Page 45 - Central and Eastern European Transfer Pricing Review

P. 45

Montenegro | 45

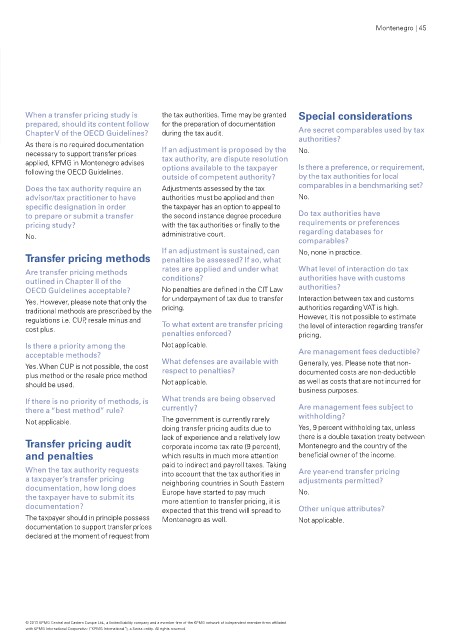

When a transfer pricing study is the tax authorities. Time may be granted Special considerations

prepared, should its content follow for the preparation of documentation

Chapter V of the OECD Guidelines? during the tax audit. Are secret comparables used by tax

authorities?

As there is no required documentation

necessary to support transfer prices If an adjustment is proposed by the No.

applied, KPMG in Montenegro advises tax authority, are dispute resolution Is there a preference, or requirement,

following the OECD Guidelines. options available to the taxpayer

outside of competent authority? by the tax authorities for local

Does the tax authority require an Adjustments assessed by the tax comparables in a benchmarking set?

advisor/tax practitioner to have authorities must be applied and then No.

specifc designation in order the taxpayer has an option to appeal to

to prepare or submit a transfer the second instance degree procedure Do tax authorities have

pricing study? with the tax authorities or fnally to the requirements or preferences

No. administrative court. regarding databases for

comparables?

If an adjustment is sustained, can No, none in practice.

Transfer pricing methods penalties be assessed? If so, what

Are transfer pricing methods rates are applied and under what What level of interaction do tax

outlined in Chapter II of the conditions? authorities have with customs

OECD Guidelines acceptable? No penalties are defned in the CIT Law authorities?

Yes. However, please note that only the for underpayment of tax due to transfer Interaction between tax and customs

traditional methods are prescribed by the pricing. authorities regarding VAT is high.

regulations i.e. CUP, resale minus and To what extent are transfer pricing However, it is not possible to estimate

cost plus. the level of interaction regarding transfer

penalties enforced? pricing.

Is there a priority among the Not applicable.

acceptable methods? Are management fees deductible?

Yes. When CUP is not possible, the cost What defenses are available with Generally, yes. Please note that non-

respect to penalties?

plus method or the resale price method documented costs are non-deductible

should be used. Not applicable. as well as costs that are not incurred for

business purposes.

If there is no priority of methods, is What trends are being observed

there a best method rule? currently? Are management fees subject to

Not applicable. The government is currently rarely withholding?

doing transfer pricing audits due to Yes, 9 percent withholding tax, unless

lack of experience and a relatively low there is a double taxation treaty between

Transfer pricing audit corporate income tax rate (9 percent), Montenegro and the country of the

and penalties which results in much more attention benefcial owner of the income.

paid to indirect and payroll taxes. Taking

When the tax authority requests into account that the tax authorities in Are year-end transfer pricing

a taxpayer s transfer pricing neighboring countries in South Eastern adjustments permitted?

documentation, how long does Europe have started to pay much No.

the taxpayer have to submit its more attention to transfer pricing, it is

documentation? expected that this trend will spread to Other unique attributes?

The taxpayer should in principle possess Montenegro as well. Not applicable.

documentation to support transfer prices

declared at the moment of request from

© 2013 KPMG Central and Eastern Europe Ltd., a limited liability company and a member firm of the KPMG network of independent member firms affiliated

with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.