject security contributions and 13% health insurance

under a tax treaty. However, no withholding tax is applied commercial, or scientific equipment) paid to non- to a 0% rate (i.e. exemption with credit or zero-rating), contributions) must be paid by employers in addition

if the recipient is a company. Since 2018, resident credit residents are generally subject to 10% withholding tax including, but not limited to: to the gross salary. Currently, employees are not

institutions and Estonian branches of non-resident credit under domestic law. 1) The export of goods; required to make any personal social tax contributions.

institutions are required to make quarterly advance 3) 20% on rental payments to non-residents for the use 2) Intra-Community supply of goods; The Estonian pension system is based on three pillars.

of immovable property located in Estonia, and movable

Transfer pricing in Estonia property subject to registration in Estonia.

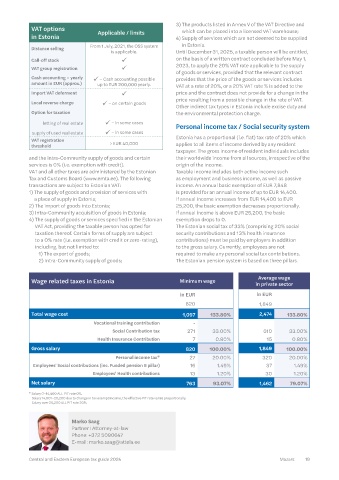

4) Interest, royalties, and rental payments to resident Wage related taxes in Estonia Minimum wage Average wage

Arm's length principle ü Since 2007 individuals. in private sector

Documentation Since 2007 5) 10% on payments to non-resident companies for in EUR in EUR

liability ü services provided in Estonia. 820 1,849

APA No – 6) Salaries, directors’ fees, and service fees paid

Country-by-Country Since 2016 to individuals. Total wage cost 1,097 133.80% 2,474 133.80%

liability ü 7) 10% on payments for the activities of non-resident Vocational training contribution -

Master file-local file artists or athletes carried out in Estonia. Social Contribution tax 271 33.00% 610 33.00%

(OECD BEPS 13) ü Since 2019 8) Certain pensions, insurance benefits, scholarships, Health Insurance Contribution 7 0.80% 15 0.80%

applicable prizes, lottery winnings, alimony, etc. paid to non-

residents and resident individuals. Gross salary 820 100.00% 1,849 100.00%

Penalty Personal income tax* 27 20.00% 320 20.00%

lack of documentation – – VAT and other indirect taxes Employees' Social contributions (inc. Funded pension II pillar) 16 1.49% 37 1.49%

20/80 tax on gross value

tax shortage ü of underpayment VAT applies to the supply of goods and services performed Employees' Health contributions 13 1.20% 30 1.20%

+ late payment interest by a taxable person in the course of their business activities Net salary 763 93.07% 1,462 79.07%

The concept of a related in Estonia.

person encompasses a wide A taxable person is one who is engaged in business, * Salary 0–14,400 ALL PIT rate 0%.

range of relationships. that is, independent economic activity in the course Salary 14,001–25,200 due to change in tax exempt income, the effective PIT rate varies proportionally.

Related parties Broad It includes all persons who of which goods or services are supplied, and is registered Salary over 25,200 ALL PIT rate 20%.

definition share a common economic

interest or where one holds or required to register for VAT.

a dominant position over The standard 20% rate applies to the supply of all goods Marko Saag

the other. and services not qualifying for the reduced rate of 9% Partner I Attorney-at-law

Safe harbors No – or exemption. A reduced rate applies to accommodation, Phone: +372 5090647

Level of attention paid by Tax books, certain periodicals, listed pharmaceutical products, E-mail: marko.saag@attela.ee

Authority 9/10 and medical devices. The VAT rate on the export of goods,

18 Mazars Central and Eastern European tax guide 2024 Central and Eastern European tax guide 2024 Mazars 19