Page 43 - CEE Tax Guide 2024

P. 43

Poland VAT options in Applicable / limits the income is earned (for example, employment contract,

sole traders’ activity, personally performed activities,

Poland etc.). PIT is calculated according to a progressive tax scale

Distance selling The OSS system is applicable from at a rate of 12% (below income amount of PLN 120k per

July 1, 2021. year) to 32% (above income amount of PLN 120k per

Call-off stock ü year). A specific rate also applies to individuals pursuing

Mazars Audyt SP. z o.o. business activities as sole proprietorships or partners

00 – 549 Warsaw, Piękna 18, VAT group registration ü in partnerships, who may opt for a flat 19% PIT rate.

Poland Cash accounting – yearly EUR 2,000,000/ year The tax-free amount is PLN 30,000 (depending on the

amount in EUR (approx.)

Phone: + 48 22 25 55 200 value of the tax base). The income of taxpayers who

Fax: + 48 22 25 55 299 Import VAT deferment ü are under the age of 26 and receive their income based

www.mazars.pl Reverse charge mechanism applies on an employment relationship, a mandate contract,

to gas supplied in the gas system,

electricity supplied in the electricity

system, and greenhouse gas emission a post-graduate internship, or a student internship is tax-

Local reverse charge allowance transfer services when such free up to an amount of income not exceeding PLN 85,528

supplies are made directly or through in the given tax year.

an authorized entity on a commodity

exchange, a regulated market, Employee Capital Plan (ECP): Payments to PPK are made

Corporate taxes and other direct taxes general rule described above. As of January 1, 2022, or an organized trading platform. both by the employer and the plan participant. The basic

changes in the regulations concerning debt financing Option for taxation payment to PPK made by the plan participant is equal

Polish companies are taxable on their worldwide income. costs entered into force. Expenses for debt financing are to 2% (as of January 1, 2022, this could be 0.5% when

Non-resident companies are taxable only on Polish sources qualified as tax deductible costs to an amount of no more letting of real estate For residential purposes (exempt), additional requirements are fulfilled) of the salary used

for commercial purposes (23%).

of income, subject to DTT. The standard CIT rate is 19%. than 30% of EBITDA or an amount not exceeding PLN as the base for the calculation of retirement and disability

The preferential CIT rate for "small taxpayers" (whose 3,000,000 (depending on which amount is higher). supply of used real estate Exempt (additional SSC, while the employer pays 1.5% of the salary used as the

sales revenue in the previous FY did not exceed the PLN Interest, royalties, and certain types of immaterial requirements needed). base for the calculation of retirement and disability SSC.

equivalent of EUR 2,000,000) is 9%. This rate also applies services paid to non-Polish residents are, as a rule, subject VAT registration PLN 200,000/year Personal income falls under the social insurance

for newly-created entities (additional requirements also to a 20% WHT rate, and dividends (or dividend-like threshold (approx. EUR 50,000) system: employee’s SC (capped) equals 13.71%;

apply). In Poland, CIT is generally payable on income. incomes) are subject to a 19% WHT rate (unless, in both to 2%. Transactions related to filling a power of attorney employer’s contributions equal approximately 20.48%.

Tax deductible costs exceeding revenues in any given instances, an exemption or reduced rate is available under and public administration actions (submitting application Additionally, the individual is required to pay a 9%

FY constitute a loss which may be deducted from income an applicable DDT or the EU Interest-Royalties Directive forms, issuing certificates, granting permissions, etc.) are health insurance contribution. As of January 1, 2022,

over the next 5 consecutive years (no more than 50% exemption applies). As of January 2022, a pay & refund subject to stamp duty. it is not possible to lower the income tax by the amount

of a loss can be offset in any one year). Starting from tax mechanism entered into force. This only applies to passive of the health insurance contribution and deduct 7.75%.

losses incurred in FY2019, it is possible to activate the payments exceeding PLN 2 Million per annum summed Personal income tax / Social security system The examples below show the employer’s and the

tax loss of a given tax year as a one-off amount up to PLN for one non-resident. The excess amounts are subject PIT is calculated on income. However, the income employee’s costs in case of the minimum wage level and

5,000,000. The surplus may be settled in line with the

to a base WHT rate pursuant to the CIT Act (19% or 20%) calculation differs depending on the source from which the average wage in the private sector.

and the tax remitter can only apply for a WHT refund

Transfer pricing in Poland if the payment could be exempt or qualifies for a reduced Average wage

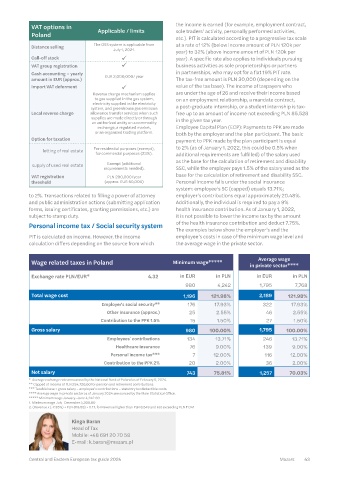

Arm’s length principle ü Since 1997 rate from the proper DTT. It is also possible to apply for Wage related taxes in Poland Minimum wage***** in private sector****

an opinion on the application of preference (additional

Documentation liability ü Since 2001 requirements also apply). There are also strict restrictions Exchange rate PLN/EUR* 4.32 in EUR in PLN in EUR in PLN

APA ü Since 2006 concerning due diligence procedures (e.g. beneficial owner 980 4,242 1,795 7,768

Country-by-Country statement; verification whether the recipient runs a real

liability ü Since 2017 business activity in its state of residence). Total wage cost 1,196 121.98% 2,189 121.98%

Master file-local file Real property tax and transport tax are charged as local Employer's social security** 176 17.93% 322 17.93%

(OECD BEPS 13) ü Since 2017 taxes in Poland. Real property tax is paid by owners Other insurance (approx.) 25 2.55% 46 2.55%

applicable of real estate. Banks and financial institutions are taxable Contribution to the PPK 1.5% 15 1.50% 27 1.50%

Penalty at a 0.0366% rate (monthly levy) of their total assets

20% (30%) of the amount (exceeding the indicated minimum value). Gross salary 980 100.00% 1,795 100.00%

of overstated loss or understated Employees` contributions 134 13.71% 246 13.71%

lack of documentation ü income (over PLN 15,000,000) + VAT and other indirect taxes Healthcare insurance 76 9.00% 139 9.00%

late payment interest + personal

liability of the members of the

Company’s Board. As a rule, the standard VAT rate is 23%. Preferential Personal income tax*** 7 12.00% 116 12.00%

10% of the amount of overstated rates of 8% and 5% apply to certain goods and services. Contribution to the PPK 2% 20 2.00% 36 2.00%

tax shortage ü loss/ understated income + late Other goods and services (e.g. exports, intra-Community Net salary 743 75.81% 1,257 70.03%

payment interest/incorrect

pricing in controlled transaction. supplies of goods, international transport services) may * Average exchange rate announced by the National Bank of Poland as of February 5, 2024.

Related parties > 25% Direct or indirect capital relations, be zero-rated or exempt. Due to inflation during the period ** Capped at income of PLN 234,720.00 for pension and retirement contributions.

personal relations. from February 1, 2022 to December 31, 2022, reduced *** Taxable base = gross salary – employee’s contributions – statutory tax deductible costs.

**** Average wage in private sector as of January 2024 announced by the Main Statistical Office.

Low value added services: rates apply to e.g. fuels; heat; natural gas; certain food ***** Minimum wage January–June 4,242.00

5% mark-up. Loans: for 2024 products. A 0% VAT rate applies to some food products 1. Minimum wage July–December 4,300.00

there is a basic interest rate 2. (Revenue x (-7.35%) + PLN 819.08) ÷ 0.17, for Revenue higher than PLN 8,549 and not exceeding PLN 11,141

on IC loans (depending on the until March 31, 2024.

Safe harbors ü loan currency), i.e. WIBOR 3M,

WIRON 3, LIBOR USD 3M, Other indirect tax types in Poland include excise duty and Kinga Baran

EURIBOR 3M, plus margin gambling tax. Some civil acts such as contracts of sale,

up to 3.1 pp (the Borrower) and Head of Tax

a minimum of 2.2 pp (the Lender). loan agreements, and foundation deeds of partnerships Mobile: +48 691 20 70 58

Level of attention paid by Tax or companies, if not subject to VAT, may be subject to civil E-mail: k.baran@mazars.pl

Authority 10/10 law activity tax (CLAT), the rates of which range from 0.1%

42 Mazars Central and Eastern European tax guide 2024 Central and Eastern European tax guide 2024 Mazars 43