Page 39 - CEE Tax Guide 2024

P. 39

Montenegro as a residence) is taxed at rates ranging from 0.3% to 1.5%. only on income derived from Montenegro. Montenegro has

Illegally built objects are taxed at between 0.3% and 2%,

progressive taxation for salaries (taxed at the rate of 0% /

whereas undeveloped construction land is taxed at 0.3% 9% / 15%) and income stemming from self-employment

to 5% range. (taxed at a rate of 9% or 15%). There is also a flat rate

of 15%, which is applicable for other sources of income

VAT and other indirect taxes (e.g. capital gains, interest, etc.).

Mazars d.o.o. Belgrade Active incomes fall under the scope of the SSC system:

11070 – Belgrade, The general rate is 21%, the reduced rate is 7% (e.g. an individual’s social contributions equal 15.5% altogether.

Bulevar Milutina Milankovica 11g, bread, milk, accommodation services, medications, These include contributions for pensions (15%) and

Serbia tourist rent, restaurants and catering services except unemployment (0.5%). The employer’s contribution

Phone: (00381) 63 244 276 alcoholic beverages), and VAT-exemption is provided for is at a rate of 6.4% of an employee’s salary. This includes

Fax: (00381) 63 293 102 donations, exports, and banking services. Taxpayers with pensions (5.5%), unemployment insurance (0.5%), and

www.mazars.rs revenues in excess of EUR 30,000 must register for VAT contributions to the Labor fund (0.2%) and Labor union

purposes. The options/limits are based on the VAT Act fund (0.2%). Also, a local surtax, calculated based on PIT

in Montenegro.

assessed, is paid by the employer to the municipality

Corporate taxes and other direct taxes in manufacturing in economically underdeveloped Personal income tax / Social security system of the taxpayer’s seat. Surtax rates range from 10% to 15%,

depending on municipality, with most municipalities

municipalities. The total amount of the tax exemption In Montenegro, resident individuals are taxed based having a 13% rate.

Since FY2022, the corporate income tax rate has been may not exceed EUR 200,000 for a period of eight years. on their worldwide income, and non-residents are taxed

progressive and dependent on taxable profits realized In Montenegro, there are no specific thin capitalization

(compared to the 9% flat rate that had been previously rules, except that interest paid to a non-resident must

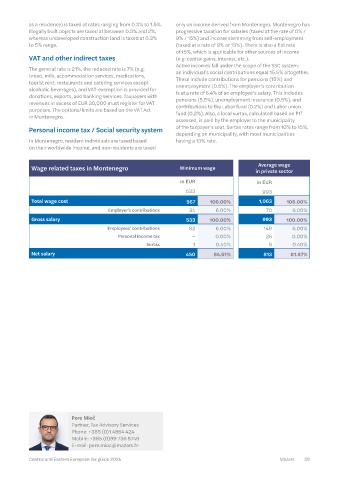

applicable), and it applies to both resident and non- be on arm’s length terms. Wage related taxes in Montenegro Minimum wage Average wage

resident companies. Resident companies are taxed in private sector

on their worldwide income, while non-residents are taxed A 15% withholding tax is applicable to dividends, interests, in EUR

only on income generated in Montenegro. The tax base capital gains, royalties and other intellectual property in EUR

is the pre-tax profit modified by several increasing and rights, fees for the lease of movable and immovable 533 993

decreasing items. Capital gains are included in the annual property, consulting services, market research, and audit Total wage cost 567 106.00% 1,063 106.00%

corporate profits tax return and are subject to a 15% services, which are paid to a non-resident legal entity.

tax. In Montenegro, losses can be carried forward for Montenegro has a wide international treaty network with Employer's contributions 34 6.00% 70 6.00%

5 years while the carry back of losses is not permitted. over 40 double tax treaties. Gross salary 533 100.00% 993 100.00%

A tax incentive (profit tax rate for the first eight years A progressive transfer tax rate starting from 3% is levied Employees' contributions 82 6.00% 149 6.00%

is 0%) is given to newly founded legal entities engaged

on the transfer of immovable property starting from Personal income tax – 0.00% 26 0.00%

2024. Namely, transfers of immovable property up to EUR Surtax 1 0.40% 5 0.40%

Transfer pricing in Montenegro 150,000 are taxed at 3%, transfers of immovable property Net salary 450 84.51% 813 81.87%

Arm’s length principle ü Since 2002 in the amount above EUR 150,000 are taxed at EUR

Yes for large taxpayers 4,500 + 5% to be applied for the amount above EUR

(revenues over EUR 10m). 150,000.01, while transfers of property valued above

Documentation liability ü Others must submit EUR 500,000.01 are taxed at EUR 22,000 + 6% rate

on request. to be applied above EUR 500,000.01.

APA No – Property tax is levied on the ownership/use of property

Country-by-Country – at rates ranging from 0.25% to 1% for real estate that is the

liability No residence of the taxpayer. Secondary real estate (not used

Master file-local file

(OECD BEPS 13) No –

applicable VAT options in Applicable / limits

Penalty Montenegro

lack of documentation ü Penalty between Distance selling No

EUR 1,000–EUR 20,000. Call-off stock No

tax shortage No Not specifically stated. VAT group registration No

The parties between whom Cash accounting – yearly

special relations exist, which amount in EUR (approx.) No

could directly impact the

Related parties > 25%

conditions or economic Import VAT deferment No

results of the transaction Purchase of electricity, heating

between them. Local reverse charge gas and other heating and cooling

Corporate Income Tax Law energy procured for further supply.

envisions safe harbor rules Option for taxation

in relation to intercompany

Safe harbors ü loans and interest rates. letting of real estate No Pere Mioč

The safe harbor rate for Partner, Tax Advisory Services

FY24 is set at 4.87% p.a. supply of used real estate No Phone: +385 (0)1 4864 424

Level of attention paid by Tax VAT registration EUR 30,000/year Mobile: +385 (0)99 736 8746

Authority 5/10 threshold E-mail: pere.mioc@mazars.hr

38 Mazars Central and Eastern European tax guide 2024 Central and Eastern European tax guide 2024 Mazars 39