Page 55 - CEE Tax Guide 2024

P. 55

Uzbekistan Excise Tax is paid by importers or sellers of:

1) Alcoholic products

2) Tobacco products

3) Oil & gas products

4) Motor vehicles.

Mazars Personal income tax / Social security system

8A Afrosiab street, office 501, 5th

floor “Dmaar Plaza” Business Center, Tax residents shall be recognized as an individual staying

Tashkent – Uzbekistan in the Republic of Uzbekistan if they do so for at least 183

Phone: +998 93 373 11 40 calendar days in any consecutive 12-month period ending

E-mail: infoca@mazars.kz in the current tax period (calendar year). The concept is the

same as worldwide.

The 12% Social Tax contains all types of contributions

to the social system, including the pension scheme and

access to the state medical system.

Corporate taxes and other direct taxes when a company has enjoyed tax benefits. There are thin

capitalization rules. A CFC rule exists.

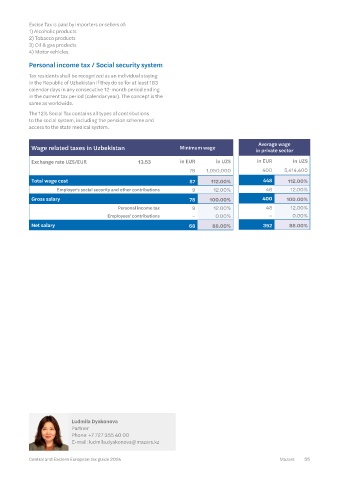

In general, the concept is similar to the CIT approach Wage related taxes in Uzbekistan Minimum wage Average wage

used in developed countries worldwide. Taxable income WHT applies to incomes paid to non-residents that are not in private sector

is calculated as annual income minus expenses. It is only registered for tax purposes in Uzbekistan. Taxable incomes in EUR in UZS in EUR in UZS

possible to deduct properly documented expenses are listed in the Tax Code. Uzbekistan has signed 54 treaties Exchange rate UZS/EUR 13.53

provided that the expenses are connected with the taxable on avoidance of double taxation. Although the treaty rates 78 1,050,000 400 5,414,400

income. Dividends and capital gains are excluded from prevail over the Tax Code, non-residents must have a duly Total wage cost 87 112.00% 448 112.00%

taxable income. The percentage of depreciation norms for issued tax residency certificate to be able to apply the treaty.

fixed assets is set out in the Tax Code and is substantively The multilateral instrument (MLI) is not in force. Employer's social security and other contributions 9 12.00% 48 12.00%

similar to IFRS principles. Losses can be carried forward Small and medium businesses may enjoy a special tax Gross salary 78 100.00% 400 100.00%

without limitation. The rules on the carrying forward regime according to which the Unified Tax on income Personal income tax 9 12.00% 48 12.00%

of losses do not apply to losses generated during periods

is paid. This tax replaces CIT. Employees' contributions – 0.00% – 0.00%

VAT and other indirect taxes Net salary 68 88.00% 352 88.00%

Transfer pricing in Uzbekistan

The VAT concept is quite similar to the concept applied

Arm’s length principle ü Since 2020 in developed countries worldwide. The turnover subject

Documentation liability ü Since 2022 to VAT is in general the total value of sales (Output VAT).

APA ü Since 2022 The VAT paid to suppliers (input VAT) is deducted from

Output VAT. Input VAT cannot be offset if the goods, works,

Country-by-Country – or services purchased are not related to taxable turnover,

liability No the VAT-invoice is not issued by a supplier or issued with

Master file-local file the violation of the legal requirements, the supplier

(OECD BEPS 13) No –

applicable is declared by a court to be inactive entity, etc. The VAT

Penalty rate for the export of goods is 0% and there is a certain

procedure for the refund of the related input VAT.

lack of documentation ü Less than 500 EUR.

tax shortage ü 40% of tax shortage.

Legal entities are considered VAT options in Applicable / limits

to be related: Uzbekistan

- legal entities are related

if one legal entity holds a direct Distance selling No

or indirect participation

in another legal entity and the Call-off stock No

share of such participation in the

Related parties charter capital exceeds 20% VAT group registration No

- an individual and a legal entity

are related if the individual holds Cash accounting – yearly

a direct or indirect participation amount in EUR (approx.) No

in the legal entity and the

share of such participation Import VAT deferment No

in subscribed capital

exceeds 20%. Local reverse charge ü

Safe harbors No – Option for taxation

2023 is the first year TP letting of real estate No Ludmila Dyakonova

reporting has to be submitted

Level of attention paid by Tax to the state authorities. supply of used real estate No Partner

Authority The tax authorities may start Phone: +7 727 355 40 00

audits on TP matters only after VAT registration 1 bUZS (approx. EUR 77k) E-mail: ludmila.dyakonova@mazars.kz

June 2023. threshold

54 Mazars Central and Eastern European tax guide 2024 Central and Eastern European tax guide 2024 Mazars 55