Page 49 - CEE Tax Guide 2024

P. 49

Slovakia of buildings, including land for building, which meets the if they do not partially or fully settle the liability within 100

conditions of state-supported residential rental housing.

days of the due date.

A special voluntary arrangement based on the receipt Other indirect tax types in Slovakia include excise taxes

of payment for goods and services (so-called “cash on wine, beer, tobacco, spirits, mineral oils, electricity, coal,

accounting”) can be applied by certain VAT payers. and natural gas.

Mazars Tax k.s. Personal income tax / Social security system

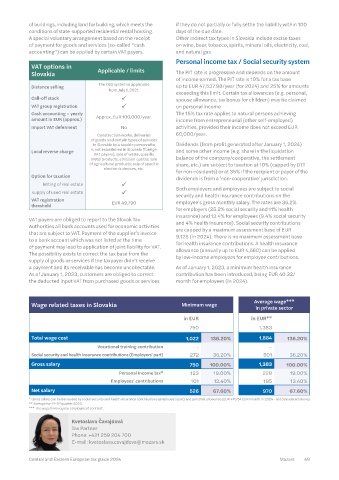

SKY PARK OFFICES 1, VAT options in Applicable / limits The PIT rate is progressive and depends on the amount

Bottova 2A Slovakia of income earned. The PIT rate is 19% for a tax base

811 09 Bratislava The OSS system is applicable up to EUR 47,537.98/year (for 2024) and 25% for amounts

Phone: +421 259 204 700 Distance selling from July 1, 2021. exceeding this limit. Certain tax allowances (e.g. personal,

Fax: +421 259 204 703 Call-off stock ü spouse allowance, tax bonus for children) may be claimed

www.mazars.sk

VAT group registration ü on personal income.

Cash accounting – yearly Approx. EUR 100,000/year. The 15% tax rate applies to natural persons achieving

amount in EUR (approx.) income from entrepreneurial (other self-employed)

Import VAT deferment No activities, provided their income does not exceed EUR

Corporate taxes and other direct taxes equipment linked to Industry 4.0 or tax exemption of part Construction works; deliveries 60,000/year.

of income for granting the right to use a protected patent/ of goods and certain types of services

The CIT rate in Slovakia is 21%. The 15% rate applies software created by the taxpayer. in Slovakia by a taxable person who Dividends (from profit generated after January 1, 2024)

to taxpayers if their income does not exceed EUR Business restructuring (mergers, acquisitions, etc.) can Local reverse charge is not established in Slovakia (foreign and some other income (e.g. share in the liquidation

VAT payers); sale of waste, specific

60,000/tax period. The tax base is calculated from be carried out solely at fair market values (in specific cases metal products, emission quotas; sale balance of the company/cooperative, the settlement

accounting profit (loss) as modified by certain increasing – historical value method available). of agricultural products; sale of specific share, etc.) are subject to taxation at 10% (capped by DTT

and decreasing items. Starting from January 1, 2024 Participation exemption rules for capital gains on the electronic devices, etc. for non-residents) or at 35% if the recipient or payer of the

a minimum tax (EUR 340 to 3,840, depending on taxable sales of shares (ownership interest) can be applied under Option for taxation dividends is from a 'non-cooperative' jurisdiction.

income) will apply to legal entities that report a tax liability specific conditions. letting of real estate ü Both employers and employees are subject to social

lower than the established amount. Thin capitalization rules apply in Slovakia, extended supply of used real estate ü security and health insurance contributions on the

Tax losses (reported since 2020) can be deducted for by ATAD provisions as of January 1, 2024. VAT registration employee's gross monthly salary. The rates are 36.2%

a maximum of five consecutive tax periods, up to 50% threshold EUR 49,790 for employers (25.2% social security and 11% health

of the taxpayer’s tax base. Withholding tax (under Slovak law) insurance) and 13.4% for employees (9.4% social security

There are several types of tax incentives potentially • 0% on dividends if paid to a company that is a tax VAT payers are obliged to report to the Slovak Tax and 4% health insurance). Social security contributions

available, e.g. super-deduction of R&D costs, additional resident of ‘cooperative jurisdiction’ and the beneficial Authorities all bank accounts used for economic activities are capped by a maximum assessment base of EUR

deduction of costs incurred for certain machinery and owner has a dividend income; that are subject to VAT. Payment of the supplier’s invoice 9,128 (in 2024). There is no maximum assessment base

• 19% on interest, royalties, bonuses, income of authors to a bank account which was not listed at the time

Transfer pricing in Slovakia of articles, etc.; of payment may lead to application of joint liability for VAT. for health insurance contributions. A health insurance

allowance (annually up to EUR 4,560) can be applied

• 35% on payments to a resident of a non-cooperative The possibility exists to correct the tax base from the

Arm’s length principle ü Since 1999 country not included in the list issued by the Slovak supply of goods or services if the taxpayer didn't receive by low-income employees for employee contributions.

Documentation liability ü Since 2009 Ministry of Finance (e.g. country that has neither a DTT a payment and its receivable has become uncollectable. As of January 1, 2023, a minimum health insurance

APA ü Since 2004 nor a treaty on tax information exchange with Slovakia), As of January 1, 2023, customers are obliged to correct contribution has been introduced, being EUR 40.32/

Country-by-Country from FY 2016 or where the beneficial owner cannot be proven; the deducted input VAT from purchased goods or services month for employees (in 2024).

liability ü Interests and royalties paid by Slovak tax residents to related

Master file-local file EU entities – exempt from tax (specific rules apply).

(OECD BEPS 13) ü Applicable for specific WHT may be reduced by provisions of applicable Wage related taxes in Slovakia Minimum wage Average wage***

taxpayers.

applicable DTT (currently, DTTs have been concluded with in private sector

Penalty 70 jurisdictions). in EUR in EUR**

up to EUR 3,000 / Real estate tax is imposed on real estate owners based

lack of documentation ü missing documentation 750 1,383

(recurrent basis) on the type of property – land, buildings and apartments. Total wage cost 1,884

13.5% p.a. of tax underpayment The ax liability is calculated by the municipal authorities 1,022 136.20% 136.20%

(up to 100% of the and depends on various factors (e.g. location, area, etc.). Vocational training contribution - –

tax shortage ü underpayment) / 27% in case Motor vehicle tax is imposed on the user/owner of the

of aggressive tax planning Social security and health insurance contributions (Employers' part) 272 36.20% 501 36.20%

in transfer pricing motor vehicle used for business purposes. Tax rates differ

Direct or indirect control based on technical parameters. Gross salary 750 100.00% 1,383 100.00%

or common managing Other taxes: insurance tax, special levy in regulated Personal income tax* 123 19.00% 228 19.00%

Related parties > 25% director, close relatives

or other control aimed purely industries. Employees' contributions 101 13.40% 185 13.40%

on circumvention of tax. VAT and other indirect taxes Net salary

No transfer pricing rules 526 67.60% 970 67.60%

applied on transactions below The basic VAT rate is 20%. The reduced rate of 10% applies * Gross salary can be decreased by social security and health insurance contributions (employee's part) and personal allowance (EUR 470.54 EUR/month in 2024 - not considered above).

EUR 10,000 or EUR 50,000 ** Average for 1 st –3 rd quarter 2023.

in case of loans. The evaluation e.g. to accommodation services, restaurant and catering *** The wage from regular employment contract.

Safe harbors of the above threshold services (excluding alcohol), services for the purpose

is more complex (i.e. the tax

value of transactions from of performing sport in indoor and outdoor sports facilities, Kvetoslava Čavajdová

both related parties have pharmaceutical products, books, lenses, basic food items Tax Partner

to be considered). (e.g. bread, butter, milk), some periodicals, healthy foodstuffs Phone: +421 259 204 700

Level of attention paid by Tax (e.g. dairy products), honey, and most vegetables and E-mail: kvetoslava.cavajdova@mazars.sk

Authority 9/10 fruits. The reduced VAT rate of 5% applies to the provision

48 Mazars Central and Eastern European tax guide 2024 Central and Eastern European tax guide 2024 Mazars 49