Page 53 - CEE Tax Guide 2024

P. 53

Ukraine The VAT registration threshold is a revenue of UAH 1 million for renewable energy, etc.). Until the end of martial law,

(approx. EUR 24 K) over 12 consecutive months. Voluntary

the import of certain military goods is exempt from VAT.

registration is available. VAT exemptions and incentives are granted under certain

requirements.

Under the general rule, the place of the supply of services The other indirect tax in Ukraine is excise tax. Excisable

is the place where the supplier is registered. However,

Mazars Ukraine LLC there are some exceptions (e.g. for consulting, marketing, goods are spirits, beer, tobacco, petroleum, cars, trailers,

motorcycles, and electricity. Certain military purpose

15A Kyrylivska Street, information services, software development, etc.). goods are exempt until the end of martial law.

Kyiv, 04080, The reverse-charge mechanism applies to services

Ukraine provided by a non-resident. Personal income tax / Social security system

Phone: +38 044 390 71 07

www.mazars.ua VAT options in The flat PIT rate of 18% is imposed on both active income

Ukraine Applicable / limits (e.g. employment, benefits in kind) and passive income

(e.g. interest, royalties, investment income) for residents

Distance selling No and non-residents.

Call-off stock No Ukraine tax residents pay PIT on their worldwide income.

Corporate taxes and other direct taxes Companies with annual income below UAH 40 million VAT group registration No Non-residents pay PIT on their Ukrainian sourced income.

(approx. EUR 963K) are entitled not to apply any tax

The standard CIT rate of 18% applies to the worldwide adjustments (except for tax losses carried forward). Cash accounting – yearly Dividends are subject to 9% PIT, except for dividends

income of resident companies. The CIT rate for banks A 15% withholding tax (WHT) is imposed on passive amount in EUR (approx.) ü distributed by Ukrainian CIT payers, which are subject

is 50% in 2023, reduced to 25% starting from 2024. income (dividends, interest, royalties) paid to non- Import VAT deferment No to 5% PIT. For the specific types of passive income, the tax

Non-resident companies and their permanent residents. Local reverse charge rates of 5% and 0% may apply.

establishments (PE) pay CIT on income received from Payment for services is WHT-exempt (except for Imported services There is a temporary military levy (until the completion

Ukrainian sources. engineering). WHT is also levied on other payments to non- Option for taxation of the military reform) at a rate of 1.5% that applies to all

Taxable profit is calculated as financial profit before residents, e.g. constructive dividends, alienation of shares letting of real estate income subject to PIT.

tax (reported in the P&L statement according in Ukrainian asset-rich companies, freight, etc. ü

to GAAP or IFRS), adjusted with certain tax adjustments supply of used real estate No During martial law, the income and gains of combatants

(depreciation, accruals and provisions, thin capitalization, A lower WHT rate or exemption may apply under a double Revenue of UAH 1 million and individuals living in combat areas received from

tax losses, etc.). tax treaty (DTT). Ukraine has a wide DTT network (more VAT registration (approx. EUR 24 K) charitable organizations are PIT-exempt. Also, financial

threshold

Thin capitalization rules apply to loans granted by any non- than 70). A “look-through approach” is available. over 12 consecutive months. support provided to law enforcement officers and military

resident (the debt-to-equity ratio is 3:5), with exceptions The application of DTT benefits is restricted by a “principal personnel is not subject to a military levy.

for certain financial and leasing entities. purpose test”. A so-called "Google tax" of 20% is imposed A reduced PIT rate of 5% applies to salaries of individuals

Tax losses can be carried forward indefinitely with Transfer pricing (TP) rules apply to controlled transactions on the provision of electronic services by non-residents employed by DiiaCity, to the remuneration of gig-experts,

limitations for large taxpayers. Loss carry back is not (CT) with related non-residents and with non-related to individuals within the customs territory of Ukraine. and to the remuneration of authors.

permitted.

foreign companies registered in low-tax jurisdictions or not Ukrainian VAT is administrated through an electronic Most forms of active income fall under the

paying income tax. TP rules apply if the company's annual system. The taxpayer is entitled to issue VAT invoices for

Transfer pricing in Ukraine revenue exceeds UAH 150 million (approx. EUR the amount within a certain cap. scope of social security contribution (SSC)

Arm’s length principle ü Since 2013 3.6 million), and its CT with the same counterparty exceed There are VAT exemptions (tobacco products, gold) and with an employer’s contribution of 22%; there

is no employee’s contribution. The minimum monthly SSC

Documentation liability ü Since 2013 UAH 10 million (approx. EUR 241 K). Transactions between temporary VAT incentives for the supply of certain goods is UAH 1,562 (approx. EUR 38), the maximum monthly SSC

non-resident and its PE fall under TP control if the amount

APA ü Applicable to large taxpayers, exceeds UAH 10 million. and services (electric vehicles, scrap metals, equipment is UAH 23,430 (approx. EUR 564).

no cases in practice.

Undistributed profits of controlled foreign companies

Country-by-Country For MNE with income ≥ EUR 750 Average wage

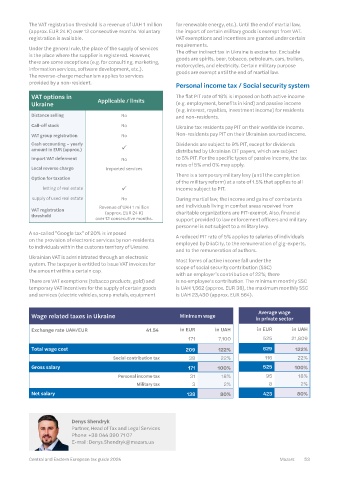

liability ü million (+ other conditions). are taxed at 18% at the level of Ukrainian company Wage related taxes in Ukraine Minimum wage in private sector

or individual (subject to exemptions).

Master file-local file in EUR in UAH in EUR in UAH

(OECD BEPS 13) ü For MNE with income ≥ EUR Non-residents operating in Ukraine through PE should Exchange rate UAH/EUR 41.54

50 million.

applicable register with the tax authorities and file their CPT returns. 171 7,100 525 21,809

Penalty Sole traders, companies with annual income below UAH Total wage cost 209 122% 629 122%

3% of the value of controlled 8.3 million (approx. EUR 199 K), and agricultural producers

transactions, but not more Social contribution tax 38 22% 116 22%

lack of documentation ü than UAH 605,600 (approx. may apply for the simplified taxation system. Gross salary 525 100%

EUR 15 K) for the 2024 171 100%

reporting year. A special beneficial tax regime called DiiaCity is available Personal income tax 31 18% 95 18%

25% of tax underpayment; for IT companies and start-ups. Military tax 3 2% 8 2%

50% in case of recurrent

tax shortage ü violation within 1,095 days VAT and other indirect taxes Net salary 138 80% 423 80%

+ late payment interest.

Direct/indirect or common As a non-EU member, Ukraine has not implemented

control; (formalized or de- EU VAT Directives.

Related parties > 25% facto); transactions with non-

related non-residents may fall The standard VAT rate is 20% (14% for the import of some Denys Shendryk

under TP control. agricultural products; 7% for the supply of pharmaceuticals Partner, Head of Tax and Legal Services

Safe harbors No – and some services; 0% for the export of goods and the Phone: +38 044 390 71 07

Level of attention paid by Tax import of certain goods and services). E-mail: Denys.Shendryk@mazars.ua

Authority 7/10

52 Mazars Central and Eastern European tax guide 2024 Central and Eastern European tax guide 2024 Mazars 53