Page 33 - CEE Tax Guide 2024

P. 33

Latvia administration (e.g. submitting application forms, issuing Personal income tax / Social security system

certificates, granting permissions, etc.) are also subject

to stamp duty. A progressive PIT rate was introduced starting from

January 1, 2018. From January 1, 2022, it includes the

VAT options in following: 20% is applied for income of less than EUR

Latvia Applicable / limits 20,004 per year; 23% for income between EUR 20,004

SIA Mazars Latvia and EUR 78,100 per year; and 31% for income exceeding

Duntes str 6-213, From July 1, 2021 the OSS system EUR 78,100 per year. A maximum amount for the object

Riga, Latvia, LV-1013 Distance selling is in force. A VAT registration threshold of social contribution tax is set for 2022, 2023 and 2024

Phone: +371 67379031 of EUR 10,000 per year is applicable. in the amount of EUR 78,100.

www.mazars.lv Call-off stock ü The tax on annual income of more than EUR 78,100 per

VAT group registration ü year is calculated in a recapitulative order when submitting

the annual income declaration. If a payroll tax book is not

Cash accounting – yearly EUR 300,000/year applicable to private

amount in EUR (approx.) entrepreneurs or agricultural companies. submitted at a place of employment, the salary tax rate

is 23% regardless of monthly income.

Import VAT deferment ü

Corporate taxes and other direct taxes Tax exempt capital gains: from 2018 onwards, distributed Timber and related services, dealings Also, from July 1, 2022, the non-taxable minimum has

profit from the sale of directly owned shares (except for involving scrap metal, construction been increased from 350 EUR to 500 EUR (please see

Since 2018, CIT is, in general, payable only on the shares of low/tax free companies) is not subject to CIT services, grain crops, precious metals, wage calculations below).

distribution of profit: dividends (also interim dividends), unless the company has held the relevant shares for fewer Local reverse charge game console supplies, supplies Income from capital and capital gains is taxed with

payments qualifying as dividends, non-business expenses, than 36 months, or the shares belong to a company the of ferrous and non-ferrous semi-finished a 20% PIT rate.

loans issued to related parties, interest payments subject majority of whose assets by value is comprised of real metal products.

to thin capitalization rules, bad debts to be written estate located in Latvia. Exemption does not apply Option for taxation Active incomes fall under the scope of the SSC system:

off, transfer pricing adjustments, liquidation quota, where the main purpose of setting up the taxpayer or the letting of real estate No individual social contributions equal a total of 34.09%,

etc. The CIT rate is 20% of the gross taxable value structure is to benefit from the holding regime (i.e. tax of which the employer’s contribution is 23.59% and the

(expense/distribution value) or 25% of the net value (i.e. optimization or avoidance of taxes has taken place). supply of used real estate ü employee’s contribution is 10.5%. Benefits in kind earned

a 20/80 rate). VAT registration EUR 50,000/year within employment are taxed with PIT and SSC at standard

Tax exemption is not applicable to profits from the sale threshold rates. The examples below show the cost to the employer

Since 2018, the following thin capitalization rules are of financial instruments (e.g. investment fund notes, and employee in the cases of the minimum and the

applicable: (1) the debt/equity ratio exceeds 4 to 1; (2) securities, bonds, etc.) or to royalties and interest received. average wage in the private sector.

the amount of interest paid exceeds EUR 3 million as well

as 30% of EBITDA. If either of the two thin capitalization A withholding tax (WHT) of 20% is applied to management

thresholds are exceeded, the interest payment will and consulting service fees paid by Latvian companies

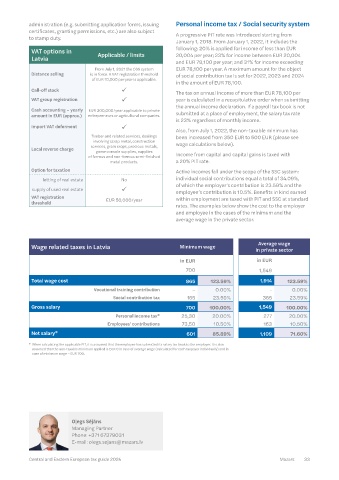

be subject to 25% CIT from the net excess interest value. to foreign companies; 3% WHT is applied to remuneration Wage related taxes in Latvia Minimum wage Average wage

paid to a foreign company for the disposal of real in private sector

estate located in Latvia, or for the disposal of shares in EUR

Transfer pricing in Latvia holding real estate located in Latvia; 5% WHT is applied in EUR

to remuneration paid to a foreign company for renting 700 1,549

Arm’s length principle ü Since 2005 or leasing of real estate in Latvia; and 20% WHT is applied

Documentation liability ü Since 2013 to all payments to offshore companies. WHT may Total wage cost 865 123.59% 1,914 123.59%

be avoided under the active international treaty network Vocational training contribution – 0.00% - 0.00%

APA ü Since 2013 consisting of more than 63 double tax treaties. Social contribution tax 165 23.59% 365 23.59%

Country-by- Since 2017

Country liability ü VAT and other indirect taxes Gross salary 700 100.00% 1,549 100.00%

Master file-local file Personal income tax* 25,30 20.00% 277 20.00%

(OECD BEPS 13) Since 2018 The general VAT rate is 21% for the sale of goods and Employees' contributions 73,50 10.50% 163 10.50%

applicable services. A reduced rate of 12% is used, for example, for

Penalty medical goods, periodicals, accommodation services, Net salary* 601 85.89% 1,109 71.60%

Penalty of up to 1% of the and thermal energy supplied to private individuals. * When calculating the applicable PIT, it is assumed that the employee has submitted its salary tax book to the employer. It is also

lack of documentation ü controlled transaction, but not Furthermore, a reduced 5% VAT rate is applicable for the assumed that the non-taxable minimum applied is EUR 0 in case of average wage (calculated for each taxpayer individually) and in

exceeding EUR 100,000. supply of fruit and vegetables typically grown in Latvia. case of minimum wage – EUR 700.

20% tax on gross value As of January 1, 2022, the VAT rate for books, news

tax shortage ü of underpayment

+ late payment interest websites, etc. has been reduced from 12% to 5%, and

on e-books from 21% to 5%. A 0% rate is applicable for the

Generally, related parties are export of goods and for the supply of Covid-19 vaccines

two or more natural or legal

persons, or representatives and devices and services related to Covid-19 treatments.

of such persons or groups

Related parties > 50% under specified conditions Exemptions are in place for postal services, medical

and health services, certain financial services, etc.

listed by law (e.g. parent and

subsidiary; shareholding; Entrepreneurs with annual sales of less than EUR 50,000

majority of votes; etc.). are exempt from VAT obligations. Monthly returns are Oļegs Sējāns

electronically recorded. The options/limits based on the

Low value-added services: Managing Partner

Safe harbors No 5% mark-up. EU Directive are determined in the VAT Act. Phone: +371 67379031

Level of attention paid by Tax Other indirect tax types in Latvia include excise and E-mail: olegs.sejans@mazars.lv

Authority 8/10 customs duties, and some transactions related to public

32 Mazars Central and Eastern European tax guide 2024 Central and Eastern European tax guide 2024 Mazars 33