Page 62 - CEE Tax Guide 2024

P. 62

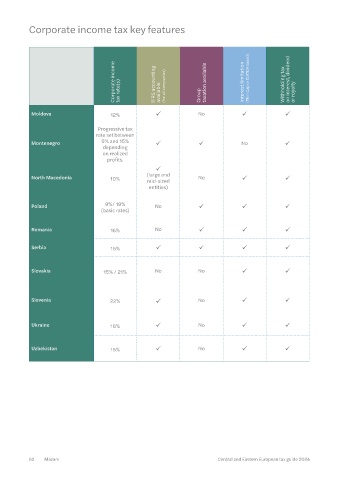

Corporate income tax key features

Corporate income tax rate(s) lFRS accounting available (for all companies) Group taxation available Interest limitation (Thin Cap or EDITDA based) Withholding tax on interest, dividend or royalty R&D / patent box incentive Loss carry-forward (years) Transfer pricing documentation liability Other comments and recent developments

Moldova 12% ü No ü ü N/A 5 ü –

Progressive tax

rate set between

Montenegro 9% and 15% ü ü No ü No 5 ü –

depending

on realized

profits.

ü

North Macedonia 10% (large and No ü ü No 3 ü The Transfer Prices Report Rulebook was recently

mid-sized

introduced.

entities)

Changes in the so-called Estonian CIT; changes

Poland 9%/ 19% No ü ü ü ü 5 ü in WHT; changes to the so-called bad debt relief; repeal

(basic rates) of provisions on so-called hidden dividends; so-called

minimum tax (effective from 2024).

Romania 16% No ü ü ü ü 5 ü Tax consolidation rules.

Serbia 15% ü ü ü ü ü 5 ü –

Exit tax; Participation exemption rules; ATAD (incl.

Slovakia 15% / 21% No No ü ü ü 5 ü hybrid mismatch) rules; Country-by-Country (CbC)

Reporting; DAC 6 and DAC 7 mandatory disclosure

requirements.

General limitation of tax base reduction for tax periods

No

Slovenia 22% ü No ü ü ü limitation period ü after January 1, 2020, resulting in setting a minimum

corporate tax rate of 7%. Exit taxation applies

as of January 1, 2020.

Yes (no limitation

Ukraine 18% ü No ü ü No period except for ü There is a beneficial tax and a legal regime called

large taxpayers) DiiaCity for IT companies and start-ups.

Since April 2024 taxpayers with high a rating may enjoy

Uzbekistan 15% ü No ü ü No No limits ü some tax benefits. Rating is automatically defined

based on many factors.

62 Mazars Central and Eastern European tax guide 2024 Central and Eastern European tax guide 2024 Mazars 63