Page 47 - CEE Tax Guide 2024

P. 47

Serbia transport and other services that are associated with the Income from the letting of real estate is taxable at 20%,

importation of goods. Taxpayers with revenue in excess

but before that, the gross basis is reduced by standardized

of approximately EUR 68,000 must register for VAT costs equaling 25%. The tax rate on income from royalties

purposes. Non-residents may register for VAT purposes and other invtellectual property amounts to 20%.

only through a tax representative. Active incomes fall under the scope of the SSC system:

social contributions payable by employees amount

Mazars d.o.o. Beograd The other indirect tax type in Serbia is excise duty. to 19.90% of the gross salary. These include contributions

Bulevar Milutina Milankovica 7đ, for pension and disability insurance (14%), health

Serbia Personal income tax / Social security system insurance (5.15%), and unemployment insurance (0.75%).

Phone: (00381) 63 244 276 In Serbia, resident individuals are taxed based on their Contributions payable by the employer amount to 15.15%

Fax: (00381) 63 293 102 worldwide income, while non-residents are taxed only and include contributions for pension and disability

www.mazars.rs

on income in Serbia. There is a flat rate of 10% for gross insurance totaling 10%, and health insurance (5.15%).

salaries. Capital gains are taxed at 15%. Furthermore, the There is no unemployment insurance payable on behalf

tax rate on income from agriculture and forestry is 10%. of the employer. Personal deductions are applicable.

Corporate taxes and other direct taxes A 20% withholding tax is applied to dividends, interests, Average wage

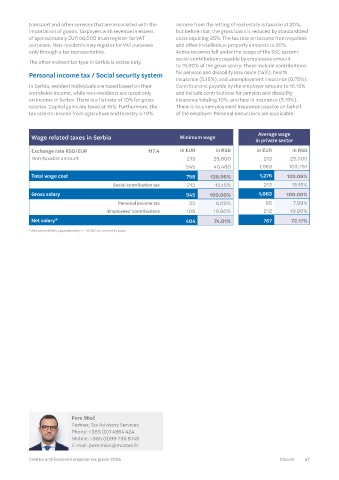

capital gains, royalties and other intellectual property Wage related taxes in Serbia Minimum wage in private sector

There is a flat 15% general corporate income tax rate. Tax rights, income from rent of immovable and movable

is levied on both resident and non-resident companies. property, and income from specific services such as market Exchange rate RSD/EUR 117.4 in EUR in RSD in EUR in RSD

Resident companies are taxed on their worldwide income, research, accounting, auditing, and other services related Non-taxable amount 213 25,000 213 25,000

and non-residents are taxed only on income generated to business and legal consulting. There is also a tax rate 545 40,480 1,063 103,797

in Serbia. The tax base is the pre-tax profit modified of 25% applicable to revenues realized by non-resident

by several increasing and decreasing items. Capital gains legal persons from jurisdictions with a preferential tax Total wage cost 758 138.96% 1,276 120.06%

are also included in the tax return for annual corporate system. Serbia has a wide international treaty network with Social contribution tax 213 15.15% 213 15.15%

profits. Losses can be carried forward for 5 years, but the more than 60 double tax treaties. Gross salary 545 100.00% 1,063 100.00%

carry back of losses is not permitted. There are several

tax deductions available on investments in relation Transactions between related parties must Personal income tax 33 6.09% 85 7.99%

to the number of employed persons and investment be at arm’s length. The comparable uncontrolled price Employees' contributions 109 19.90% 212 19.90%

funds, investing into the capital of newly incorporated method may be used, but in the absence of this method, Net salary* 404 74.01% 767 72.17%

companies performing innovative activities, and income taxpayers can use the cost-plus method, the resale price

from the use of deposited IP rights. Serbia applies a thin method, the profit-sharing method, or the net profit * Net salary differs approximately +/- 15 EUR on a monthly basis.

capitalization ratio of 4:1 (10:1 for banks). There is also method. There is an obligation to enclose transfer pricing

a requirement that interest paid to a non-resident must documentation with the annual tax returns.

be on arm’s length terms. A transfer tax of 2.5% is applied to transfers listed

in the Property Tax Act. There is no surtax or alternative

Transfer pricing in Serbia minimum taxes.

Arm’s length principle ü Since 2013 VAT and other indirect taxes

Since 2013, transfer pricing

Documentation liability ü documentation is submitted The general rate is 20%, reduced rates are 10% (e.g. bread,

along with the CIT return. milk, accommodation services, medications, fertilizer,

APA No – etc.) and VAT-exemption is provided for exports and for

Country-by-Country Tax resident that is the ultimate

liability ü parent entity of an MNE. VAT options in Applicable / limits

Master file-local file Serbia

(OECD BEPS 13) No – Distance selling No

applicable

Penalty Call-off stock ü

lack of documentation ü ~ EUR 16,900 for missing VAT group registration No

documentation

Cash accounting – yearly

30% on tax underpayment + amount in EUR (approx.) Approx. EUR 405,000/year.

tax shortage ü

late payment interest

Import VAT deferment No

Direct or indirect control

or common managing director, Sale of secondary raw materials and

Related parties > 25% close family members, services that are directly related

non-resident entities from Local reverse charge to these goods, transactions involving

tax havens. the construction of buildings, and

construction work services.

Interest as described

in the Governmental Rulebook, Option for taxation Pere Mioč

Safe harbors ü transactions (other than letting of real estate No Partner, Tax Advisory Services

financial) below EUR 68,000

are not subject to TP rules. supply of used real estate No Phone: +385 (0)1 4864 424

Level of attention paid by Tax VAT registration Approx. EUR 68,000/past Mobile: +385 (0)99 736 8746

Authority 8/10 threshold 12 months. E-mail: pere.mioc@mazars.hr

46 Mazars Central and Eastern European tax guide 2024 Central and Eastern European tax guide 2024 Mazars 47