Page 29 - CEE Tax Guide 2024

P. 29

Kosovo borders of Kosovo. The holder of the transaction pays VAT Personal income tax / Social security system

on the basis of the customs value and any other import

duty (customs and excise tax, if applicable) regardless The object of taxation for a resident taxpayer is taxable

income from a source in Kosovo and from a foreign

of their origin. VAT is levied on imports and any supply source. The object of taxation for a non-resident taxpayer

of goods or services, except those which are considered is taxable income from a source in Kosovo.

as exempt by law.

Mazars Kosova sh.p.k With the exception of income exempt from tax under the

Rr. Ukshin Hoti, No.45/6, VAT options in law, gross income is all income received or accrued from

Prishtina, Kosovo Applicable / limits any source, including: wages, rent, business activity, the

Phone: +383 38 609 029 Kosovo use of intangible assets, interest, capital gains, lotteries

www.mazars.al Distance selling No and other games of chance, pensions paid by an employer,

Call-off stock No or in line with the Law on Pensions in Kosovo and any other

VAT group registration No income that increases the taxpayer’s net worth.

Cash accounting – yearly Taxpayers are natural persons, resident and non-resident,

amount in EUR (approx.) No personal businesses, partnerships, and companies who

Corporate taxes and other direct taxes by Kosovo residents or non-residents. Reflecting the Import VAT deferment ü receive or create gross income from all sources, including

change in the corporate income tax rate, except for wages, business activities, rents, lottery winnings,

Resident companies are subject to corporate income tax the withholding tax on rent (9%), all other income Supply of construction and interest, dividends, capital gains, use of intangible

on their worldwide income, while the object of taxation is taxed at 10%. Local reverse charge construction-related works; property, pensions, and any other income that increases

for a non-resident taxpayer is only the taxable income construction activities. the taxpayers’ net worth. The taxable period for Personal

generated from a source in Kosovo. The Corporate Income Withholding tax will be levied even in cases where the Option for taxation Income Tax is the calendar year. Personal Income Tax

Tax (CIT) system in Kosovo adheres to the principles recipient of the income is subject to corporate income letting of real estate ü is applied at progressive rates (rates from 0% to 10%).

of worldwide taxation. tax and such income is included in the recipient's taxable The Kosovo Pension Savings Fund is responsible

profits. The withholding tax is offset against the corporate supply of used real estate No

The annual turnover threshold for taxation has been income tax payable by the recipient on the annual VAT registration for administering and managing individual pension

reduced from an annual turnover of EUR 50,000 to EUR tax return. threshold EUR 30,000/year saving accounts. This fund obliges the employee

30,000. Resident companies and sole traders whose and the employer to contribute to financing the

gross annual income exceeds EUR 30,000 are subject Transfer pricing (TP) effective from 2017 regulates the The VAT rate has increased to two fixed rates: the standard employee’s pension at the rate of 5% from the

to CIT. Below the threshold, taxpayers can opt for a special intra-company pricing arrangement between affiliated rate of 18% and the reduced rate of 8% of the value employee’s salary and 5% from the employer.

quarterly payment on their gross income. business entities. Controlled taxation comes into effect of supplies of imported and domestic taxable supplies,

whenever there is a minimum 50% ownership or voting except for exempt supplies and supplies treated as exports.

The CIT rate on annual turnover is 10%. This tax is paid right condition exists for the transaction. Controlled

every three months depending on annual turnover. Taxable transactions include all types of transactions that may Average wage

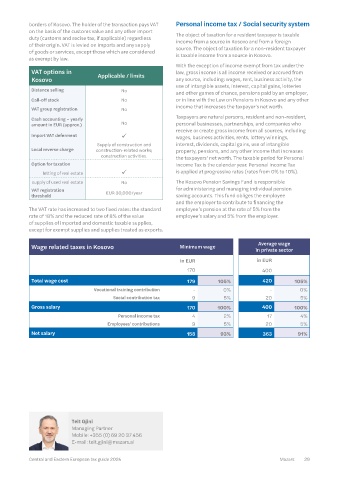

income for the CIT period is the difference between gross affect the taxable income of a taxpayer. Wage related taxes in Kosovo Minimum wage in private sector

income received or accrued during the tax period and the

deductions allowable with respect to such gross income. Taxpayers performing controlled transactions above the in EUR in EUR

The tax period for CIT is the calendar year. Losses can amount of EUR 300,000 within a calendar year must 170 400

be carried forward for six consecutive tax periods. submit an annual controlled transactions form to the tax

authorities by March 31 of the following year. Total wage cost 179 105% 420 105%

Withholding tax is also levied on income from interest,

royalties, rents, lotteries, and games of chance earned The regulation excludes internal controlled transactions Vocational training contribution - 0% - 0%

(it applies only to cross border transactions) and provides Social contribution tax 9 5% 20 5%

Transfer pricing in Kosovo for certain safe harbors to prove that the arm’s length Gross salary 170 100% 400 100%

Arm’s length principle ü Since 2017 principle is respected. Safe harbors involve calculating the Personal income tax 4 2% 17 4%

total costs of all group members for the low value-adding

Documentation liability ü Since 2017 intra-group services on an annual basis. For such services, Employees' contributions 9 5% 20 5%

APA ü Since 2017 there is no need to prepare a transfer pricing study, but Net salary 158 93% 363 91%

Country-by- From FY 2017 instead a profit mark-up to a maximum 7% on costs

Country liability ü (with transitional rules). is allowable.

Master file-local file VAT and other indirect taxes

(OECD BEPS 13) ü From FY 2018 on.

applicable A transaction is subject to VAT taxation in Kosovo if it is for

Penalty the supply of goods or services against payment made

within the territory of Kosovo by a taxable person acting

lack of documentation ü A maximum of EUR 2,500. as such. Furthermore, the import of goods pursuant to the

tax shortage N.A. law is subject to VAT taxation.

Direct or indirect A taxable person is any person, whether natural or legal,

Related parties > 50% control or common or organized in any other form recognized by law in Kosovo,

managing director. who independently carries out an economic activity Teit Gjini

Low value-added services: pursuant to the law, regardless of the place, purpose,

Safe harbors ü mark-up to a maximum 7%. or result of this activity. In line with EU and VAT principles, Managing Partner

Mobile: +355 (0) 69 20 37 456

Level of attention paid by Tax exports are exempt from VAT with the right of deduction E-mail: teit.gjini@mazars.al

Authority 9/10 of input VAT. VAT on imports is collected at the state

28 Mazars Central and Eastern European tax guide 2024 Central and Eastern European tax guide 2024 Mazars 29