Page 37 - CEE Tax Guide 2024

P. 37

Moldova agricultural products, etc.) (hotel accommodation, assimilated to employment) or independent activities

restaurant services).

(freelancers). Annual personal exemption is applied to the

VAT-exempt activities include medical services, financial amount of EUR 1,350.

and banking services, insurance and reinsurance, sale Social Security Contribution (24% – employer part) and

and rental of land and residential premises (houses and Health Insurance Contribution (9% – employee part).

apartments), certain types of educational and training

TAXACO SRL activities, and other activities of public interest. Dependent activities are subject to HIC at the employee

str. Calea Iesilor 8/1,3rd fl, of. 9a Other indirect taxes applicable include excise and (9%) and SCC at the employer level (24%).

MD2069, Chisinau, Moldova environmental tax.

Phone: 373 22 211 819 A 24% SCC rate is applied to meal vouchers.

E-mail: www.taxaco.md Personal income tax / Social security system The minimum monthly gross wage for the period starting

January 1, 2024 in the real sector is MDL 5,000 per month.

A 12% flat-rate tax is applicable to revenues obtained

from dependent activities (e.g. employment or activities

Average wage

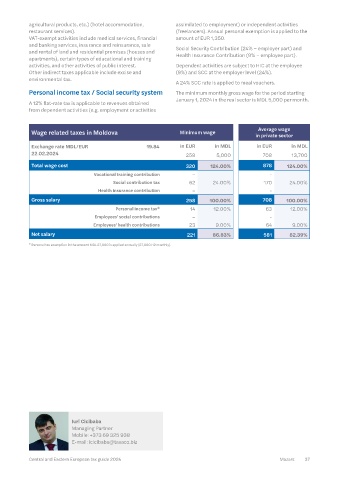

Corporate taxes and other direct taxes • 4% on total revenue. Wage related taxes in Moldova Minimum wage in private sector

A microenterprise may opt for the CIT regime if it fulfils the

General CIT is 12%. To compute taxable profit, the following: Exchange rate MDL/EUR 19.84 in EUR in MDL in EUR in MDL

accounting profit is adjusted upwards (with non- • it becomes a VAT payer; 22.02.2024

deductible expenses) or downwards (with non-taxable • more than 50% of its revenue is generated by VAT- 258 5,000 708 13,700

revenues). Tax losses are carried forward for 5 years. Total wage cost 320 124.00% 878 124.00%

exempted supplies.

For CY 2023-2025, a special tax relief is being applied A special tax regime applies for residents of IT Parks (Law Vocational training contribution – -

for limited liability companies and joint stock companies No 77/2016): 7% on monthly sales income, but no less than Social contribution tax 62 24.00% 170 24.00%

that represent SME (small and medium enterprises) – CIT MDL 3,510 per employee per month (Unique Tax). This Health insurance contribution – -

calculated for CY 2023-2025 is paid to the State Budget regime is available for the period until 2037 inclusive. 70%

only in the case of dividend payments. This tax relief is not of the sales generated by a resident should correspond Gross salary 258 100.00% 708 100.00%

applied to financial and insurance companies. Personal income tax* 14 12.00% 63 12.00%

to the list of IT services approved by law (including

Moldova has a treaty network consisting of 50 double tax 3D programming and R&D). Starting February 12, 2024 Employees' social contributions – -

treaties. The WHT rate on dividends is 6%, while for interest the Law is also applicable to Business Process Operations Employees' health contributions 23 9.00% 64 9.00%

and royalties it is 12%. Outsourcing that is 100% provided to exports. Net salary 221 86.83% 581 82.39%

Capital gains from the sale of shares and other capital This unique tax includes all payroll taxes, social insurance * Personal tax exemption in the amount MDL 27,000 is applied annually (27,000/12 monthly).

assets are taxable for non-residents – at 12% for legal contributions, compulsory state health insurance, and all

persons; for individuals, only 50% of the capital gain local taxes. Consequently, a resident of an IT Park is liable

is taxed at the rate of 12%. The relevant double tax treaties for a special tax, withholding tax, and VAT.

are applicable.

VAT and other indirect taxes

A compulsory micro-company scheme is applicable for

companies not subject to VAT and with revenues below The general rate is 20%. Reduced rates are 8% (e.g.

MDL 1,200,000 (approx. EUR 58,500) for a calendar year: bread, milk and dairy products, medicines, natural gas,

Transfer pricing in Moldova VAT options in

Since 2024 for operations Moldova Applicable / limits

Arm's length principle ü that cumulatively exceed

EUR 1,000,000. Distance selling ü

Documentation liability ü Since 2024 Call-off stock No

APA No – VAT group registration No

Country-by-Country – Cash accounting – yearly

liability No amount in EUR (approx.) No

Master file-local file Since 2024

(OECD BEPS 13) ü Only Local file rules are Import VAT deferment AEO, tax on goods is paid no later than

applicable applicable. when custom clearance is performed.

Penalty

lack of documentation ü EUR 15,500–51,670 Local reverse charge Sale of collaterals and property

of bankrupt entities.

tax shortage No – Option for taxation

Min.

Related parties of Direct or indirect control. letting of real estate Land and residential premises Iuri Cicibaba

are exempt.

25% Managing Partner

Safe harbors No – supply of used real estate VAT is not calculated for individuals on Mobile: +373 69 325 938

real estate transactions.

Level of attention paid by Tax VAT registration E-mail: icicibaba@taxaco.biz

Authority N/A threshold approx. EUR 58,800

36 Mazars Central and Eastern European tax guide 2024 Central and Eastern European tax guide 2024 Mazars 37