Page 27 - Central and Eastern European Transfer Pricing Review

P. 27

Estonia | 27

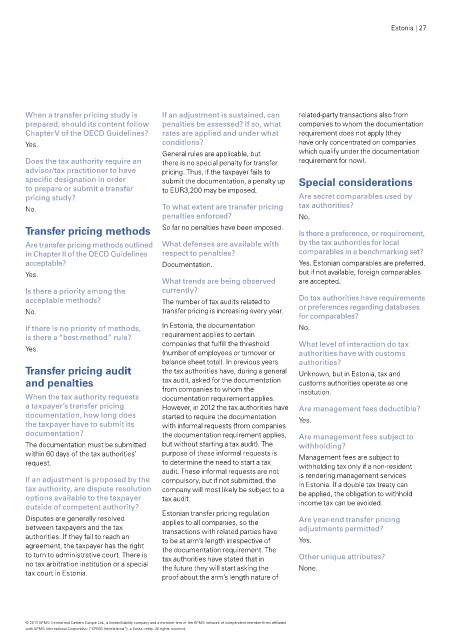

When a transfer pricing study is If an adjustment is sustained, can related-party transactions also from

prepared, should its content follow penalties be assessed? If so, what companies to whom the documentation

Chapter V of the OECD Guidelines? rates are applied and under what requirement does not apply (they

Yes. conditions? have only concentrated on companies

General rules are applicable, but which qualify under the documentation

Does the tax authority require an there is no special penalty for transfer requirement for now).

advisor/tax practitioner to have pricing. Thus, if the taxpayer fails to

specifc designation in order submit the documentation, a penalty up Special considerations

to prepare or submit a transfer to EUR3,200 may be imposed.

pricing study? Are secret comparables used by

No. To what extent are transfer pricing tax authorities?

penalties enforced? No.

Transfer pricing methods So far no penalties have been imposed. Is there a preference, or requirement,

Are transfer pricing methods outlined What defenses are available with by the tax authorities for local

in Chapter II of the OECD Guidelines respect to penalties? comparables in a benchmarking set?

acceptable? Documentation. Yes. Estonian comparables are preferred,

Yes. but if not available, foreign comparables

What trends are being observed are accepted.

Is there a priority among the currently?

acceptable methods? The number of tax audits related to Do tax authorities have requirements

No. transfer pricing is increasing every year. or preferences regarding databases

for comparables?

If there is no priority of methods, In Estonia, the documentation No.

is there a best method rule? requirement applies to certain

companies that fulfll the threshold What level of interaction do tax

Yes.

(number of employees or turnover or authorities have with customs

balance sheet total). In previous years authorities?

Transfer pricing audit the tax authorities have, during a general Unknown, but in Estonia, tax and

and penalties tax audit, asked for the documentation customs authorities operate as one

from companies to whom the institution.

When the tax authority requests documentation requirement applies.

a taxpayer s transfer pricing However, in 2012 the tax authorities have Are management fees deductible?

documentation, how long does started to require the documentation

the taxpayer have to submit its with informal requests (from companies Yes.

documentation? the documentation requirement applies, Are management fees subject to

The documentation must be submitted but without starting a tax audit). The withholding?

within 60 days of the tax authorities purpose of these informal requests is Management fees are subject to

request. to determine the need to start a tax withholding tax only if a non-resident

audit. These informal requests are not

If an adjustment is proposed by the compulsory, but if not submitted, the is rendering management services

tax authority, are dispute resolution company will most likely be subject to a in Estonia. If a double tax treaty can

options available to the taxpayer tax audit. be applied, the obligation to withhold

outside of competent authority? income tax can be avoided.

Estonian transfer pricing regulation

Disputes are generally resolved applies to all companies, so the Are year-end transfer pricing

between taxpayers and the tax transactions with related parties have adjustments permitted?

authorities. If they fail to reach an to be at arms length irrespective of Yes.

agreement, the taxpayer has the right the documentation requirement. The

to turn to administrative court. There is tax authorities have stated that in Other unique attributes?

no tax arbitration institution or a special the future they will start asking the None.

tax court in Estonia.

proof about the arms length nature of

© 2013 KPMG Central and Eastern Europe Ltd., a limited liability company and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.