Page 38 - THE ROMANIAN HEALTH CARE

P. 38

The average size of the distributors is relatively low (around 12m), but their profitability is far

from low. Diamedix and Medical Technologies International score a profit margin of 8%, but

Mediclim at 21% and Sante International at 29% score very high.

5.4 Other medical products

Imports in Romania of the subgroup of other medical products is relatively small. The import

of reagents has the largest share. Most reagents are imported from: Germany 40%, France

11% and Belgium 9%

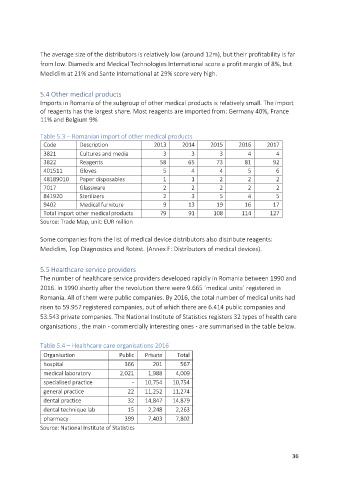

Table 5.3 – Romanian import of other medical products

Code Description 2013 2014 2015 2016 2017

3821 Cultures and media 3 3 3 4 4

3822 Reagents 58 65 73 81 92

401511 Gloves 5 4 4 5 6

48189010 Paper disposables 1 1 2 2 2

7017 Glassware 2 2 2 2 2

841920 Sterilizers 2 3 5 4 5

9402 Medical furniture 9 13 19 16 17

Total import other medical products 79 91 108 114 127

Source: Trade Map, unit: EUR million

Some companies from the list of medical device distributors also distribute reagents:

Mediclim, Top Diagnostics and Rotest. (Annex F: Distributors of medical devices).

5.5 Healthcare service providers

The number of healthcare service providers developed rapidly in Romania between 1990 and

2016. In 1990 shortly after the revolution there were 9.665 ´medical units´ registered in

Romania. All of them were public companies. By 2016, the total number of medical units had

risen to 59.957 registered companies, out of which there are 6.414 public companies and

53.543 private companies. The National Institute of Statistics registers 32 types of health care

organisations , the main - commercially interesting ones - are summarised in the table below.

Table 5.4 – Healthcare care organisations 2016

Organisation Public Private Total

hospital 366 201 567

medical laboratory 2,021 1,988 4,009

specialised practice - 10,754 10,754

general practice 22 11,252 11,274

dental practice 32 14,847 14,879

dental technique lab 15 2,248 2,263

pharmacy 399 7,403 7,802

Source: National Institute of Statistics

36