Page 64 - CEE Tax Guide 2024

P. 64

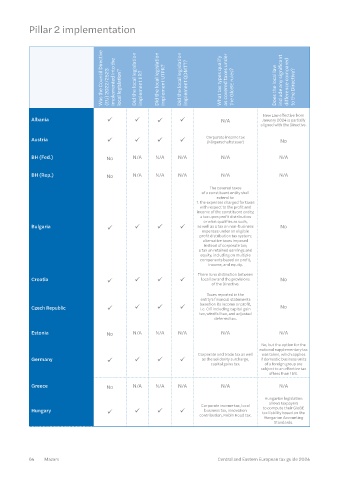

Pillar 2 implementation

Was the Council Directive (EU) 2022/2523 implemented into the local legislation? Did the local legislation implement IIR? Did the local legislation implement UTPR? Did the local legislation implement QDMTT? What tax types qualify as covered taxes under the GloBE rules? Does the local law include any significant difference compared to the Directive? Was the Council Directive (EU) 2022/2523 implemented int

New Law effective from Kazakhstan N/A N/A N/A N/A N/A

Albania ü ü ü ü N/A January 2024 is partially No

aligned with the Directive.

Austria ü ü ü ü Corporate income tax No Kosovo No N/A N/A N/A Corporate Income Tax 5%

(Körperschaftsteuer)

BH (Fed.) No N/A N/A N/A N/A N/A Kyrgyzstan No N/A N/A N/A N/A N/A

BH (Rep.) No N/A N/A N/A N/A N/A Latvia No N/A N/A N/A N/A N/A

The covered taxes

of a constituent entity shall Lithuania No N/A N/A N/A N/A N/A

extend to:

1. the expenses charged for taxes

with respect to the profit and

income of the constituent entity; Moldova No N/A N/A N/A N/A N/A

a tax upon profit distribution

or what qualifies as such,

Bulgaria ü ü ü ü as well as a tax on non-business No Montenegro No N/A N/A N/A N/A N/A

expenses under an eligible

profit distribution tax system;

alternative taxes imposed

instead of corporate tax;

a tax on retained earnings and North Macedonia ü ü ü ü – –

equity, including on multiple

components based on profit,

income, and equity.

Poland No N/A N/A N/A N/A N/A

There is no distinction between

Croatia ü ü ü ü local law and the provisions No

Romania must notify

Corporate Income Tax or any

of the Directive.

substitute, taxes on distributed the EC of the election

Taxes reported in the profits, payments qualifying of the QDMTT within

4 months following the

as profit distributions, and

entity's financial statements Romania ü ü ü ü non-business expenses, taxes adoption of the domestic

Czech Republic ü ü ü ü based on its income or profit, No on retained earnings and law, meaning by end

i.e. CIT including capital gain

tax, windfall tax, and adjusted corporate equity. of April 2024.

deferred tax.

Serbia No N/A N/A N/A N/A N/A

Estonia No N/A N/A N/A N/A N/A

No, but the option for the

national supplementary tax Tax declared in financial

Corporate and trade tax as well was taken, which applies Slovakia ü No No ü statements of constituent entity No

Germany ü ü ü ü as the solidarity surcharge, if domestic business units in relation to its income (profit).

capital gains tax. of a foreign group are

subject to an effective tax

of less than 15%.

Slovenia ü ü ü ü Income tax No

Greece No N/A N/A N/A N/A N/A

Hungarian legislation Ukraine No N/A N/A N/A N/A N/A

allows taxpayers

Corporate income tax, local

to compute their GloBE

Hungary ü ü ü ü business tax, innovation tax liability based on the

contribution, Robin Hood tax.

Hungarian Accounting Uzbekistan No N/A N/A N/A N/A N/A

Standards.

64 Mazars Central and Eastern European tax guide 2024 Central and Eastern European tax guide 2024 Mazars 65