Page 45 - CEE Tax Guide 2024

P. 45

Romania carriages and as of 01/07/2022 for those classified as a tax SSC are the following: Social Security Contribution/

risk within Romania (e.g. fruit, vegetables, alcoholic drinks,

Pension (25% – employee part), Health Insurance

clothing, footwear, and certain minerals and metals). Contribution (10% – employee part) and Work Insurance

As of 01/01/2024 non-alcoholic beverages with a sugar Contribution (2.25% – employer part).

content exceeding 5 gram/liter are subject of excise liability. Income received from dependent activities is subject

Mazars Tax Consulting S.R.L. SAF-T is already implemented for large and medium to SSC at the employee (35%) and the employer level

4b and 2–4 Ing. George taxpayers and as of 01/01/2025 will be mandatory for all (2.25%). As of 2024, the annual base for calculating SSC

Constantinescu Street, taxpayers. for some categories of income is amended.

Building B, Globalworth Campus As regards the SSC/Pension Contribution due for income

Pipera, RO-020339, Bucharest VAT options in received from independent income and IP rights, this

Phone: (+40) 21 528 57 57 Romania Applicable / limits is due in case the income is at least 12 minimum gross

Fax: (+40) 21 528 57 50 salary (e.g RON 3,300 for 2024, thus RON 36,000 per

www.mazars.ro Distance selling The OSS system is applicable. annum). The 25% is applied to the following computation

Call-off stock ü base regardless of the level of revenues obtained:

VAT group registration ü • base of 12 minimum gross salaries in case the level

Corporate taxes and other direct taxes The tax incentive can be applied, through which CIT Cash accounting – yearly EUR 900,000/year of the obtained revenue is between 12 and 24 minimum

amount in EUR (approx.)

payers can benefit, under certain conditions, from gross salaries;

CIT is 16%. To calculate the taxable profit, the accounting annual CIT discounts (2% up to 15%), which is applicable Certificate of payment deferral / AEO / • base of 24 minimum gross salary in case the level of the

profit is adjusted upwards (with non-deductible expenses) until FY 2025. Import VAT deferment simplified customs procedure / products obtained revenue exceeds 24 minimum gross salaries.

subject to VAT r/c.

or downwards (with non-taxable revenues). An additional Tax losses can be carried forward for a period of 5 years For sale of: certain types of waste, certain The Health Insurance Contribution (HIC) is applied to the

deduction of no more than 50% can be applied for certain and offset with taxable profits up to 70%. types of cereal, wood, greenhouse annual net income obtained by the freelancer and the

R&D expenses. Treaty network consisting of around 88 DTTs. Local reverse charge gas emission certificates, electricity, taxable base cannot be higher than 60 minimum gross

Starting with 01/01/2024, entities with a turnover The WHT on Dividends is 8%. natural gas, green certificates, land and salary (capped at this value). For other types of income

buildings, laptops, and mobile phones.

exceeding EUR 50 million are required to pay a minimum The WHT for Interest and Royalties is 16%. Option for taxation (rental income, dividend, capital gain, etc. - except salary

1% tax applied to adjusted turnover if the CIT computed Capital gains from the sale of shares are tax exempt income), the HIC is due as follows:

under general rules is lower than the 1% turnover tax. (certain conditions apply). In all other relations for WHT, letting of real estate ü • base of 6 minimum gross salaries in case the level

Operators in the oil and gas sectors will have to pay a 0.5% the general tax rate and DTTs are applicable. supply of used real estate ü of the obtained revenue is between 6 and 12 minimum

tax applied to adjusted turnover, while credit institutions In 2024 MLI provisions will affect the covered agreements VAT registration approx. EUR 60,000 gross salaries;

will pay a 2% turnover tax for the period of 2024-2025 and in Romania. threshold • base of 12 minimum gross salaries in case the level

1% starting with 01/01/2026. From 2024, shareholders with more than 25% shares of the obtained revenue is between 12 and 24 minimum

Capital gains arising from the sale of the participations in a micro-company cannot have additional shareholdings Personal income tax / Social security system gross salaries;

held in any state that Romania has concluded a DTT with in other companies that apply the same regime. A 10% flat tax rate is applicable to revenues obtained • base of 24 minimum gross salary in case the level of the

are non-taxable. 2 tax rates are applicable for the micro tax regime. from dependent activities (e.g., employment or activities obtained revenue exceeds 24 minimum gross salaries.

Tax consolidation is applicable in the field of CIT at the The 3% tax is reintroduced, however turnover has assimilated to employment) or independent activities

level of two or more legal entities. Once tax consolidation to be between EUR 60k and EUR 500k, or the company has (freelancers).

has been opted for, it must be applied for 5 years.

to have certain NACE codes. The 1% tax is still applicable

for turnover of less than EUR 60k.

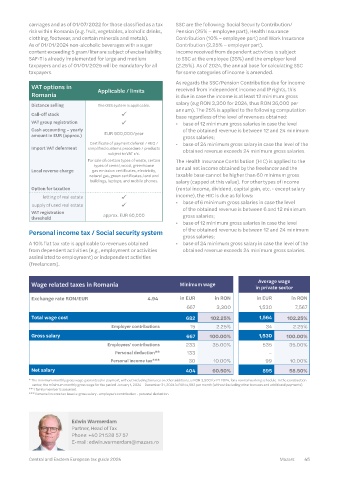

Average wage

Transfer pricing in Romania Legal entities in certain domains are not eligible to apply Wage related taxes in Romania Minimum wage in private sector

Arm’s length principle ü Since 2003 (Law 227/2015) the micro tax regime (insurance, gambling). in EUR in RON in EUR in RON

The incentive implemented to stimulate the capitalization

Since 2003

Documentation ü (Order 222/2008, of CIT payers is also applicable for microenterprise taxpayers Exchange rate RON/EUR 4.94

liability Order 442/2016) for the tax due in the fourth quarter of the fiscal year. 667 3,300 1,530 7,567

APA ü Since 2007 (Order 3735/2015) VAT and other indirect taxes Total wage cost 682 102.25% 1,564 102.25%

Country-by- Non-Public CbCR and Public CbCR Employer contributions 15 2.25% 34 2.25%

Country liability ü (early adoption with FY 2023) are General rate is 19%. Reduced rates are 9% (e.g. medicines, Gross salary 667 100.00% 1,530 100.00%

applicable in Romania.

Master file-local file food, agricultural products, hotel, restaurant services, Employees' contributions 233 35.00% 535 35.00%

certain residential sales and photovoltaic systems etc.)

(OECD BEPS 13) ü Only Local File rules are applicable.

applicable and 5% (e.g. books). Personal deduction** 133 –

Penalty VAT-exempt activities include medical services, financial Personal income tax*** 30 10.00% 99 10.00%

and banking services, insurance and reinsurance, sale

For large and medium tax payers and rental of real estate, sale of medical prostheses and Net salary 404 60.50% 895 58.50%

– approx. EUR 2,500–2,900

lack of documentation ü Other taxpayers – EUR 410–720 orthopedic products, certain types of educational and * The minimum monthly gross wage guaranteed in payment, without including bonuses or other additions, is RON 3,300 for FY 2024, for a normal working schedule. In the construction

Adjustment of tax base plus late training activities, and other activities of public interest. sector, the minimum monthly gross wage for the period January 1, 2024 – December 31, 2024 is RON 4,582 per month (without including other bonuses and additional payments).

payment interest and penalties. E-invoicing systems are mandatory as of 01/01/2024 ** 1 family member is assumed.

*** Personal income tax base is: gross salary - employee's contribution - personal deduction.

tax shortage ü Regular tax regime. for taxpayers who perform B2B transactions considered

minimum of to take place in RO. Starting with 01/07/2024 for the

Related parties 25% Direct or indirect control. purposes of deduction the original invoice is considered

OECD's simplified approach to be the xml file received in the e-invoice system, together Edwin Warmerdam

Safe harbors No on low value adding services is not with electronic signature attached by Ministry of Finance. Partner, Head of Tax

applicable in Romania. The e-transport system for the real time tracking of goods Phone: +40 21 528 57 57

Level of attention paid by Tax is mandatory as of 15/12/2023 for all taxpayers who E-mail: edwin.warmerdam@mazars.ro

Authority 10/10 arrange the transport of goods for all kind of international

44 Mazars Central and Eastern European tax guide 2024 Central and Eastern European tax guide 2024 Mazars 45