Page 37 - THE ROMANIAN HEALTH CARE

P. 37

on the side of the international pharmaceutical companies this has implications, they must

compete with their own product in some markets. Parallel trade and the low medicine prices

have resulted in de-registration of medicines from the Romanian market by pharmaceutical

companies. Doctors have less choice when prescribing medicines to their patients, who get a

lower quality of care.

5.3 Medical devices

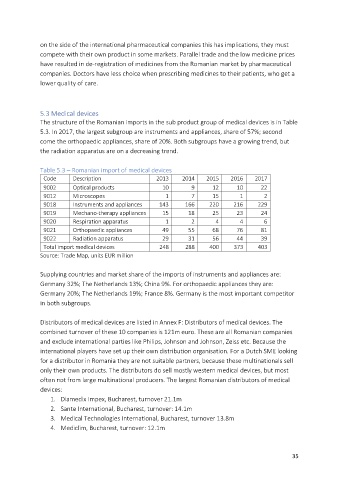

The structure of the Romanian imports in the sub product group of medical devices is in Table

5.3. In 2017, the largest subgroup are instruments and appliances, share of 57%; second

come the orthopaedic appliances, share of 20%. Both subgroups have a growing trend, but

the radiation apparatus are on a decreasing trend.

Table 5.3 – Romanian import of medical devices

Code Description 2013 2014 2015 2016 2017

9002 Optical products 10 9 12 10 22

9012 Microscopes 1 7 15 1 2

9018 Instruments and appliances 143 166 220 216 229

9019 Mechano-therapy appliances 15 18 25 23 24

9020 Respiration apparatus 1 2 4 4 6

9021 Orthopaedic appliances 49 55 68 76 81

9022 Radiation apparatus 29 31 56 44 39

Total import medical devices 248 288 400 373 403

Source: Trade Map, units EUR million

Supplying countries and market share of the imports of instruments and appliances are:

Germany 32%; The Netherlands 13%; China 9%. For orthopaedic appliances they are:

Germany 20%; The Netherlands 19%; France 8%. Germany is the most important competitor

in both subgroups.

Distributors of medical devices are listed in Annex F: Distributors of medical devices. The

combined turnover of these 10 companies is 121m euro. These are all Romanian companies

and exclude international parties like Philips, Johnson and Johnson, Zeiss etc. Because the

international players have set up their own distribution organisation. For a Dutch SME looking

for a distributor in Romania they are not suitable partners, because these multinationals sell

only their own products. The distributors do sell mostly western medical devices, but most

often not from large multinational producers. The largest Romanian distributors of medical

devices:

1. Diamedix Impex, Bucharest, turnover 21.1m

2. Sante International, Bucharest, turnover: 14.1m

3. Medical Technologies International, Bucharest, turnover 13.8m

4. Mediclim, Bucharest, turnover: 12.1m

35